Sprott Inc. lifted its holdings in MAG Silver Corp. (NYSEAMERICAN:MAG - Free Report) by 8.5% in the 4th quarter, according to its most recent 13F filing with the SEC. The firm owned 2,649,507 shares of the company's stock after purchasing an additional 208,252 shares during the quarter. MAG Silver comprises 2.1% of Sprott Inc.'s holdings, making the stock its 13th biggest position. Sprott Inc. owned approximately 2.56% of MAG Silver worth $36,004,000 as of its most recent SEC filing.

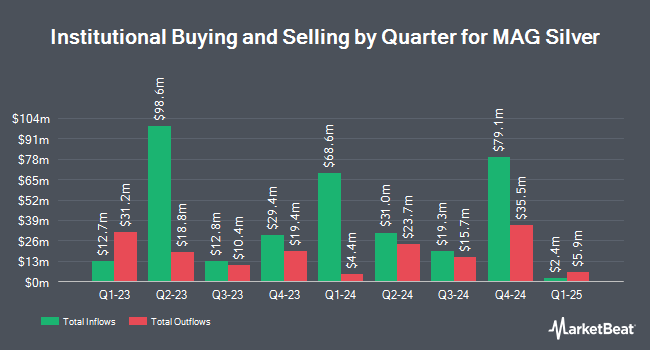

Several other institutional investors and hedge funds have also modified their holdings of the business. Barclays PLC boosted its position in MAG Silver by 211.5% during the 3rd quarter. Barclays PLC now owns 30,780 shares of the company's stock worth $432,000 after acquiring an additional 20,899 shares during the last quarter. Van ECK Associates Corp boosted its position in MAG Silver by 4.8% during the 3rd quarter. Van ECK Associates Corp now owns 10,231,410 shares of the company's stock worth $143,649,000 after acquiring an additional 467,817 shares during the last quarter. Strategic Financial Concepts LLC acquired a new position in MAG Silver during the 4th quarter worth approximately $240,000. JPMorgan Chase & Co. boosted its position in MAG Silver by 69.1% during the 3rd quarter. JPMorgan Chase & Co. now owns 456,335 shares of the company's stock worth $6,407,000 after acquiring an additional 186,445 shares during the last quarter. Finally, PCJ Investment Counsel Ltd. boosted its position in MAG Silver by 38.1% during the 3rd quarter. PCJ Investment Counsel Ltd. now owns 369,290 shares of the company's stock worth $5,196,000 after acquiring an additional 101,870 shares during the last quarter. 52.50% of the stock is currently owned by institutional investors and hedge funds.

MAG Silver Stock Performance

Shares of MAG Silver stock remained flat at $15.01 on Friday. The stock had a trading volume of 570,976 shares, compared to its average volume of 577,074. MAG Silver Corp. has a one year low of $8.19 and a one year high of $18.27. The company has a market cap of $1.55 billion, a PE ratio of 21.14 and a beta of 1.09.

Analyst Upgrades and Downgrades

Separately, HC Wainwright reaffirmed a "buy" rating and set a $21.00 price target on shares of MAG Silver in a research report on Tuesday. Four investment analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to data from MarketBeat, MAG Silver currently has a consensus rating of "Hold" and an average target price of $18.63.

View Our Latest Report on MAG

About MAG Silver

(

Free Report)

MAG Silver Corp. develops and explores for precious metal properties in Canada. It explores for silver, gold, lead, copper, and zinc deposits. The company's flagship property is the 44% owned Juanicipio property located in the Fresnillo District, Zacatecas State, Mexico. MAG Silver Corp. is headquartered in Vancouver, Canada.

Read More

Before you consider MAG Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MAG Silver wasn't on the list.

While MAG Silver currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.