State Street Corp lifted its holdings in Celanese Co. (NYSE:CE - Free Report) by 3.1% in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 4,500,813 shares of the basic materials company's stock after purchasing an additional 136,994 shares during the quarter. State Street Corp owned 4.12% of Celanese worth $611,931,000 at the end of the most recent quarter.

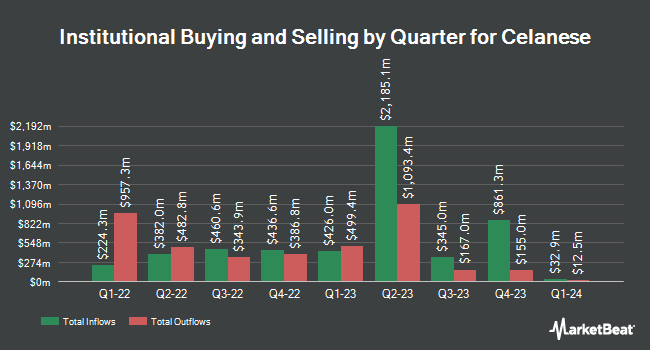

A number of other institutional investors and hedge funds have also recently modified their holdings of the business. Thrivent Financial for Lutherans boosted its stake in Celanese by 608.2% during the third quarter. Thrivent Financial for Lutherans now owns 689,570 shares of the basic materials company's stock worth $93,754,000 after buying an additional 592,196 shares during the period. LPL Financial LLC boosted its stake in Celanese by 528.9% during the second quarter. LPL Financial LLC now owns 260,523 shares of the basic materials company's stock worth $35,142,000 after buying an additional 219,095 shares during the period. Dimensional Fund Advisors LP boosted its stake in Celanese by 14.9% during the second quarter. Dimensional Fund Advisors LP now owns 1,161,298 shares of the basic materials company's stock worth $156,663,000 after buying an additional 150,201 shares during the period. KBC Group NV boosted its stake in Celanese by 155.5% during the third quarter. KBC Group NV now owns 213,657 shares of the basic materials company's stock worth $29,049,000 after buying an additional 130,037 shares during the period. Finally, Allspring Global Investments Holdings LLC boosted its stake in Celanese by 512.5% during the third quarter. Allspring Global Investments Holdings LLC now owns 118,149 shares of the basic materials company's stock worth $16,064,000 after buying an additional 98,860 shares during the period. 98.87% of the stock is owned by hedge funds and other institutional investors.

Celanese Stock Up 2.7 %

Shares of CE traded up $1.89 during mid-day trading on Monday, hitting $72.43. 3,304,906 shares of the company traded hands, compared to its average volume of 1,067,385. Celanese Co. has a 1-year low of $68.88 and a 1-year high of $172.16. The business has a 50 day moving average of $105.19 and a 200 day moving average of $124.59. The company has a quick ratio of 0.76, a current ratio of 1.37 and a debt-to-equity ratio of 1.47. The company has a market capitalization of $7.92 billion, a PE ratio of 7.10, a price-to-earnings-growth ratio of 0.75 and a beta of 1.18.

Celanese (NYSE:CE - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The basic materials company reported $2.44 earnings per share for the quarter, missing the consensus estimate of $2.85 by ($0.41). Celanese had a return on equity of 13.17% and a net margin of 10.40%. The business had revenue of $2.65 billion during the quarter, compared to analyst estimates of $2.70 billion. During the same quarter last year, the company posted $2.50 EPS. Celanese's quarterly revenue was down 2.8% compared to the same quarter last year. Equities research analysts anticipate that Celanese Co. will post 8.38 EPS for the current year.

Celanese Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, November 13th. Shareholders of record on Wednesday, October 30th were given a $0.70 dividend. The ex-dividend date of this dividend was Wednesday, October 30th. This represents a $2.80 annualized dividend and a yield of 3.87%. Celanese's dividend payout ratio is presently 28.17%.

Analyst Ratings Changes

CE has been the subject of several recent analyst reports. Jefferies Financial Group dropped their price objective on shares of Celanese from $102.00 to $82.00 in a research note on Thursday. Vertical Research lowered shares of Celanese from a "hold" rating to a "sell" rating and set a $130.00 target price for the company. in a research note on Tuesday, October 29th. Deutsche Bank Aktiengesellschaft raised shares of Celanese from a "hold" rating to a "buy" rating and lowered their target price for the company from $135.00 to $110.00 in a research note on Wednesday, November 6th. Robert W. Baird lowered their target price on shares of Celanese from $150.00 to $110.00 and set an "outperform" rating for the company in a research note on Wednesday, November 6th. Finally, KeyCorp lowered shares of Celanese from an "overweight" rating to a "sector weight" rating in a research note on Monday, October 7th. Five analysts have rated the stock with a sell rating, ten have assigned a hold rating and three have assigned a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $116.56.

Check Out Our Latest Stock Analysis on CE

About Celanese

(

Free Report)

Celanese Corporation, a chemical and specialty materials company, manufactures and sells high performance engineered polymers in the United States and internationally. It operates through Engineered Materials and Acetyl Chain. The Engineered Materials segment develops, produces, and supplies specialty polymers for automotive and medical applications, as well as for use in industrial products and consumer electronics.

Further Reading

Before you consider Celanese, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celanese wasn't on the list.

While Celanese currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.