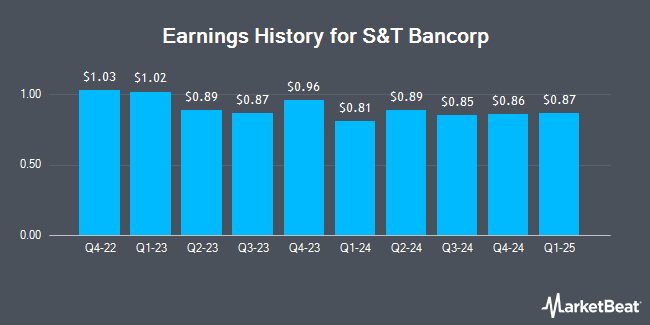

S&T Bancorp (NASDAQ:STBA - Get Free Report) will likely be posting its quarterly earnings results before the market opens on Thursday, January 30th. Analysts expect the company to announce earnings of $0.78 per share and revenue of $96,875.75 billion for the quarter. Persons that are interested in participating in the company's earnings conference call can do so using this link.

S&T Bancorp Stock Up 0.3 %

NASDAQ:STBA traded up $0.12 during mid-day trading on Thursday, reaching $37.16. The company's stock had a trading volume of 53,577 shares, compared to its average volume of 152,576. The company has a quick ratio of 0.99, a current ratio of 0.99 and a debt-to-equity ratio of 0.08. S&T Bancorp has a 1 year low of $28.83 and a 1 year high of $45.79. The stock has a fifty day moving average of $40.16 and a 200-day moving average of $40.51. The firm has a market capitalization of $1.42 billion, a PE ratio of 10.57 and a beta of 0.84.

Insider Activity

In other news, Director Frank J. Palermo, Jr. sold 4,982 shares of the company's stock in a transaction on Wednesday, November 13th. The stock was sold at an average price of $43.21, for a total transaction of $215,272.22. Following the transaction, the director now directly owns 23,143 shares of the company's stock, valued at approximately $1,000,009.03. This represents a 17.71 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Company insiders own 1.38% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, StockNews.com upgraded shares of S&T Bancorp from a "sell" rating to a "hold" rating in a research note on Thursday, October 24th.

Read Our Latest Stock Report on STBA

About S&T Bancorp

(

Get Free Report)

S&T Bancorp, Inc is a bank holding company, which engages in the provision of consumer, commercial, and small business banking services. It operates through the following segments: Commercial Real Estate, Commercial and Industrial, Commercial Construction, Business Banking, Consumer Real Estate, and Other Consumer.

Further Reading

Before you consider S&T Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and S&T Bancorp wasn't on the list.

While S&T Bancorp currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.