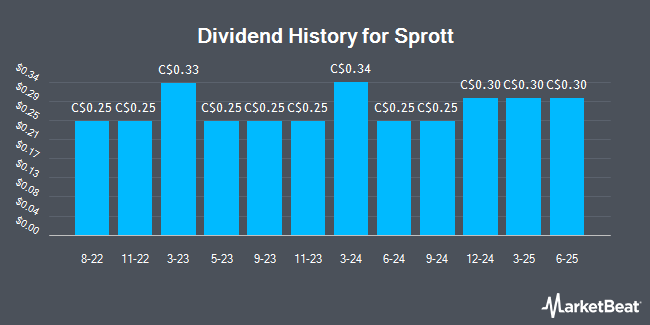

Sprott Inc. (TSE:SII - Get Free Report) announced a quarterly dividend on Monday, March 10th, TickerTech Dividends reports. Investors of record on Tuesday, March 25th will be given a dividend of 0.30 per share on Tuesday, March 25th. This represents a $1.20 annualized dividend and a yield of 1.95%. The ex-dividend date is Monday, March 10th.

Sprott Stock Up 2.0 %

TSE:SII traded up C$1.20 on Wednesday, reaching C$61.68. The stock had a trading volume of 55,418 shares, compared to its average volume of 31,001. The company has a 50-day moving average of C$61.38 and a 200 day moving average of C$60.39. The company has a current ratio of 3.30, a quick ratio of 2.89 and a debt-to-equity ratio of 5.65. The stock has a market cap of C$1.10 billion, a P/E ratio of 24.04, a price-to-earnings-growth ratio of -3.34 and a beta of 1.45. Sprott has a 12-month low of C$46.59 and a 12-month high of C$66.31.

Sprott (TSE:SII - Get Free Report) last released its quarterly earnings results on Wednesday, February 26th. The company reported C$0.46 EPS for the quarter. Sprott had a return on equity of 15.02% and a net margin of 28.20%. On average, research analysts predict that Sprott will post 3.2178828 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of research firms have recently weighed in on SII. BMO Capital Markets set a C$75.00 price target on shares of Sprott and gave the stock an "outperform" rating in a research report on Friday, March 7th. TD Securities raised their price objective on shares of Sprott from C$70.00 to C$71.00 and gave the stock a "buy" rating in a report on Friday, February 28th. Finally, Canaccord Genuity Group boosted their target price on shares of Sprott from C$67.00 to C$71.00 and gave the stock a "buy" rating in a research report on Thursday, February 27th.

View Our Latest Report on SII

About Sprott

(

Get Free Report)

Sprott Inc is an alternative asset manager operating in Canada. The company has six reportable segments: Exchange Listed Products, which includes management services to the company's closed-end physical trusts and exchange-traded funds, both of which are actively traded on public securities exchanges; Managed equities segment provides asset management and sub-advisory services to the Company's branded funds, fixed-term LPs and managed accounts; Lending segment provides lending and streaming activities through limited partnership vehicles; Brokerage segment includes activities of Canadian and U.S.

Read More

Before you consider Sprott, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sprott wasn't on the list.

While Sprott currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.