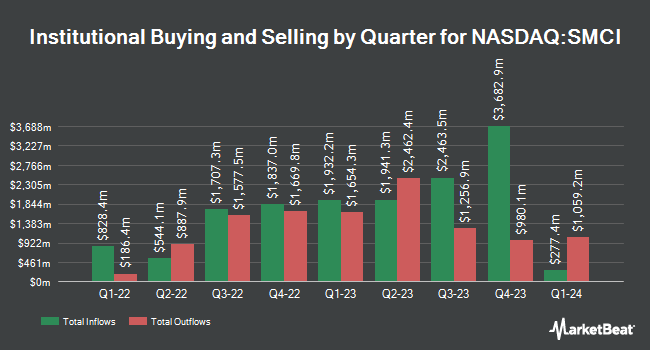

State of Alaska Department of Revenue grew its position in Super Micro Computer, Inc. (NASDAQ:SMCI - Free Report) by 877.3% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 57,395 shares of the company's stock after purchasing an additional 51,522 shares during the quarter. State of Alaska Department of Revenue's holdings in Super Micro Computer were worth $1,749,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds have also modified their holdings of the company. Emerald Mutual Fund Advisers Trust bought a new position in shares of Super Micro Computer in the third quarter worth approximately $87,000. Wealth Effects LLC boosted its position in shares of Super Micro Computer by 90.7% in the third quarter. Wealth Effects LLC now owns 515 shares of the company's stock worth $214,000 after purchasing an additional 245 shares during the period. Retirement Systems of Alabama boosted its position in shares of Super Micro Computer by 2.3% in the third quarter. Retirement Systems of Alabama now owns 11,367 shares of the company's stock worth $4,733,000 after purchasing an additional 258 shares during the period. Livforsakringsbolaget Skandia Omsesidigt boosted its position in shares of Super Micro Computer by 252.8% in the third quarter. Livforsakringsbolaget Skandia Omsesidigt now owns 374 shares of the company's stock worth $156,000 after purchasing an additional 268 shares during the period. Finally, CWM LLC boosted its position in shares of Super Micro Computer by 11.7% in the third quarter. CWM LLC now owns 2,773 shares of the company's stock worth $1,155,000 after purchasing an additional 290 shares during the period. 84.06% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of equities analysts have weighed in on SMCI shares. Argus lowered shares of Super Micro Computer from a "buy" rating to a "hold" rating in a research report on Thursday, October 31st. Loop Capital boosted their target price on shares of Super Micro Computer from $40.00 to $50.00 and gave the stock a "buy" rating in a report on Wednesday. Cfra raised shares of Super Micro Computer from a "hold" rating to a "buy" rating and set a $48.00 target price on the stock in a report on Tuesday. Northland Capmk raised shares of Super Micro Computer to a "strong-buy" rating in a report on Friday, December 20th. Finally, The Goldman Sachs Group lowered their target price on shares of Super Micro Computer from $67.50 to $28.00 and set a "neutral" rating on the stock in a report on Wednesday, November 6th. Three equities research analysts have rated the stock with a sell rating, ten have issued a hold rating, five have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, Super Micro Computer currently has a consensus rating of "Hold" and a consensus target price of $60.20.

View Our Latest Stock Analysis on Super Micro Computer

Super Micro Computer Price Performance

Super Micro Computer stock traded up $5.63 during mid-day trading on Friday, reaching $47.91. 132,026,965 shares of the company's stock traded hands, compared to its average volume of 35,788,788. Super Micro Computer, Inc. has a 12-month low of $17.25 and a 12-month high of $122.90. The company has a market cap of $28.05 billion, a price-to-earnings ratio of 24.05 and a beta of 1.30. The company has a quick ratio of 1.93, a current ratio of 3.77 and a debt-to-equity ratio of 0.32. The stock has a 50 day moving average of $33.59 and a two-hundred day moving average of $40.16.

Super Micro Computer Company Profile

(

Free Report)

Super Micro Computer, Inc, together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software.

Recommended Stories

Before you consider Super Micro Computer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Micro Computer wasn't on the list.

While Super Micro Computer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.