Stantec (NYSE:STN - Get Free Report) TSE: STN was upgraded by Canaccord Genuity Group from a "hold" rating to a "buy" rating in a note issued to investors on Monday.

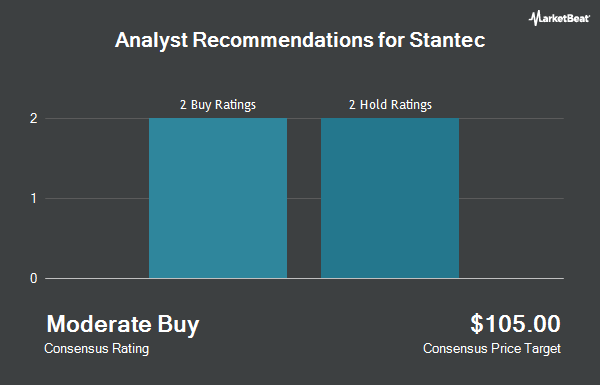

Several other research analysts have also commented on STN. Raymond James lowered shares of Stantec from a "moderate buy" rating to a "hold" rating in a report on Thursday, August 8th. Scotiabank began coverage on Stantec in a research report on Friday, October 25th. They issued a "sector outperform" rating on the stock. Canaccord Genuity Group raised Stantec from a "hold" rating to a "buy" rating in a research report on Monday. Finally, StockNews.com downgraded Stantec from a "buy" rating to a "hold" rating in a report on Friday. Three investment analysts have rated the stock with a hold rating and three have issued a buy rating to the company's stock. According to MarketBeat.com, Stantec has an average rating of "Moderate Buy".

Check Out Our Latest Stock Report on STN

Stantec Trading Up 2.9 %

STN stock traded up $2.32 during trading on Monday, reaching $82.96. 226,754 shares of the stock traded hands, compared to its average volume of 118,935. The firm has a market capitalization of $9.46 billion, a PE ratio of 37.38 and a beta of 1.02. The company has a debt-to-equity ratio of 0.51, a current ratio of 1.39 and a quick ratio of 1.39. The business's 50 day moving average price is $81.33 and its 200-day moving average price is $82.40. Stantec has a 52-week low of $67.54 and a 52-week high of $88.42.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of the business. BNP Paribas Financial Markets raised its holdings in Stantec by 8.4% during the first quarter. BNP Paribas Financial Markets now owns 10,035 shares of the business services provider's stock worth $833,000 after purchasing an additional 779 shares in the last quarter. Quantbot Technologies LP raised its position in Stantec by 17.9% in the first quarter. Quantbot Technologies LP now owns 11,910 shares of the business services provider's stock worth $989,000 after acquiring an additional 1,807 shares in the last quarter. SG Americas Securities LLC bought a new position in shares of Stantec during the 1st quarter valued at about $235,000. Russell Investments Group Ltd. grew its stake in shares of Stantec by 3.7% in the 1st quarter. Russell Investments Group Ltd. now owns 342,455 shares of the business services provider's stock worth $28,494,000 after purchasing an additional 12,208 shares during the last quarter. Finally, Pembroke Management LTD raised its holdings in shares of Stantec by 4.7% in the 1st quarter. Pembroke Management LTD now owns 7,599 shares of the business services provider's stock worth $631,000 after purchasing an additional 342 shares in the last quarter. Institutional investors own 63.86% of the company's stock.

About Stantec

(

Get Free Report)

Stantec Inc provides professional services in the areas of infrastructure and facilities to the public and private sectors in Canada, the United States, and internationally. It offers evaluation, planning, and designing infrastructure solutions; solutions for sustainable water resources, planning, management, and infrastructure; environmental services; integrated architecture, engineering, interior design, and planning solutions for buildings; and energy and resources solutions.

Featured Articles

Before you consider Stantec, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stantec wasn't on the list.

While Stantec currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.