State of New Jersey Common Pension Fund D lessened its stake in shares of Vale S.A. (NYSE:VALE - Free Report) by 29.5% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 485,219 shares of the basic materials company's stock after selling 203,216 shares during the quarter. State of New Jersey Common Pension Fund D's holdings in Vale were worth $5,667,000 at the end of the most recent reporting period.

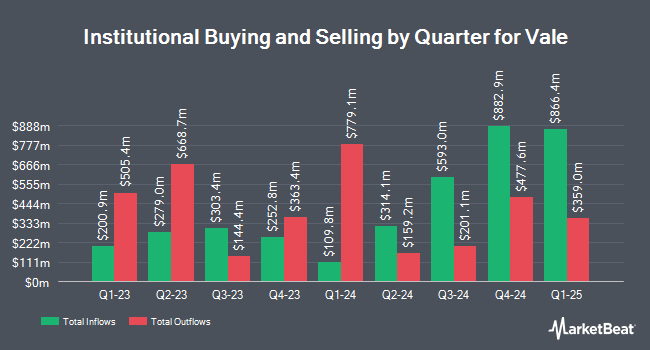

Other institutional investors have also modified their holdings of the company. Ballentine Partners LLC raised its position in Vale by 7.8% during the 3rd quarter. Ballentine Partners LLC now owns 13,627 shares of the basic materials company's stock worth $159,000 after buying an additional 987 shares during the last quarter. Legacy Capital Group California Inc. grew its stake in shares of Vale by 6.9% during the 2nd quarter. Legacy Capital Group California Inc. now owns 17,932 shares of the basic materials company's stock worth $200,000 after purchasing an additional 1,154 shares during the period. Bank of New York Mellon Corp grew its stake in shares of Vale by 1.9% during the 2nd quarter. Bank of New York Mellon Corp now owns 62,076 shares of the basic materials company's stock worth $693,000 after purchasing an additional 1,187 shares during the period. Inspire Advisors LLC grew its stake in shares of Vale by 6.8% during the 1st quarter. Inspire Advisors LLC now owns 19,277 shares of the basic materials company's stock worth $235,000 after purchasing an additional 1,226 shares during the period. Finally, IFG Advisory LLC grew its stake in shares of Vale by 6.1% during the 2nd quarter. IFG Advisory LLC now owns 22,702 shares of the basic materials company's stock worth $254,000 after purchasing an additional 1,296 shares during the period. Hedge funds and other institutional investors own 21.85% of the company's stock.

Vale Price Performance

NYSE:VALE traded down $0.28 during midday trading on Tuesday, hitting $9.94. 15,544,617 shares of the stock were exchanged, compared to its average volume of 27,596,082. The company has a market capitalization of $44.56 billion, a price-to-earnings ratio of 4.73, a P/E/G ratio of 0.29 and a beta of 0.94. Vale S.A. has a one year low of $9.66 and a one year high of $16.08. The business has a 50-day moving average price of $10.80 and a two-hundred day moving average price of $11.18. The company has a current ratio of 0.91, a quick ratio of 0.58 and a debt-to-equity ratio of 0.39.

Vale (NYSE:VALE - Get Free Report) last released its earnings results on Thursday, October 24th. The basic materials company reported $0.56 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.41 by $0.15. The company had revenue of $9.55 billion during the quarter, compared to analyst estimates of $9.61 billion. Vale had a return on equity of 21.07% and a net margin of 22.59%. During the same quarter in the prior year, the company earned $0.66 earnings per share. Sell-side analysts predict that Vale S.A. will post 2.12 EPS for the current year.

Analyst Ratings Changes

A number of research analysts have issued reports on VALE shares. JPMorgan Chase & Co. reduced their target price on shares of Vale from $16.50 to $15.00 and set an "overweight" rating on the stock in a report on Monday, September 23rd. Wolfe Research lowered shares of Vale from a "peer perform" rating to an "underperform" rating in a report on Wednesday, October 9th. Scotiabank reduced their target price on shares of Vale from $17.00 to $16.00 and set a "sector perform" rating on the stock in a report on Tuesday, October 15th. Morgan Stanley reduced their target price on Vale from $16.00 to $15.50 and set an "overweight" rating on the stock in a report on Thursday, September 19th. Finally, StockNews.com assumed coverage on Vale in a research report on Friday, October 18th. They issued a "buy" rating on the stock. One investment analyst has rated the stock with a sell rating, five have given a hold rating and six have assigned a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $15.83.

View Our Latest Research Report on Vale

About Vale

(

Free Report)

Vale SA, together with its subsidiaries, produces and sells iron ore and iron ore pellets for use as raw materials in steelmaking in Brazil and internationally. The company operates through Iron Solutions and Energy Transition Materials segments. The Iron Solutions segment produces and extracts iron ore and pellets, manganese, and other ferrous products; and provides related logistic services.

Featured Stories

Before you consider Vale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vale wasn't on the list.

While Vale currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.