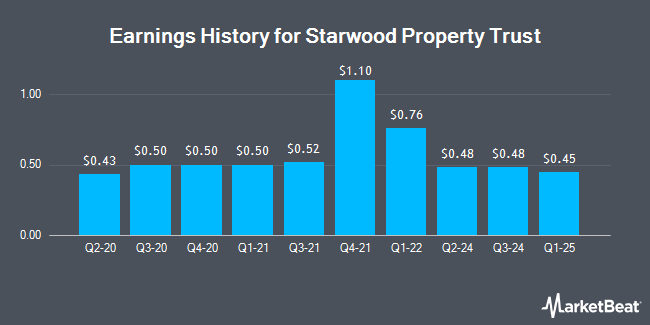

Starwood Property Trust (NYSE:STWD - Get Free Report) announced its quarterly earnings data on Thursday. The real estate investment trust reported $0.45 EPS for the quarter, missing analysts' consensus estimates of $0.46 by ($0.01), Zacks reports. The business had revenue of $454.39 million during the quarter, compared to the consensus estimate of $466.37 million. Starwood Property Trust had a return on equity of 9.93% and a net margin of 18.82%.

Starwood Property Trust Stock Performance

Shares of STWD traded down $0.40 during mid-day trading on Monday, reaching $20.12. The company's stock had a trading volume of 2,693,348 shares, compared to its average volume of 2,091,625. The company has a current ratio of 1.79, a quick ratio of 1.79 and a debt-to-equity ratio of 2.61. Starwood Property Trust has a 1-year low of $18.12 and a 1-year high of $21.17. The business has a 50-day simple moving average of $19.41 and a two-hundred day simple moving average of $19.82. The stock has a market cap of $6.78 billion, a P/E ratio of 17.20 and a beta of 1.69.

Analyst Upgrades and Downgrades

STWD has been the topic of several analyst reports. Keefe, Bruyette & Woods cut their price target on shares of Starwood Property Trust from $22.50 to $22.00 and set an "outperform" rating on the stock in a research report on Tuesday, January 14th. JPMorgan Chase & Co. dropped their target price on Starwood Property Trust from $20.00 to $19.50 and set an "overweight" rating on the stock in a report on Tuesday, January 21st. JMP Securities decreased their price target on Starwood Property Trust from $24.00 to $23.00 and set a "market outperform" rating for the company in a research note on Thursday, November 7th. Finally, UBS Group boosted their price target on Starwood Property Trust from $19.50 to $20.00 and gave the stock a "neutral" rating in a research report on Friday, November 15th. Three equities research analysts have rated the stock with a hold rating, five have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $22.13.

Read Our Latest Report on Starwood Property Trust

Starwood Property Trust Company Profile

(

Get Free Report)

Starwood Property Trust, Inc operates as a real estate investment trust (REIT) in the United States and internationally. The company operates through Commercial and Residential Lending, Infrastructure Lending, Property, and Investing and Servicing segments. The Commercial and Residential Lending segment originates, acquires, finances, and manages commercial first mortgages, non-agency residential mortgages, subordinated mortgages, mezzanine loans, preferred equity, commercial mortgage-backed securities (CMBS), and residential mortgage-backed securities, as well as other real estate and real estate-related debt investments, include distressed or non-performing loans.

Recommended Stories

Before you consider Starwood Property Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Starwood Property Trust wasn't on the list.

While Starwood Property Trust currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.