STAR Financial Bank purchased a new position in Invesco QQQ (NASDAQ:QQQ - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 7,115 shares of the exchange traded fund's stock, valued at approximately $3,473,000. Invesco QQQ comprises about 2.3% of STAR Financial Bank's portfolio, making the stock its 7th largest position.

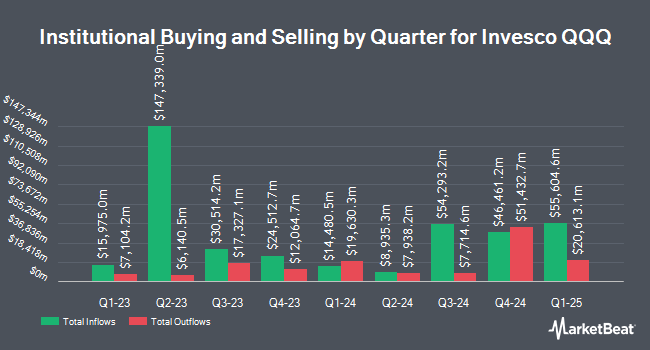

Other hedge funds have also recently modified their holdings of the company. New Covenant Trust Company N.A. bought a new stake in shares of Invesco QQQ during the 1st quarter valued at about $28,000. Mechanics Financial Corp bought a new stake in Invesco QQQ during the 2nd quarter valued at approximately $30,000. Chelsea Counsel Co. purchased a new position in shares of Invesco QQQ during the 1st quarter worth approximately $40,000. CGC Financial Services LLC raised its position in shares of Invesco QQQ by 736.4% in the 2nd quarter. CGC Financial Services LLC now owns 92 shares of the exchange traded fund's stock worth $44,000 after acquiring an additional 81 shares in the last quarter. Finally, Legacy Bridge LLC lifted its stake in shares of Invesco QQQ by 60.0% in the 3rd quarter. Legacy Bridge LLC now owns 120 shares of the exchange traded fund's stock valued at $59,000 after purchasing an additional 45 shares during the period. Hedge funds and other institutional investors own 44.58% of the company's stock.

Invesco QQQ Stock Down 0.1 %

Shares of QQQ stock opened at $503.17 on Thursday. The business's fifty day moving average is $491.83 and its 200 day moving average is $476.02. Invesco QQQ has a twelve month low of $382.66 and a twelve month high of $515.58.

Invesco QQQ Cuts Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Investors of record on Monday, September 23rd were paid a $0.677 dividend. The ex-dividend date was Monday, September 23rd. This represents a $2.71 annualized dividend and a dividend yield of 0.54%.

Invesco QQQ Company Profile

(

Free Report)

PowerShares QQQ Trust, Series 1 is a unit investment trust that issues securities called Nasdaq-100 Index Tracking Stock. The Trust's investment objective is to provide investment results that generally correspond to the price and yield performance of the Nasdaq-100 Index. The Trust provides investors with the opportunity to purchase units of beneficial interest in the Trust representing proportionate undivided interests in the portfolio of securities held by the Trust, which consists of substantially all of the securities, in substantially the same weighting, as the component securities of the Nasdaq-100 Index.

Read More

Want to see what other hedge funds are holding QQQ? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Invesco QQQ (NASDAQ:QQQ - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Invesco QQQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invesco QQQ wasn't on the list.

While Invesco QQQ currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.