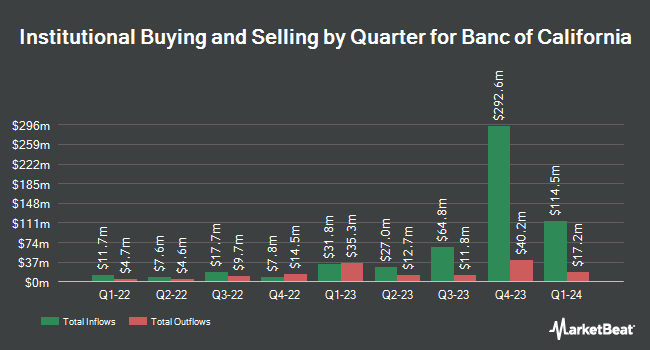

State Street Corp lessened its stake in Banc of California, Inc. (NYSE:BANC - Free Report) by 4.4% in the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 9,480,166 shares of the bank's stock after selling 433,646 shares during the quarter. State Street Corp owned approximately 5.97% of Banc of California worth $140,661,000 at the end of the most recent reporting period.

Several other large investors have also recently made changes to their positions in BANC. Fifth Third Bancorp raised its holdings in shares of Banc of California by 146.3% during the 2nd quarter. Fifth Third Bancorp now owns 2,143 shares of the bank's stock worth $27,000 after acquiring an additional 1,273 shares during the period. Future Financial Wealth Managment LLC purchased a new position in Banc of California in the third quarter worth approximately $29,000. GAMMA Investing LLC increased its stake in Banc of California by 32.3% during the third quarter. GAMMA Investing LLC now owns 3,005 shares of the bank's stock worth $44,000 after acquiring an additional 734 shares during the last quarter. Mendon Capital Advisors Corp acquired a new stake in Banc of California in the 2nd quarter valued at approximately $102,000. Finally, Paloma Partners Management Co acquired a new position in Banc of California during the third quarter worth $158,000. 86.88% of the stock is currently owned by hedge funds and other institutional investors.

Banc of California Price Performance

Banc of California stock traded down $0.02 during mid-day trading on Friday, hitting $16.72. 1,113,154 shares of the company were exchanged, compared to its average volume of 2,319,004. The company has a debt-to-equity ratio of 0.31, a current ratio of 0.89 and a quick ratio of 0.89. Banc of California, Inc. has a 12-month low of $11.88 and a 12-month high of $18.08. The business's 50 day simple moving average is $15.98 and its two-hundred day simple moving average is $14.47. The company has a market capitalization of $2.66 billion, a P/E ratio of -3.92 and a beta of 1.14.

Banc of California (NYSE:BANC - Get Free Report) last announced its quarterly earnings data on Tuesday, October 22nd. The bank reported $0.25 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.14 by $0.11. The business had revenue of $431.44 million for the quarter, compared to the consensus estimate of $229.46 million. Banc of California had a negative net margin of 20.75% and a positive return on equity of 2.93%. During the same quarter in the prior year, the firm posted $0.30 earnings per share. Analysts forecast that Banc of California, Inc. will post 0.7 earnings per share for the current fiscal year.

Banc of California Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Thursday, January 2nd. Stockholders of record on Monday, December 16th will be given a $0.10 dividend. This represents a $0.40 annualized dividend and a dividend yield of 2.39%. The ex-dividend date of this dividend is Monday, December 16th. Banc of California's payout ratio is -9.37%.

Analysts Set New Price Targets

A number of research firms have issued reports on BANC. Wells Fargo & Company increased their target price on shares of Banc of California from $16.00 to $17.00 and gave the stock an "equal weight" rating in a report on Wednesday, October 23rd. DA Davidson raised their target price on shares of Banc of California from $16.50 to $19.00 and gave the company a "buy" rating in a report on Wednesday, October 23rd. Keefe, Bruyette & Woods increased their price objective on shares of Banc of California from $17.50 to $20.00 and gave the company an "outperform" rating in a research report on Wednesday, December 4th. Wedbush lifted their price objective on shares of Banc of California from $18.00 to $19.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 23rd. Finally, Citigroup began coverage on shares of Banc of California in a research report on Thursday, October 10th. They set a "neutral" rating and a $15.00 price objective for the company. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and six have given a buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $17.80.

Check Out Our Latest Stock Analysis on Banc of California

About Banc of California

(

Free Report)

Banc of California, Inc operates as the bank holding company for Banc of California that provides various banking products and services in California. The company offers deposit products, such as checking, savings, money market, demand, and time deposits; certificates of deposit; retirement accounts; and safe deposit boxes.

Featured Articles

Before you consider Banc of California, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banc of California wasn't on the list.

While Banc of California currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.