State of Alaska Department of Revenue lowered its position in Carpenter Technology Co. (NYSE:CRS - Free Report) by 80.1% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The fund owned 5,685 shares of the basic materials company's stock after selling 22,820 shares during the period. State of Alaska Department of Revenue's holdings in Carpenter Technology were worth $964,000 at the end of the most recent reporting period.

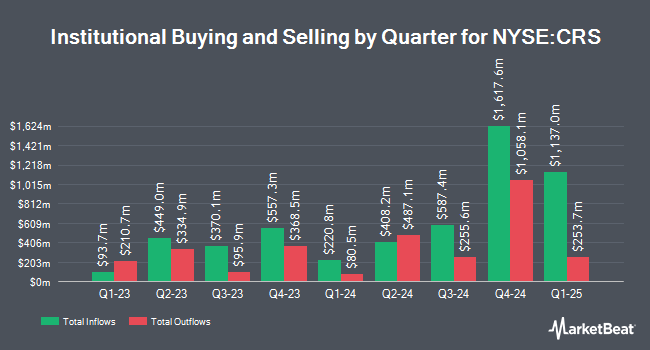

Other hedge funds have also recently added to or reduced their stakes in the company. Tidal Investments LLC grew its holdings in Carpenter Technology by 91.9% during the third quarter. Tidal Investments LLC now owns 21,083 shares of the basic materials company's stock valued at $3,364,000 after purchasing an additional 10,094 shares during the last quarter. Fisher Asset Management LLC grew its holdings in Carpenter Technology by 3.9% during the third quarter. Fisher Asset Management LLC now owns 364,312 shares of the basic materials company's stock valued at $58,137,000 after purchasing an additional 13,815 shares during the last quarter. Forest Avenue Capital Management LP acquired a new position in Carpenter Technology during the third quarter valued at approximately $25,262,000. Natixis Advisors LLC grew its holdings in Carpenter Technology by 6.0% during the third quarter. Natixis Advisors LLC now owns 23,817 shares of the basic materials company's stock valued at $3,801,000 after purchasing an additional 1,343 shares during the last quarter. Finally, Park Avenue Securities LLC acquired a new position in Carpenter Technology during the fourth quarter valued at approximately $419,000. Institutional investors and hedge funds own 92.03% of the company's stock.

Analyst Upgrades and Downgrades

CRS has been the topic of several analyst reports. JPMorgan Chase & Co. increased their price target on Carpenter Technology from $220.00 to $235.00 and gave the company an "overweight" rating in a report on Monday, January 27th. Benchmark restated a "buy" rating and issued a $175.00 price objective on shares of Carpenter Technology in a research note on Friday, October 25th. One investment analyst has rated the stock with a sell rating and five have assigned a buy rating to the company's stock. According to MarketBeat.com, Carpenter Technology currently has an average rating of "Moderate Buy" and a consensus price target of $155.50.

View Our Latest Research Report on CRS

Carpenter Technology Stock Performance

Shares of Carpenter Technology stock traded up $5.75 during midday trading on Monday, hitting $188.92. The company had a trading volume of 974,277 shares, compared to its average volume of 711,263. The business's 50 day simple moving average is $186.77 and its two-hundred day simple moving average is $168.66. The stock has a market cap of $9.44 billion, a PE ratio of 35.65, a P/E/G ratio of 0.88 and a beta of 1.54. The company has a debt-to-equity ratio of 0.40, a current ratio of 3.80 and a quick ratio of 1.92. Carpenter Technology Co. has a 1-year low of $62.99 and a 1-year high of $213.65.

Carpenter Technology (NYSE:CRS - Get Free Report) last announced its quarterly earnings data on Thursday, January 30th. The basic materials company reported $1.66 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.58 by $0.08. Carpenter Technology had a net margin of 9.34% and a return on equity of 19.88%. As a group, equities analysts predict that Carpenter Technology Co. will post 6.83 EPS for the current fiscal year.

Carpenter Technology Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, March 6th. Investors of record on Friday, February 28th will be given a $0.20 dividend. The ex-dividend date is Tuesday, January 28th. This represents a $0.80 annualized dividend and a yield of 0.42%. Carpenter Technology's dividend payout ratio (DPR) is currently 15.09%.

Carpenter Technology Company Profile

(

Free Report)

Carpenter Technology Corporation engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally. It operates in two segments, Specialty Alloys Operations and Performance Engineered Products. The company offers specialty alloys, including titanium alloys, powder metals, stainless steels, alloy steels, and tool steels, as well as additives, and metal powders and parts.

See Also

Before you consider Carpenter Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carpenter Technology wasn't on the list.

While Carpenter Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.