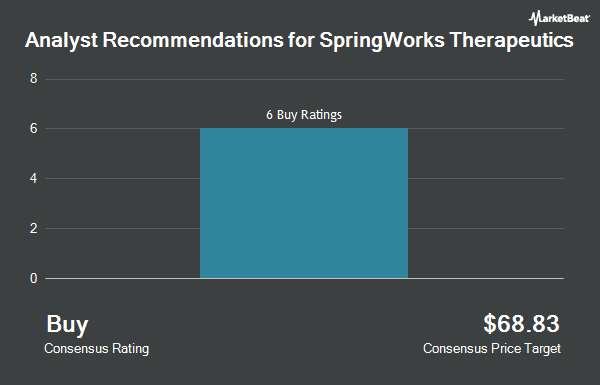

Shares of SpringWorks Therapeutics, Inc. (NASDAQ:SWTX - Get Free Report) have been assigned a consensus rating of "Buy" from the six brokerages that are covering the stock, MarketBeat Ratings reports. Six equities research analysts have rated the stock with a buy recommendation. The average 12 month price target among brokers that have issued ratings on the stock in the last year is $69.50.

SWTX has been the subject of a number of research reports. HC Wainwright decreased their target price on shares of SpringWorks Therapeutics from $76.00 to $74.00 and set a "buy" rating for the company in a research report on Tuesday, November 12th. JPMorgan Chase & Co. upped their price objective on shares of SpringWorks Therapeutics from $64.00 to $68.00 and gave the stock an "overweight" rating in a research report on Wednesday, September 4th. Wedbush restated an "outperform" rating and set a $77.00 target price on shares of SpringWorks Therapeutics in a research report on Monday, November 18th. Finally, Evercore ISI started coverage on SpringWorks Therapeutics in a research note on Wednesday, November 20th. They issued an "outperform" rating and a $60.00 price target for the company.

View Our Latest Report on SpringWorks Therapeutics

SpringWorks Therapeutics Trading Down 0.6 %

Shares of NASDAQ SWTX traded down $0.25 during mid-day trading on Friday, reaching $41.48. The company had a trading volume of 645,350 shares, compared to its average volume of 1,451,189. The business's 50-day moving average is $33.19 and its 200-day moving average is $36.74. SpringWorks Therapeutics has a 52 week low of $28.00 and a 52 week high of $53.92. The stock has a market cap of $3.09 billion, a price-to-earnings ratio of -10.69 and a beta of 0.79.

SpringWorks Therapeutics (NASDAQ:SWTX - Get Free Report) last announced its quarterly earnings results on Tuesday, November 12th. The company reported ($0.72) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.75) by $0.03. SpringWorks Therapeutics had a negative return on equity of 48.21% and a negative net margin of 203.09%. The business had revenue of $49.10 million for the quarter, compared to the consensus estimate of $53.28 million. During the same period last year, the business posted ($1.27) EPS. The business's revenue was up 4810.0% compared to the same quarter last year. As a group, equities research analysts forecast that SpringWorks Therapeutics will post -3.12 earnings per share for the current year.

Institutional Trading of SpringWorks Therapeutics

Hedge funds have recently bought and sold shares of the business. CANADA LIFE ASSURANCE Co grew its position in shares of SpringWorks Therapeutics by 20.3% in the first quarter. CANADA LIFE ASSURANCE Co now owns 4,465 shares of the company's stock valued at $220,000 after purchasing an additional 754 shares in the last quarter. DNB Asset Management AS boosted its stake in SpringWorks Therapeutics by 16.5% during the second quarter. DNB Asset Management AS now owns 11,402 shares of the company's stock worth $429,000 after buying an additional 1,617 shares during the last quarter. First Horizon Advisors Inc. grew its holdings in SpringWorks Therapeutics by 47.9% in the 2nd quarter. First Horizon Advisors Inc. now owns 1,183 shares of the company's stock valued at $45,000 after buying an additional 383 shares in the last quarter. Bank of New York Mellon Corp increased its stake in shares of SpringWorks Therapeutics by 28.4% in the 2nd quarter. Bank of New York Mellon Corp now owns 298,961 shares of the company's stock worth $11,262,000 after acquiring an additional 66,161 shares during the last quarter. Finally, Allspring Global Investments Holdings LLC purchased a new position in shares of SpringWorks Therapeutics during the 2nd quarter worth $123,000.

SpringWorks Therapeutics Company Profile

(

Get Free ReportSpringWorks Therapeutics, Inc, a commercial-stage biopharmaceutical company, engages in the development and commercialization of medicines for underserved patient populations suffering from rare diseases and cancer. Its lead product candidate is OGSIVEO (nirogacestat), an oral small molecule gamma secretase inhibitor that is in Phase III DeFi trial for the treatment of desmoid tumors; and Nirogacestat, is also in Phase 2 clinical development as a monotherapy for the treatment of ovarian granulosa cell tumors (GCT), a subtype of ovarian cancer.

Featured Stories

Before you consider SpringWorks Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SpringWorks Therapeutics wasn't on the list.

While SpringWorks Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.