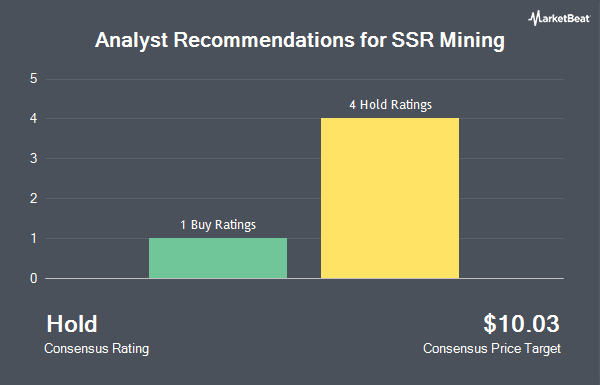

Shares of SSR Mining Inc. (NASDAQ:SSRM - Get Free Report) TSE: SSO have been given an average recommendation of "Reduce" by the seven brokerages that are presently covering the company, MarketBeat.com reports. Two investment analysts have rated the stock with a sell rating, four have given a hold rating and one has given a buy rating to the company. The average 1 year target price among brokers that have covered the stock in the last year is $7.01.

Separately, UBS Group lifted their price target on SSR Mining from $6.30 to $6.80 and gave the stock a "buy" rating in a report on Tuesday, October 15th.

Get Our Latest Stock Report on SSR Mining

Hedge Funds Weigh In On SSR Mining

A number of hedge funds have recently modified their holdings of SSRM. D. E. Shaw & Co. Inc. increased its position in SSR Mining by 45.9% in the 2nd quarter. D. E. Shaw & Co. Inc. now owns 8,228,572 shares of the basic materials company's stock valued at $37,124,000 after acquiring an additional 2,587,212 shares during the period. Tidal Investments LLC purchased a new position in SSR Mining during the 1st quarter worth $6,485,000. National Bank of Canada FI raised its holdings in SSR Mining by 73.7% during the second quarter. National Bank of Canada FI now owns 2,636,902 shares of the basic materials company's stock worth $11,815,000 after purchasing an additional 1,118,417 shares in the last quarter. Hsbc Holdings PLC acquired a new stake in SSR Mining in the second quarter valued at about $3,289,000. Finally, Acadian Asset Management LLC boosted its holdings in SSR Mining by 111.3% in the 2nd quarter. Acadian Asset Management LLC now owns 1,209,763 shares of the basic materials company's stock valued at $5,440,000 after purchasing an additional 637,161 shares in the last quarter. 68.30% of the stock is currently owned by hedge funds and other institutional investors.

SSR Mining Stock Up 8.0 %

NASDAQ:SSRM traded up $0.42 during mid-day trading on Friday, hitting $5.70. The stock had a trading volume of 4,027,728 shares, compared to its average volume of 3,501,579. SSR Mining has a twelve month low of $3.76 and a twelve month high of $12.18. The stock has a 50-day simple moving average of $5.80 and a two-hundred day simple moving average of $5.35. The company has a current ratio of 3.54, a quick ratio of 1.78 and a debt-to-equity ratio of 0.08. The company has a market capitalization of $1.15 billion, a PE ratio of -2.38, a PEG ratio of 0.91 and a beta of 0.72.

SSR Mining (NASDAQ:SSRM - Get Free Report) TSE: SSO last released its quarterly earnings data on Wednesday, November 6th. The basic materials company reported $0.03 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.15 by ($0.12). The firm had revenue of $257.36 million for the quarter. SSR Mining had a positive return on equity of 4.02% and a negative net margin of 44.13%. On average, equities research analysts anticipate that SSR Mining will post 0.38 EPS for the current year.

SSR Mining Company Profile

(

Get Free ReportSSR Mining Inc, together with its subsidiaries, engages in the operation, acquisition, exploration, and development of precious metal resource properties in the United States, Türkiye, Canada, and Argentina. The company explores for gold doré, copper, silver, lead, and zinc deposits. Its mines include the Çöpler, located in Erzincan province, Turkey; the Marigold, located in Nevada, the United States; the Seabee, located in Saskatchewan, Canada; and the Puna, located in Jujuy province, Argentina.

Featured Stories

Before you consider SSR Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SSR Mining wasn't on the list.

While SSR Mining currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.