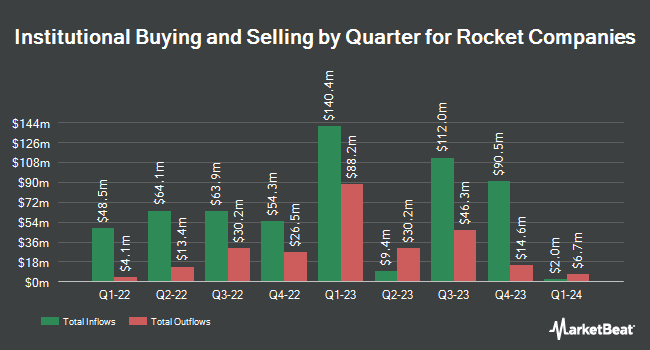

State Street Corp raised its stake in Rocket Companies, Inc. (NYSE:RKT - Free Report) by 44.7% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 4,108,189 shares of the company's stock after buying an additional 1,269,795 shares during the period. State Street Corp owned approximately 0.21% of Rocket Companies worth $78,836,000 as of its most recent filing with the SEC.

Other institutional investors and hedge funds also recently modified their holdings of the company. Quadrature Capital Ltd acquired a new position in shares of Rocket Companies in the third quarter worth about $1,071,000. Quantinno Capital Management LP grew its position in Rocket Companies by 2.3% during the 3rd quarter. Quantinno Capital Management LP now owns 153,564 shares of the company's stock worth $2,947,000 after purchasing an additional 3,402 shares in the last quarter. Centiva Capital LP acquired a new stake in Rocket Companies during the 3rd quarter valued at $1,274,000. Paloma Partners Management Co purchased a new stake in shares of Rocket Companies in the third quarter valued at $368,000. Finally, PDT Partners LLC boosted its position in shares of Rocket Companies by 130.3% in the third quarter. PDT Partners LLC now owns 253,936 shares of the company's stock worth $4,873,000 after buying an additional 143,664 shares during the period. Institutional investors and hedge funds own 4.59% of the company's stock.

Rocket Companies Stock Down 4.5 %

Rocket Companies stock traded down $0.55 during mid-day trading on Wednesday, hitting $11.58. 6,258,026 shares of the company's stock were exchanged, compared to its average volume of 2,908,535. Rocket Companies, Inc. has a 1-year low of $10.87 and a 1-year high of $21.38. The stock has a 50 day moving average of $15.01 and a two-hundred day moving average of $16.21. The company has a current ratio of 15.47, a quick ratio of 15.47 and a debt-to-equity ratio of 1.51. The stock has a market cap of $23.10 billion, a P/E ratio of -72.38 and a beta of 2.38.

Rocket Companies (NYSE:RKT - Get Free Report) last issued its quarterly earnings data on Tuesday, November 12th. The company reported $0.08 earnings per share for the quarter, hitting analysts' consensus estimates of $0.08. Rocket Companies had a negative net margin of 0.38% and a positive return on equity of 2.86%. The business had revenue of $647.00 million during the quarter, compared to analysts' expectations of $1.25 billion. During the same period in the previous year, the company earned ($0.01) earnings per share. Rocket Companies's revenue for the quarter was down 46.2% on a year-over-year basis. As a group, analysts anticipate that Rocket Companies, Inc. will post 0.16 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Several research analysts recently weighed in on the company. Wedbush reissued a "neutral" rating and set a $13.00 price target (down from $18.00) on shares of Rocket Companies in a research report on Wednesday, November 13th. JPMorgan Chase & Co. reduced their price target on shares of Rocket Companies from $19.00 to $14.00 and set an "underweight" rating for the company in a research report on Monday, December 9th. Barclays decreased their price target on shares of Rocket Companies from $14.00 to $13.00 and set an "underweight" rating for the company in a report on Wednesday, November 13th. Morgan Stanley began coverage on shares of Rocket Companies in a research note on Tuesday, November 5th. They issued an "equal weight" rating and a $18.00 price objective on the stock. Finally, UBS Group decreased their target price on shares of Rocket Companies from $14.00 to $12.50 and set a "sell" rating for the company in a research note on Thursday, November 14th. Six equities research analysts have rated the stock with a sell rating and six have assigned a hold rating to the stock. Based on data from MarketBeat.com, Rocket Companies currently has a consensus rating of "Hold" and an average target price of $14.33.

Check Out Our Latest Stock Analysis on Rocket Companies

Rocket Companies Profile

(

Free Report)

Rocket Companies, Inc, a fintech holding company, provides mortgage lending, title and settlement services, and other financial technology services in the United States and Canada. It operates through two segments, Direct to Consumer and Partner Network. The company's solutions include Rocket Mortgage, a mortgage lender; Amrock that provides title insurance, property valuation, and settlement services; Rocket Homes, a home search platform and real estate agent referral network, which offers technology-enabled services to support the home buying and selling experience; and Rocket Loans, an online-based personal loans business.

Featured Articles

Before you consider Rocket Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rocket Companies wasn't on the list.

While Rocket Companies currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.