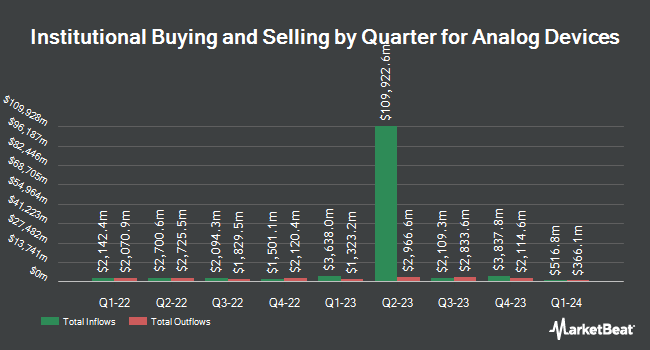

State of New Jersey Common Pension Fund D trimmed its position in Analog Devices, Inc. (NASDAQ:ADI - Free Report) by 1.4% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 180,057 shares of the semiconductor company's stock after selling 2,626 shares during the quarter. State of New Jersey Common Pension Fund D's holdings in Analog Devices were worth $41,444,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors and hedge funds have also made changes to their positions in the company. Capital Performance Advisors LLP acquired a new position in Analog Devices in the third quarter valued at approximately $28,000. New Millennium Group LLC acquired a new position in Analog Devices during the 2nd quarter valued at approximately $29,000. ORG Partners LLC grew its stake in Analog Devices by 675.0% during the 2nd quarter. ORG Partners LLC now owns 155 shares of the semiconductor company's stock worth $35,000 after buying an additional 135 shares during the last quarter. CVA Family Office LLC increased its position in Analog Devices by 40.2% in the second quarter. CVA Family Office LLC now owns 157 shares of the semiconductor company's stock worth $36,000 after buying an additional 45 shares during the period. Finally, Hobbs Group Advisors LLC bought a new stake in Analog Devices in the second quarter valued at $37,000. 86.81% of the stock is owned by institutional investors and hedge funds.

Insider Activity at Analog Devices

In other news, CEO Vincent Roche sold 10,000 shares of the business's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $228.69, for a total value of $2,286,900.00. Following the completion of the sale, the chief executive officer now directly owns 51,039 shares in the company, valued at approximately $11,672,108.91. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In related news, EVP Gregory M. Bryant sold 30,000 shares of the business's stock in a transaction on Wednesday, September 25th. The shares were sold at an average price of $224.10, for a total transaction of $6,723,000.00. Following the transaction, the executive vice president now owns 109,093 shares of the company's stock, valued at approximately $24,447,741.30. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CEO Vincent Roche sold 10,000 shares of the stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $228.69, for a total transaction of $2,286,900.00. Following the completion of the sale, the chief executive officer now directly owns 51,039 shares of the company's stock, valued at approximately $11,672,108.91. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 111,495 shares of company stock valued at $25,229,958. Corporate insiders own 0.31% of the company's stock.

Analog Devices Stock Down 0.9 %

Shares of NASDAQ ADI traded down $1.97 during mid-day trading on Friday, reaching $225.80. The company had a trading volume of 3,426,964 shares, compared to its average volume of 2,521,661. The company has a debt-to-equity ratio of 0.19, a quick ratio of 1.24 and a current ratio of 1.69. Analog Devices, Inc. has a twelve month low of $166.78 and a twelve month high of $244.14. The stock's 50 day moving average is $226.61 and its 200-day moving average is $224.63. The stock has a market capitalization of $112.11 billion, a PE ratio of 67.81, a price-to-earnings-growth ratio of 3.17 and a beta of 1.08.

Analog Devices (NASDAQ:ADI - Get Free Report) last announced its quarterly earnings results on Wednesday, August 21st. The semiconductor company reported $1.58 EPS for the quarter, beating the consensus estimate of $1.50 by $0.08. The business had revenue of $2.31 billion during the quarter, compared to analysts' expectations of $2.27 billion. Analog Devices had a return on equity of 9.47% and a net margin of 17.07%. The firm's quarterly revenue was down 24.8% compared to the same quarter last year. During the same quarter in the previous year, the business posted $2.49 EPS. As a group, equities analysts anticipate that Analog Devices, Inc. will post 6.34 earnings per share for the current fiscal year.

Analog Devices Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, September 17th. Stockholders of record on Tuesday, September 3rd were paid a dividend of $0.92 per share. The ex-dividend date was Tuesday, September 3rd. This represents a $3.68 annualized dividend and a dividend yield of 1.63%. Analog Devices's dividend payout ratio (DPR) is presently 110.51%.

Wall Street Analyst Weigh In

A number of analysts recently weighed in on the stock. Bank of America dropped their price objective on shares of Analog Devices from $260.00 to $255.00 and set a "buy" rating on the stock in a report on Thursday, August 22nd. Cantor Fitzgerald restated a "neutral" rating and issued a $250.00 price target on shares of Analog Devices in a research note on Tuesday, October 8th. Morgan Stanley boosted their price objective on Analog Devices from $250.00 to $257.00 and gave the stock an "overweight" rating in a research report on Thursday, August 22nd. JPMorgan Chase & Co. raised their target price on Analog Devices from $260.00 to $280.00 and gave the company an "overweight" rating in a research report on Thursday, August 22nd. Finally, Truist Financial lowered Analog Devices from a "buy" rating to a "hold" rating and reduced their price target for the stock from $266.00 to $233.00 in a research report on Monday, September 23rd. Six investment analysts have rated the stock with a hold rating and sixteen have given a buy rating to the stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $249.80.

Check Out Our Latest Stock Analysis on ADI

Analog Devices Profile

(

Free Report)

Analog Devices, Inc designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia. The company provides data converter products, which translate real-world analog signals into digital data, as well as translates digital data into analog signals; power management and reference products for power conversion, driver monitoring, sequencing, and energy management applications in the automotive, communications, industrial, and consumer markets; and power ICs that include performance, integration, and software design simulation tools for accurate power supply designs.

Read More

Before you consider Analog Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Analog Devices wasn't on the list.

While Analog Devices currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report