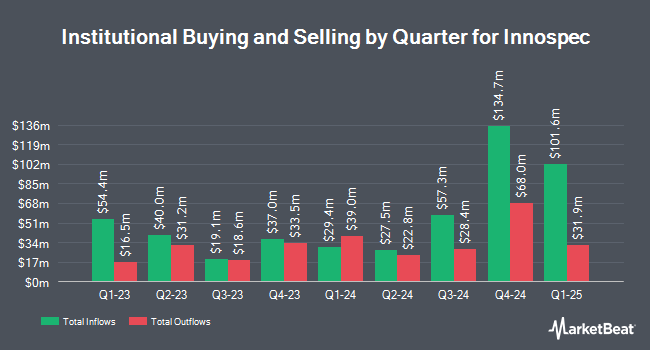

State Street Corp raised its position in Innospec Inc. (NASDAQ:IOSP - Free Report) by 2.1% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 996,281 shares of the specialty chemicals company's stock after acquiring an additional 20,744 shares during the quarter. State Street Corp owned 3.99% of Innospec worth $112,669,000 at the end of the most recent quarter.

Other large investors also recently bought and sold shares of the company. Allspring Global Investments Holdings LLC grew its stake in Innospec by 4.6% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 2,405,770 shares of the specialty chemicals company's stock valued at $272,069,000 after purchasing an additional 105,311 shares in the last quarter. Wasatch Advisors LP boosted its stake in shares of Innospec by 0.6% during the 3rd quarter. Wasatch Advisors LP now owns 1,805,546 shares of the specialty chemicals company's stock valued at $204,189,000 after buying an additional 11,231 shares during the last quarter. Victory Capital Management Inc. increased its stake in shares of Innospec by 4.8% in the third quarter. Victory Capital Management Inc. now owns 908,032 shares of the specialty chemicals company's stock worth $102,689,000 after buying an additional 41,449 shares during the last quarter. Royce & Associates LP raised its holdings in Innospec by 9.3% in the third quarter. Royce & Associates LP now owns 835,333 shares of the specialty chemicals company's stock valued at $94,468,000 after acquiring an additional 70,902 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. boosted its stake in Innospec by 3.5% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 336,522 shares of the specialty chemicals company's stock valued at $38,057,000 after acquiring an additional 11,479 shares during the last quarter. Institutional investors and hedge funds own 96.64% of the company's stock.

Innospec Trading Up 0.1 %

Innospec stock traded up $0.11 during mid-day trading on Monday, reaching $115.97. The company's stock had a trading volume of 120,206 shares, compared to its average volume of 108,528. The firm has a market cap of $2.89 billion, a price-to-earnings ratio of 20.24 and a beta of 1.09. Innospec Inc. has a twelve month low of $103.97 and a twelve month high of $133.71. The business has a 50 day moving average price of $115.62 and a 200-day moving average price of $117.32.

Innospec (NASDAQ:IOSP - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The specialty chemicals company reported $1.35 earnings per share for the quarter, hitting the consensus estimate of $1.35. Innospec had a net margin of 7.68% and a return on equity of 13.33%. The firm had revenue of $443.40 million for the quarter, compared to analyst estimates of $442.13 million. During the same quarter in the prior year, the business earned $1.59 earnings per share. Innospec's quarterly revenue was down 4.5% on a year-over-year basis. On average, equities analysts expect that Innospec Inc. will post 5.88 EPS for the current fiscal year.

Innospec Increases Dividend

The business also recently disclosed a Semi-Annual dividend, which was paid on Tuesday, November 26th. Investors of record on Monday, November 18th were paid a dividend of $0.79 per share. This is an increase from Innospec's previous Semi-Annual dividend of $0.72. This represents a yield of 1.3%. The ex-dividend date of this dividend was Monday, November 18th. Innospec's dividend payout ratio is presently 27.57%.

Analyst Upgrades and Downgrades

Separately, StockNews.com raised shares of Innospec from a "buy" rating to a "strong-buy" rating in a research report on Tuesday, December 10th.

Check Out Our Latest Stock Analysis on Innospec

Insider Buying and Selling at Innospec

In other news, Director Milton C. Blackmore sold 1,035 shares of the business's stock in a transaction that occurred on Wednesday, November 13th. The stock was sold at an average price of $122.92, for a total transaction of $127,222.20. Following the completion of the transaction, the director now directly owns 9,028 shares in the company, valued at approximately $1,109,721.76. The trade was a 10.29 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. 1.52% of the stock is currently owned by company insiders.

About Innospec

(

Free Report)

Innospec Inc develops, manufactures, blends, markets, and supplies specialty chemicals in the United States, rest of North America, the United Kingdom, rest of Europe, and internationally. The company's Fuel Specialties segment offers a range of specialty chemical products that are used as additives in additives in diesel, jet, marine, fuel oil and other fuels.

See Also

Before you consider Innospec, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Innospec wasn't on the list.

While Innospec currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.