SS&C Technologies (NASDAQ:SSNC - Get Free Report) was downgraded by equities researchers at StockNews.com from a "strong-buy" rating to a "buy" rating in a report issued on Friday.

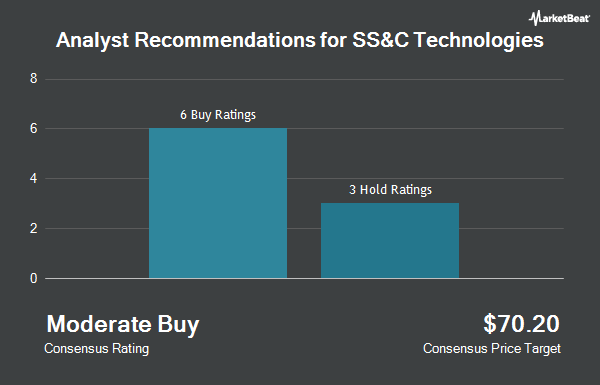

Several other research firms have also commented on SSNC. Needham & Company LLC reaffirmed a "buy" rating and set a $90.00 price target on shares of SS&C Technologies in a research report on Friday, October 25th. Raymond James increased their price target on shares of SS&C Technologies from $79.00 to $85.00 and gave the stock a "strong-buy" rating in a research note on Friday, October 25th. Royal Bank of Canada lifted their price objective on shares of SS&C Technologies from $75.00 to $86.00 and gave the company an "outperform" rating in a research note on Thursday, September 19th. Finally, DA Davidson reiterated a "buy" rating and set a $92.00 target price on shares of SS&C Technologies in a research note on Thursday, October 10th. Two investment analysts have rated the stock with a hold rating, six have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, SS&C Technologies currently has an average rating of "Moderate Buy" and an average target price of $77.75.

Check Out Our Latest Stock Analysis on SSNC

SS&C Technologies Stock Down 1.1 %

SSNC traded down $0.83 during trading hours on Friday, hitting $73.40. 1,530,169 shares of the company's stock were exchanged, compared to its average volume of 1,081,484. The company has a current ratio of 1.21, a quick ratio of 1.21 and a debt-to-equity ratio of 1.04. SS&C Technologies has a 12-month low of $54.44 and a 12-month high of $77.02. The firm has a market cap of $18.18 billion, a P/E ratio of 26.31 and a beta of 1.39. The firm has a 50 day moving average of $74.03 and a 200 day moving average of $68.90.

SS&C Technologies (NASDAQ:SSNC - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The technology company reported $1.29 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.26 by $0.03. SS&C Technologies had a return on equity of 17.33% and a net margin of 12.26%. The business had revenue of $1.47 billion for the quarter, compared to analysts' expectations of $1.44 billion. During the same period last year, the firm earned $1.04 earnings per share. The company's revenue for the quarter was up 7.3% compared to the same quarter last year. Analysts predict that SS&C Technologies will post 4.62 EPS for the current fiscal year.

SS&C Technologies announced that its board has authorized a share buyback plan on Thursday, July 25th that permits the company to buyback $1.00 billion in shares. This buyback authorization permits the technology company to repurchase up to 5.4% of its shares through open market purchases. Shares buyback plans are generally an indication that the company's management believes its shares are undervalued.

Insider Activity

In other news, Director Michael Jay Zamkow sold 19,000 shares of the company's stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $75.97, for a total transaction of $1,443,430.00. Following the completion of the transaction, the director now directly owns 22,576 shares of the company's stock, valued at approximately $1,715,098.72. This represents a 45.70 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, COO Rahul Kanwar sold 412,190 shares of the stock in a transaction that occurred on Wednesday, August 21st. The stock was sold at an average price of $73.13, for a total value of $30,143,454.70. Following the sale, the chief operating officer now owns 57,642 shares in the company, valued at $4,215,359.46. The trade was a 87.73 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 561,190 shares of company stock worth $41,386,285 over the last ninety days. Corporate insiders own 15.40% of the company's stock.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Executive Wealth Management LLC acquired a new stake in SS&C Technologies in the 3rd quarter valued at approximately $7,212,000. Guardian Wealth Management Inc. grew its position in SS&C Technologies by 1.3% in the 3rd quarter. Guardian Wealth Management Inc. now owns 33,943 shares of the technology company's stock valued at $2,519,000 after buying an additional 432 shares in the last quarter. LRI Investments LLC increased its stake in SS&C Technologies by 299.3% during the 3rd quarter. LRI Investments LLC now owns 22,598 shares of the technology company's stock valued at $1,677,000 after buying an additional 16,939 shares during the period. SGL Investment Advisors Inc. bought a new stake in shares of SS&C Technologies during the 3rd quarter worth about $4,358,000. Finally, Groupama Asset Managment lifted its stake in shares of SS&C Technologies by 0.8% in the 3rd quarter. Groupama Asset Managment now owns 30,763 shares of the technology company's stock worth $2,283,000 after acquiring an additional 256 shares during the period. Institutional investors and hedge funds own 96.95% of the company's stock.

SS&C Technologies Company Profile

(

Get Free Report)

SS&C Technologies Holdings, Inc, together with its subsidiaries, provides software products and software-enabled services to financial services and healthcare industries. The company owns and operates technology stack across securities accounting; front-office functions, such as trading and modeling; middle-office functions comprising portfolio management and reporting; back-office functions, such as accounting, performance measurement, reconciliation, reporting, processing and clearing, and compliance and tax reporting; and healthcare solutions consisting of claims adjudication, benefit management, care management, and business intelligence solutions.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SS&C Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SS&C Technologies wasn't on the list.

While SS&C Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.