Spyglass Capital Management LLC lessened its position in Procore Technologies, Inc. (NYSE:PCOR - Free Report) by 1.8% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 935,896 shares of the company's stock after selling 17,484 shares during the quarter. Procore Technologies comprises about 3.8% of Spyglass Capital Management LLC's investment portfolio, making the stock its 12th biggest position. Spyglass Capital Management LLC owned about 0.63% of Procore Technologies worth $57,764,000 at the end of the most recent reporting period.

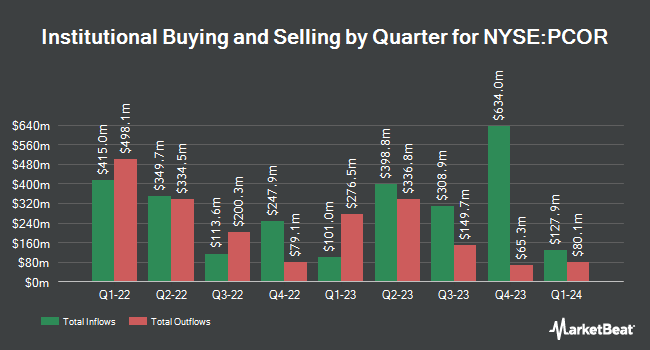

A number of other institutional investors and hedge funds have also recently bought and sold shares of the company. Park Avenue Securities LLC increased its stake in shares of Procore Technologies by 16.9% in the second quarter. Park Avenue Securities LLC now owns 8,741 shares of the company's stock worth $580,000 after purchasing an additional 1,266 shares during the period. M&G Plc lifted its holdings in shares of Procore Technologies by 12.4% during the second quarter. M&G Plc now owns 120,626 shares of the company's stock worth $7,961,000 after buying an additional 13,334 shares during the last quarter. Westfield Capital Management Co. LP lifted its holdings in shares of Procore Technologies by 39.2% during the third quarter. Westfield Capital Management Co. LP now owns 966,215 shares of the company's stock worth $59,635,000 after buying an additional 272,030 shares during the last quarter. Burney Co. bought a new stake in shares of Procore Technologies in the first quarter valued at approximately $1,371,000. Finally, SG Americas Securities LLC grew its stake in shares of Procore Technologies by 118.0% in the second quarter. SG Americas Securities LLC now owns 17,466 shares of the company's stock worth $1,158,000 after acquiring an additional 9,454 shares during the last quarter. Institutional investors and hedge funds own 81.10% of the company's stock.

Insiders Place Their Bets

In other Procore Technologies news, CEO Craig F. Jr. Courtemanche sold 22,665 shares of the company's stock in a transaction dated Thursday, November 21st. The shares were sold at an average price of $71.36, for a total transaction of $1,617,374.40. Following the transaction, the chief executive officer now directly owns 770,458 shares in the company, valued at approximately $54,979,882.88. This represents a 2.86 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Connor Kevin J. O sold 8,974 shares of Procore Technologies stock in a transaction that occurred on Tuesday, September 17th. The stock was sold at an average price of $58.06, for a total transaction of $521,030.44. Following the sale, the director now owns 1,371,104 shares of the company's stock, valued at approximately $79,606,298.24. This represents a 0.65 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 115,553 shares of company stock valued at $7,933,974. Insiders own 29.00% of the company's stock.

Wall Street Analyst Weigh In

PCOR has been the subject of a number of research reports. TD Cowen increased their price target on shares of Procore Technologies from $70.00 to $82.00 and gave the company a "buy" rating in a report on Friday, November 22nd. Scotiabank lifted their target price on Procore Technologies from $70.00 to $85.00 and gave the stock a "sector outperform" rating in a research report on Friday, November 22nd. KeyCorp upped their price target on Procore Technologies from $68.00 to $85.00 and gave the company an "overweight" rating in a report on Friday, November 22nd. BMO Capital Markets lifted their price objective on Procore Technologies from $71.00 to $85.00 and gave the stock an "outperform" rating in a report on Friday, November 22nd. Finally, Barclays raised their target price on Procore Technologies from $66.00 to $78.00 and gave the stock an "equal weight" rating in a research report on Friday, November 22nd. Five equities research analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $79.25.

Read Our Latest Analysis on Procore Technologies

Procore Technologies Price Performance

Procore Technologies stock traded down $0.26 during trading hours on Friday, hitting $81.19. 1,029,071 shares of the stock were exchanged, compared to its average volume of 1,608,447. The stock has a market capitalization of $12.07 billion, a P/E ratio of -162.40 and a beta of 0.71. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.57 and a current ratio of 1.57. Procore Technologies, Inc. has a 12 month low of $49.46 and a 12 month high of $83.35. The business's 50-day moving average is $66.01 and its two-hundred day moving average is $64.33.

Procore Technologies (NYSE:PCOR - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The company reported ($0.11) earnings per share for the quarter, meeting analysts' consensus estimates of ($0.11). The firm had revenue of $295.89 million during the quarter, compared to analysts' expectations of $287.42 million. Procore Technologies had a negative return on equity of 2.51% and a negative net margin of 6.59%. Equities research analysts expect that Procore Technologies, Inc. will post -0.23 EPS for the current fiscal year.

Procore Technologies Company Profile

(

Free Report)

Procore Technologies, Inc engages in the provision of a cloud-based construction management platform and related software products in the United States and internationally. The company's platform enables owners, general and specialty contractors, architects, and engineers to collaborate on construction projects.

Recommended Stories

Before you consider Procore Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procore Technologies wasn't on the list.

While Procore Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.