State Street Corp grew its holdings in Sable Offshore Corp. (NYSE:SOC - Free Report) by 74.3% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 1,589,395 shares of the company's stock after purchasing an additional 677,426 shares during the quarter. State Street Corp owned about 2.45% of Sable Offshore worth $37,557,000 as of its most recent filing with the SEC.

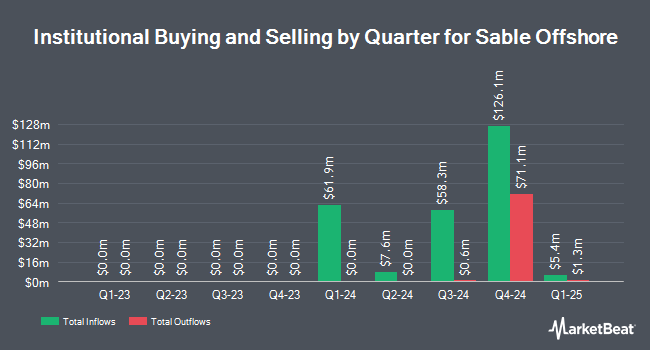

A number of other institutional investors have also made changes to their positions in the business. Himalaya Capital Management LLC bought a new position in Sable Offshore during the third quarter worth $31,735,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its holdings in shares of Sable Offshore by 9.9% during the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 39,248 shares of the company's stock worth $927,000 after purchasing an additional 3,531 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank raised its position in shares of Sable Offshore by 31.9% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 7,565 shares of the company's stock valued at $179,000 after buying an additional 1,830 shares during the last quarter. BBR Partners LLC bought a new stake in shares of Sable Offshore in the third quarter valued at about $354,000. Finally, MetLife Investment Management LLC grew its position in Sable Offshore by 129.1% during the third quarter. MetLife Investment Management LLC now owns 29,606 shares of the company's stock worth $700,000 after buying an additional 16,682 shares in the last quarter. 26.19% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

A number of brokerages have commented on SOC. Benchmark reiterated a "buy" rating and issued a $37.00 price objective on shares of Sable Offshore in a research report on Monday, October 7th. Johnson Rice started coverage on shares of Sable Offshore in a research note on Tuesday, November 5th. They set a "buy" rating and a $30.00 price target on the stock. Jefferies Financial Group increased their price objective on shares of Sable Offshore from $19.00 to $32.00 and gave the company a "buy" rating in a research note on Wednesday, September 4th. Pickering Energy Partners assumed coverage on shares of Sable Offshore in a report on Tuesday. They set an "outperform" rating for the company. Finally, BWS Financial reissued a "sell" rating and issued a $6.00 target price on shares of Sable Offshore in a research note on Wednesday, November 27th. One analyst has rated the stock with a sell rating and five have assigned a buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $25.00.

View Our Latest Report on SOC

Sable Offshore Stock Up 0.0 %

Shares of NYSE:SOC traded up $0.01 on Friday, hitting $22.27. The stock had a trading volume of 4,382,117 shares, compared to its average volume of 659,600. The firm's 50 day moving average price is $21.65 and its 200-day moving average price is $19.14. The company has a quick ratio of 3.34, a current ratio of 3.50 and a debt-to-equity ratio of 4.86. Sable Offshore Corp. has a twelve month low of $10.11 and a twelve month high of $28.67.

Sable Offshore Profile

(

Free Report)

Sable Offshore Corp. engages in the oil and gas exploration and development activities in the United States. The company operates through three platforms located in federal waters offshore California. It owns and operates 16 federal leases across approximately 76,000 acres and subsea pipelines, which transport crude oil, natural gas, and produced water from the platforms to the onshore processing facilities.

See Also

Before you consider Sable Offshore, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sable Offshore wasn't on the list.

While Sable Offshore currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.