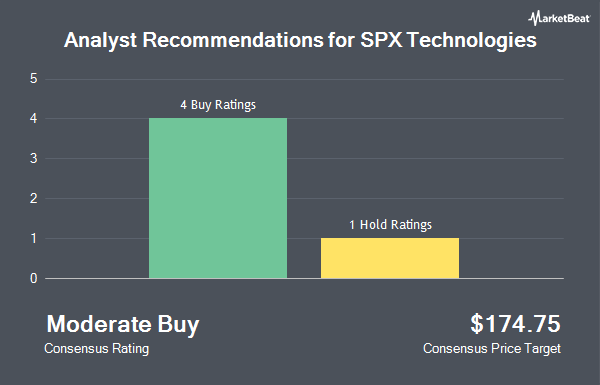

SPX Technologies, Inc. (NYSE:SPXC - Get Free Report) has earned a consensus rating of "Hold" from the five ratings firms that are presently covering the stock, Marketbeat reports. Three analysts have rated the stock with a hold recommendation and two have issued a buy recommendation on the company. The average 1-year price objective among analysts that have updated their coverage on the stock in the last year is $164.00.

SPXC has been the subject of several recent analyst reports. Sidoti lowered SPX Technologies from a "buy" rating to a "neutral" rating and reduced their target price for the company from $187.00 to $175.00 in a report on Friday. Wolfe Research assumed coverage on shares of SPX Technologies in a research report on Monday, November 25th. They set an "outperform" rating and a $199.00 price target for the company.

View Our Latest Research Report on SPX Technologies

Hedge Funds Weigh In On SPX Technologies

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the business. American Century Companies Inc. lifted its stake in shares of SPX Technologies by 195.2% during the 2nd quarter. American Century Companies Inc. now owns 14,492 shares of the company's stock valued at $2,060,000 after buying an additional 9,582 shares in the last quarter. Victory Capital Management Inc. grew its position in shares of SPX Technologies by 15.7% in the second quarter. Victory Capital Management Inc. now owns 73,768 shares of the company's stock valued at $10,485,000 after purchasing an additional 10,010 shares in the last quarter. Diversified Trust Co bought a new stake in shares of SPX Technologies during the 2nd quarter valued at $798,000. Dana Investment Advisors Inc. purchased a new stake in SPX Technologies during the 2nd quarter worth about $855,000. Finally, Mutual of America Capital Management LLC boosted its stake in SPX Technologies by 212.5% in the 3rd quarter. Mutual of America Capital Management LLC now owns 23,744 shares of the company's stock worth $3,786,000 after purchasing an additional 16,145 shares during the period. Institutional investors own 92.82% of the company's stock.

SPX Technologies Stock Down 6.2 %

Shares of SPX Technologies stock traded down $10.46 on Friday, hitting $159.43. The company had a trading volume of 376,449 shares, compared to its average volume of 219,010. SPX Technologies has a 1 year low of $87.08 and a 1 year high of $183.83. The company has a debt-to-equity ratio of 0.49, a quick ratio of 1.19 and a current ratio of 1.85. The stock has a 50 day moving average of $164.94 and a 200-day moving average of $153.53. The stock has a market capitalization of $7.39 billion, a price-to-earnings ratio of 42.86, a P/E/G ratio of 1.76 and a beta of 1.26.

SPX Technologies (NYSE:SPXC - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The company reported $1.39 earnings per share for the quarter, beating the consensus estimate of $1.38 by $0.01. SPX Technologies had a return on equity of 19.70% and a net margin of 9.11%. The business had revenue of $483.70 million for the quarter, compared to analysts' expectations of $501.02 million. During the same period last year, the business earned $1.06 EPS. The business's revenue was up 7.8% on a year-over-year basis. As a group, sell-side analysts forecast that SPX Technologies will post 5.56 earnings per share for the current year.

SPX Technologies Company Profile

(

Get Free ReportSPX Technologies, Inc supplies infrastructure equipment serving the heating, ventilation, and cooling (HVAC); and detection and measurement markets worldwide. The company operates in two segments, HVAC and Detection and Measurement. The HVAC segment engineers, designs, manufactures, installs, and services package and process cooling products and engineered air movement solutions for the HVAC industrial and power generation markets, as well as boilers, heating, and ventilation products for the residential and commercial markets.

Further Reading

Before you consider SPX Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SPX Technologies wasn't on the list.

While SPX Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.