State of New Jersey Common Pension Fund D increased its holdings in LiveRamp Holdings, Inc. (NYSE:RAMP - Free Report) by 30.2% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 77,696 shares of the company's stock after acquiring an additional 18,009 shares during the period. State of New Jersey Common Pension Fund D owned about 0.12% of LiveRamp worth $1,925,000 at the end of the most recent reporting period.

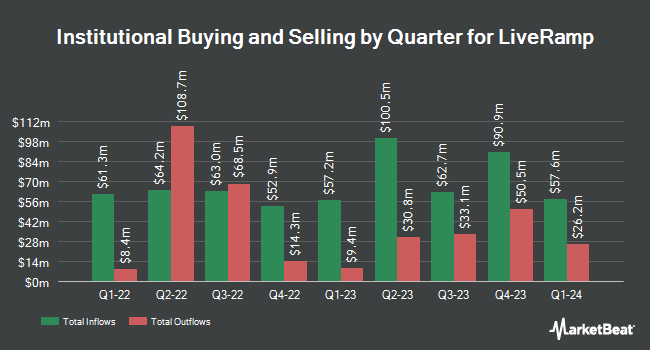

A number of other institutional investors have also recently bought and sold shares of RAMP. Louisiana State Employees Retirement System increased its stake in shares of LiveRamp by 1.5% in the second quarter. Louisiana State Employees Retirement System now owns 33,300 shares of the company's stock worth $1,030,000 after acquiring an additional 500 shares during the last quarter. Arizona State Retirement System raised its stake in shares of LiveRamp by 2.9% during the 2nd quarter. Arizona State Retirement System now owns 18,528 shares of the company's stock worth $573,000 after purchasing an additional 523 shares in the last quarter. DT Investment Partners LLC lifted its holdings in shares of LiveRamp by 62.6% during the 3rd quarter. DT Investment Partners LLC now owns 1,415 shares of the company's stock valued at $35,000 after buying an additional 545 shares during the last quarter. Covestor Ltd lifted its holdings in shares of LiveRamp by 44.9% during the 1st quarter. Covestor Ltd now owns 2,131 shares of the company's stock valued at $73,000 after buying an additional 660 shares during the last quarter. Finally, Blue Trust Inc. grew its stake in shares of LiveRamp by 187.1% in the 2nd quarter. Blue Trust Inc. now owns 1,065 shares of the company's stock valued at $33,000 after buying an additional 694 shares in the last quarter. 93.83% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity at LiveRamp

In related news, Director Debora B. Tomlin sold 9,765 shares of the firm's stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $25.07, for a total value of $244,808.55. Following the completion of the transaction, the director now directly owns 24,509 shares of the company's stock, valued at $614,440.63. This trade represents a 28.49 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, CTO Mohsin Hussain sold 5,773 shares of LiveRamp stock in a transaction on Friday, August 30th. The stock was sold at an average price of $25.98, for a total transaction of $149,982.54. Following the sale, the chief technology officer now owns 73,614 shares in the company, valued at $1,912,491.72. This represents a 7.27 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 19,538 shares of company stock worth $495,471 in the last ninety days. 3.39% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

RAMP has been the subject of a number of analyst reports. Macquarie reiterated an "outperform" rating and issued a $43.00 target price on shares of LiveRamp in a research note on Thursday, November 7th. Craig Hallum decreased their price objective on shares of LiveRamp from $55.00 to $43.00 and set a "buy" rating for the company in a report on Thursday, August 8th. Benchmark cut their target price on LiveRamp from $48.00 to $42.00 and set a "buy" rating on the stock in a report on Thursday, November 7th. Wells Fargo & Company began coverage on LiveRamp in a research note on Monday, October 28th. They set an "equal weight" rating and a $25.00 price target for the company. Finally, Evercore ISI lowered their price objective on LiveRamp from $50.00 to $40.00 and set an "outperform" rating on the stock in a report on Thursday, August 8th. One research analyst has rated the stock with a hold rating and seven have given a buy rating to the company. According to data from MarketBeat.com, LiveRamp presently has a consensus rating of "Moderate Buy" and a consensus target price of $41.14.

Check Out Our Latest Stock Report on RAMP

LiveRamp Stock Performance

Shares of LiveRamp stock traded up $0.25 during trading on Monday, reaching $28.14. The company's stock had a trading volume of 398,183 shares, compared to its average volume of 647,258. LiveRamp Holdings, Inc. has a one year low of $21.45 and a one year high of $42.66. The firm has a market cap of $1.84 billion, a price-to-earnings ratio of 562.80 and a beta of 0.96. The business's fifty day moving average price is $25.45 and its 200-day moving average price is $28.05.

LiveRamp (NYSE:RAMP - Get Free Report) last released its earnings results on Wednesday, November 6th. The company reported $0.51 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.37 by $0.14. LiveRamp had a return on equity of 1.25% and a net margin of 0.40%. The firm had revenue of $185.00 million for the quarter, compared to analyst estimates of $176.16 million. During the same quarter last year, the firm posted $0.21 EPS. The company's revenue was up 15.6% on a year-over-year basis. Sell-side analysts anticipate that LiveRamp Holdings, Inc. will post 0.37 EPS for the current year.

LiveRamp Profile

(

Free Report)

LiveRamp Holdings, Inc, a technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally. The company operates LiveRamp Data Collaboration platform enables an organization to unify customer and prospect data to build a single view of the customer in a way that protects consumer privacy.

Further Reading

Before you consider LiveRamp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LiveRamp wasn't on the list.

While LiveRamp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.