State Street Corp grew its position in shares of Lazard, Inc. (NYSE:LAZ - Free Report) by 2.9% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,948,167 shares of the asset manager's stock after purchasing an additional 55,469 shares during the period. State Street Corp owned approximately 1.73% of Lazard worth $98,149,000 as of its most recent SEC filing.

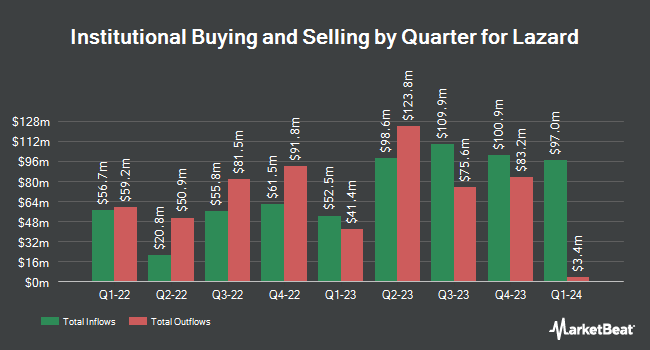

A number of other hedge funds have also made changes to their positions in the stock. Principal Financial Group Inc. lifted its holdings in shares of Lazard by 10.1% in the third quarter. Principal Financial Group Inc. now owns 2,250,049 shares of the asset manager's stock valued at $113,357,000 after buying an additional 206,295 shares during the period. Fisher Asset Management LLC grew its position in Lazard by 2.2% in the 3rd quarter. Fisher Asset Management LLC now owns 1,772,237 shares of the asset manager's stock worth $89,285,000 after purchasing an additional 37,681 shares during the last quarter. Claro Advisors LLC raised its position in Lazard by 10,306.7% in the third quarter. Claro Advisors LLC now owns 1,235,793 shares of the asset manager's stock worth $62,259,000 after purchasing an additional 1,223,918 shares in the last quarter. Charles Schwab Investment Management Inc. raised its stake in shares of Lazard by 2.1% in the third quarter. Charles Schwab Investment Management Inc. now owns 1,099,191 shares of the asset manager's stock valued at $55,377,000 after acquiring an additional 22,425 shares during the last quarter. Finally, Victory Capital Management Inc. increased its position in Lazard by 5,770.1% in the 3rd quarter. Victory Capital Management Inc. now owns 1,064,431 shares of the asset manager's stock valued at $53,626,000 after acquiring an additional 1,046,298 shares in the last quarter. Institutional investors and hedge funds own 54.80% of the company's stock.

Lazard Stock Performance

NYSE LAZ traded up $0.36 during trading hours on Monday, hitting $53.36. 927,290 shares of the stock were exchanged, compared to its average volume of 930,215. Lazard, Inc. has a 12-month low of $34.25 and a 12-month high of $61.14. The stock has a 50-day moving average of $54.40 and a 200 day moving average of $47.92. The company has a market cap of $6.02 billion, a price-to-earnings ratio of 21.28 and a beta of 1.38. The company has a quick ratio of 2.24, a current ratio of 2.24 and a debt-to-equity ratio of 2.72.

Lazard (NYSE:LAZ - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The asset manager reported $0.38 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.41 by ($0.03). Lazard had a net margin of 8.28% and a return on equity of 42.20%. The firm had revenue of $646.00 million for the quarter, compared to analysts' expectations of $644.22 million. During the same period last year, the firm posted $0.10 EPS. Lazard's revenue was up 21.4% on a year-over-year basis. As a group, equities research analysts forecast that Lazard, Inc. will post 2.18 earnings per share for the current year.

Lazard Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Friday, November 8th were paid a dividend of $0.50 per share. This represents a $2.00 dividend on an annualized basis and a dividend yield of 3.75%. The ex-dividend date of this dividend was Friday, November 8th. Lazard's dividend payout ratio (DPR) is presently 79.68%.

Analyst Upgrades and Downgrades

LAZ has been the subject of a number of analyst reports. StockNews.com downgraded Lazard from a "buy" rating to a "hold" rating in a research note on Monday, November 4th. Wells Fargo & Company began coverage on shares of Lazard in a research note on Thursday, September 12th. They set an "equal weight" rating and a $51.00 price target for the company. Keefe, Bruyette & Woods increased their target price on shares of Lazard from $59.00 to $65.00 and gave the company an "outperform" rating in a research report on Friday, November 1st. UBS Group lifted their price objective on Lazard from $49.00 to $52.00 and gave the company a "neutral" rating in a research note on Tuesday, October 8th. Finally, JMP Securities raised their price target on Lazard from $55.00 to $59.00 and gave the stock a "market outperform" rating in a research report on Friday, November 1st. One research analyst has rated the stock with a sell rating, four have issued a hold rating and three have given a buy rating to the company's stock. According to MarketBeat.com, Lazard presently has a consensus rating of "Hold" and an average price target of $53.43.

Get Our Latest Analysis on Lazard

Lazard Profile

(

Free Report)

Lazard, Inc, together with its subsidiaries, operates as a financial advisory and asset management firm in North and South America, Europe, the Middle East, Asia, and Australia. It operates in two segments, Financial Advisory and Asset Management. The Financial Advisory segment offers financial advisory services, such as mergers and acquisitions, capital markets, shareholder, sovereign, geopolitical advisory, and other strategic advisory services, as well as restructuring and liability management, and capital raising and placement services.

Further Reading

Before you consider Lazard, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lazard wasn't on the list.

While Lazard currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.