State of New Jersey Common Pension Fund D reduced its stake in shares of Vornado Realty Trust (NYSE:VNO - Free Report) by 21.2% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 64,140 shares of the real estate investment trust's stock after selling 17,254 shares during the period. State of New Jersey Common Pension Fund D's holdings in Vornado Realty Trust were worth $2,527,000 at the end of the most recent quarter.

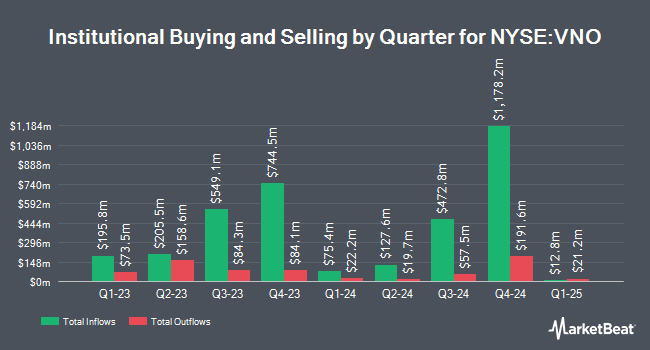

Several other large investors have also bought and sold shares of the stock. Atria Investments Inc raised its position in shares of Vornado Realty Trust by 5.6% in the 3rd quarter. Atria Investments Inc now owns 51,725 shares of the real estate investment trust's stock worth $2,038,000 after acquiring an additional 2,752 shares in the last quarter. Assetmark Inc. grew its stake in shares of Vornado Realty Trust by 122.2% in the 3rd quarter. Assetmark Inc. now owns 1,202 shares of the real estate investment trust's stock valued at $47,000 after buying an additional 661 shares during the period. Principal Financial Group Inc. boosted its stake in Vornado Realty Trust by 428.3% during the 3rd quarter. Principal Financial Group Inc. now owns 2,820,958 shares of the real estate investment trust's stock valued at $111,146,000 after purchasing an additional 2,286,997 shares during the last quarter. Asset Management One Co. Ltd. boosted its stake in Vornado Realty Trust by 1.1% during the 3rd quarter. Asset Management One Co. Ltd. now owns 237,156 shares of the real estate investment trust's stock valued at $9,344,000 after purchasing an additional 2,659 shares during the last quarter. Finally, Van ECK Associates Corp boosted its stake in Vornado Realty Trust by 10.1% during the 3rd quarter. Van ECK Associates Corp now owns 77,794 shares of the real estate investment trust's stock valued at $3,335,000 after purchasing an additional 7,144 shares during the last quarter. 90.02% of the stock is owned by institutional investors.

Vornado Realty Trust Price Performance

NYSE:VNO traded down $0.42 during midday trading on Thursday, hitting $41.65. The company had a trading volume of 1,257,544 shares, compared to its average volume of 2,017,967. Vornado Realty Trust has a 52-week low of $21.16 and a 52-week high of $46.63. The stock's fifty day moving average price is $40.11 and its 200-day moving average price is $32.01. The company has a market capitalization of $7.94 billion, a PE ratio of -143.59 and a beta of 1.64. The company has a quick ratio of 4.97, a current ratio of 4.97 and a debt-to-equity ratio of 1.93.

Vornado Realty Trust (NYSE:VNO - Get Free Report) last posted its quarterly earnings results on Monday, November 4th. The real estate investment trust reported ($0.10) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.51 by ($0.61). Vornado Realty Trust had a net margin of 0.46% and a return on equity of 1.72%. The business had revenue of $443.26 million for the quarter, compared to analysts' expectations of $445.07 million. During the same quarter in the previous year, the company earned $0.66 earnings per share. The business's quarterly revenue was down 1.7% on a year-over-year basis. As a group, research analysts expect that Vornado Realty Trust will post 2.15 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of research firms have issued reports on VNO. The Goldman Sachs Group lifted their price target on Vornado Realty Trust from $21.50 to $23.75 and gave the company a "sell" rating in a research note on Thursday, September 12th. Piper Sandler reaffirmed a "neutral" rating and issued a $44.00 price target (up previously from $30.00) on shares of Vornado Realty Trust in a report on Friday, October 18th. StockNews.com raised shares of Vornado Realty Trust to a "sell" rating in a report on Tuesday. Truist Financial lifted their price target on shares of Vornado Realty Trust from $26.00 to $31.00 and gave the stock a "hold" rating in a report on Tuesday, August 27th. Finally, BMO Capital Markets raised shares of Vornado Realty Trust from a "market perform" rating to an "outperform" rating and boosted their target price for the company from $29.00 to $40.00 in a report on Thursday, August 8th. Four equities research analysts have rated the stock with a sell rating, six have issued a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat.com, Vornado Realty Trust presently has a consensus rating of "Hold" and a consensus price target of $34.07.

Get Our Latest Research Report on Vornado Realty Trust

About Vornado Realty Trust

(

Free Report)

Vornado Realty Trust is a fully - integrated equity real estate investment trust.

Read More

Before you consider Vornado Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vornado Realty Trust wasn't on the list.

While Vornado Realty Trust currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.