State Street Corp boosted its stake in TE Connectivity Ltd. (NYSE:TEL - Free Report) by 2.1% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 12,852,607 shares of the electronics maker's stock after purchasing an additional 268,837 shares during the quarter. State Street Corp owned about 4.30% of TE Connectivity worth $1,940,615,000 at the end of the most recent reporting period.

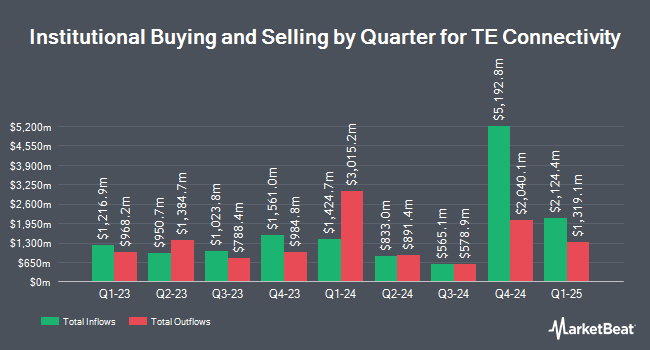

Other institutional investors and hedge funds have also bought and sold shares of the company. Venturi Wealth Management LLC increased its stake in shares of TE Connectivity by 1,632.0% in the 3rd quarter. Venturi Wealth Management LLC now owns 6,547 shares of the electronics maker's stock valued at $989,000 after purchasing an additional 6,169 shares during the last quarter. Waverton Investment Management Ltd grew its position in TE Connectivity by 8.2% in the third quarter. Waverton Investment Management Ltd now owns 1,411,048 shares of the electronics maker's stock valued at $213,089,000 after acquiring an additional 106,688 shares during the last quarter. Marshall Financial Group LLC acquired a new position in TE Connectivity during the second quarter worth about $995,000. Oppenheimer Asset Management Inc. lifted its holdings in shares of TE Connectivity by 21.2% in the third quarter. Oppenheimer Asset Management Inc. now owns 69,349 shares of the electronics maker's stock worth $10,471,000 after acquiring an additional 12,140 shares during the last quarter. Finally, Glenmede Trust Co. NA boosted its stake in shares of TE Connectivity by 13.9% in the 3rd quarter. Glenmede Trust Co. NA now owns 194,264 shares of the electronics maker's stock valued at $29,322,000 after purchasing an additional 23,755 shares in the last quarter. Institutional investors own 91.43% of the company's stock.

TE Connectivity Trading Down 0.0 %

Shares of TE Connectivity stock traded down $0.03 on Friday, hitting $152.40. 1,465,061 shares of the company's stock traded hands, compared to its average volume of 1,286,881. The company has a fifty day moving average of $149.75 and a two-hundred day moving average of $149.77. TE Connectivity Ltd. has a one year low of $128.52 and a one year high of $159.98. The company has a market capitalization of $45.59 billion, a price-to-earnings ratio of 14.84, a price-to-earnings-growth ratio of 2.08 and a beta of 1.32. The company has a debt-to-equity ratio of 0.27, a current ratio of 1.61 and a quick ratio of 1.08.

TE Connectivity (NYSE:TEL - Get Free Report) last issued its earnings results on Wednesday, October 30th. The electronics maker reported $1.95 EPS for the quarter, meeting analysts' consensus estimates of $1.95. The business had revenue of $4.07 billion during the quarter, compared to analyst estimates of $4 billion. TE Connectivity had a return on equity of 18.48% and a net margin of 20.15%. The firm's revenue was up .8% compared to the same quarter last year. During the same period in the previous year, the company posted $1.78 EPS. As a group, sell-side analysts expect that TE Connectivity Ltd. will post 8.14 earnings per share for the current year.

TE Connectivity announced that its board has approved a share repurchase program on Wednesday, October 30th that authorizes the company to repurchase $2.50 billion in outstanding shares. This repurchase authorization authorizes the electronics maker to buy up to 5.4% of its shares through open market purchases. Shares repurchase programs are often a sign that the company's management believes its stock is undervalued.

Analyst Ratings Changes

Several equities analysts recently commented on TEL shares. Wolfe Research raised shares of TE Connectivity from a "peer perform" rating to an "outperform" rating in a research note on Thursday, September 5th. The Goldman Sachs Group lowered their target price on TE Connectivity from $189.00 to $179.00 and set a "buy" rating for the company in a report on Tuesday, October 1st. StockNews.com raised TE Connectivity from a "buy" rating to a "strong-buy" rating in a research note on Wednesday. HSBC downgraded TE Connectivity from a "hold" rating to a "reduce" rating and set a $137.00 price objective for the company. in a research note on Thursday, October 31st. Finally, Wells Fargo & Company cut their target price on shares of TE Connectivity from $155.00 to $153.00 and set an "equal weight" rating on the stock in a research report on Friday, September 20th. One investment analyst has rated the stock with a sell rating, six have issued a hold rating, five have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $159.55.

View Our Latest Report on TEL

About TE Connectivity

(

Free Report)

TE Connectivity Ltd., together with its subsidiaries, manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the AsiaPacific, and the Americas. The company operates through three segments: Transportation Solutions, Industrial Solutions, and Communications Solutions.

Featured Stories

Before you consider TE Connectivity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TE Connectivity wasn't on the list.

While TE Connectivity currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.