State Street Corp raised its position in shares of Viasat, Inc. (NASDAQ:VSAT - Free Report) by 6.6% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 4,445,811 shares of the communications equipment provider's stock after purchasing an additional 276,376 shares during the quarter. State Street Corp owned 3.46% of Viasat worth $53,083,000 as of its most recent SEC filing.

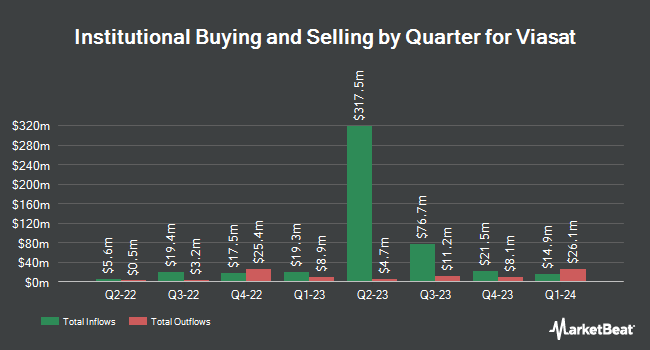

Several other hedge funds and other institutional investors have also recently made changes to their positions in VSAT. Quest Partners LLC purchased a new position in Viasat during the second quarter valued at $29,000. Point72 Hong Kong Ltd bought a new position in shares of Viasat in the third quarter worth about $28,000. KBC Group NV lifted its position in shares of Viasat by 63.7% during the 3rd quarter. KBC Group NV now owns 2,623 shares of the communications equipment provider's stock valued at $31,000 after buying an additional 1,021 shares in the last quarter. GAMMA Investing LLC lifted its position in shares of Viasat by 176.3% during the 3rd quarter. GAMMA Investing LLC now owns 2,777 shares of the communications equipment provider's stock valued at $33,000 after buying an additional 1,772 shares in the last quarter. Finally, Point72 Asia Singapore Pte. Ltd. bought a new position in shares of Viasat during the 2nd quarter valued at approximately $61,000. Hedge funds and other institutional investors own 86.05% of the company's stock.

Insider Activity at Viasat

In related news, EVP Mark J. Miller sold 3,564 shares of the stock in a transaction dated Thursday, December 12th. The shares were sold at an average price of $9.21, for a total value of $32,824.44. Following the completion of the transaction, the executive vice president now owns 350,351 shares of the company's stock, valued at approximately $3,226,732.71. This trade represents a 1.01 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 3.20% of the stock is currently owned by insiders.

Viasat Price Performance

Shares of VSAT traded up $0.21 during midday trading on Friday, hitting $8.79. 4,860,089 shares of the company traded hands, compared to its average volume of 1,967,738. The stock has a market cap of $1.13 billion, a price-to-earnings ratio of -2.82 and a beta of 1.34. The firm has a 50 day moving average of $9.46 and a 200-day moving average of $13.24. The company has a debt-to-equity ratio of 1.28, a quick ratio of 1.34 and a current ratio of 1.44. Viasat, Inc. has a 52 week low of $6.69 and a 52 week high of $29.11.

Viasat (NASDAQ:VSAT - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The communications equipment provider reported ($1.07) EPS for the quarter, missing analysts' consensus estimates of ($0.54) by ($0.53). The firm had revenue of $1.12 billion for the quarter, compared to the consensus estimate of $1.11 billion. Viasat had a negative net margin of 8.73% and a negative return on equity of 7.58%. Viasat's quarterly revenue was down 8.4% on a year-over-year basis. During the same period in the previous year, the company posted ($6.16) earnings per share. On average, analysts forecast that Viasat, Inc. will post -2.38 EPS for the current fiscal year.

Analyst Ratings Changes

Several brokerages have weighed in on VSAT. Needham & Company LLC lowered their price target on shares of Viasat from $28.00 to $19.00 and set a "buy" rating on the stock in a report on Tuesday, October 15th. Bank of America lowered their target price on shares of Viasat from $31.00 to $19.00 and set a "buy" rating on the stock in a research note on Friday, September 20th. JPMorgan Chase & Co. lowered Viasat from an "overweight" rating to a "neutral" rating and cut their price target for the stock from $29.00 to $15.00 in a research note on Tuesday, September 17th. Barclays lowered their price objective on Viasat from $24.00 to $9.00 and set an "equal weight" rating on the stock in a research report on Wednesday, November 20th. Finally, StockNews.com downgraded Viasat from a "hold" rating to a "sell" rating in a research note on Saturday, August 31st. One analyst has rated the stock with a sell rating, four have assigned a hold rating and two have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $18.33.

Get Our Latest Research Report on VSAT

Viasat Company Profile

(

Free Report)

Viasat, Inc provides broadband and communications products and services worldwide. The company's Satellite Services segment offers satellite-based fixed broadband services, including broadband internet access and voice over internet protocol services to consumers and businesses; in-flight entertainment and aviation software services to commercial airlines and private business jets; satellite-based connectivity services; mobile broadband services, including satellite-based internet services to energy offshore vessels, cruise ships, consumer ferries, and yachts; and energy services, which include ultra-secure solutions IP connectivity, bandwidth-optimized over-the-top applications, industrial internet-of-things big data enablement, and industry-leading machine learning analytics.

See Also

Before you consider Viasat, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viasat wasn't on the list.

While Viasat currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.