State Street Corp increased its holdings in shares of Yelp Inc. (NYSE:YELP - Free Report) by 0.9% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 2,553,227 shares of the local business review company's stock after acquiring an additional 23,719 shares during the period. State Street Corp owned approximately 3.82% of Yelp worth $89,567,000 at the end of the most recent reporting period.

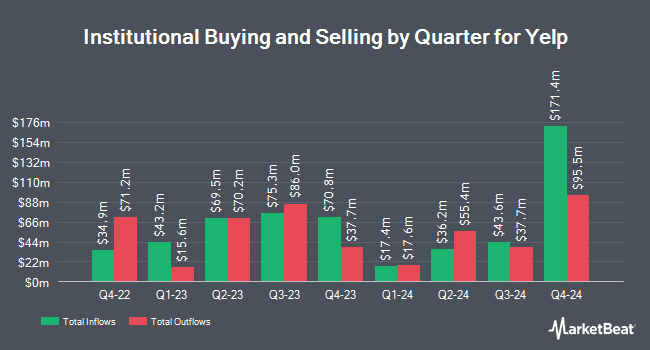

A number of other hedge funds and other institutional investors have also bought and sold shares of YELP. Petrus Trust Company LTA raised its stake in shares of Yelp by 38.6% in the third quarter. Petrus Trust Company LTA now owns 22,092 shares of the local business review company's stock worth $775,000 after purchasing an additional 6,157 shares during the last quarter. Jacobs Levy Equity Management Inc. increased its holdings in Yelp by 11.6% in the 3rd quarter. Jacobs Levy Equity Management Inc. now owns 543,698 shares of the local business review company's stock worth $19,073,000 after buying an additional 56,598 shares in the last quarter. Holocene Advisors LP purchased a new position in Yelp in the 3rd quarter worth about $2,859,000. Centiva Capital LP lifted its stake in Yelp by 40.5% during the 3rd quarter. Centiva Capital LP now owns 18,729 shares of the local business review company's stock valued at $657,000 after acquiring an additional 5,401 shares during the period. Finally, Verition Fund Management LLC purchased a new stake in shares of Yelp during the 3rd quarter valued at about $293,000. Hedge funds and other institutional investors own 90.11% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have commented on the stock. The Goldman Sachs Group downgraded shares of Yelp from a "buy" rating to a "neutral" rating and cut their target price for the stock from $46.00 to $38.00 in a research report on Monday, October 14th. Robert W. Baird reduced their price objective on Yelp from $39.00 to $37.00 and set a "neutral" rating for the company in a research report on Friday, November 8th. StockNews.com raised Yelp from a "buy" rating to a "strong-buy" rating in a research report on Monday, November 11th. Bank of America started coverage on shares of Yelp in a research report on Monday, September 16th. They set an "underperform" rating and a $30.00 price target for the company. Finally, Evercore ISI upgraded shares of Yelp to a "hold" rating in a research report on Monday, November 11th. Two equities research analysts have rated the stock with a sell rating, six have given a hold rating, one has issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $37.00.

Check Out Our Latest Stock Analysis on YELP

Yelp Stock Performance

Shares of YELP traded down $0.15 during mid-day trading on Tuesday, reaching $39.67. The stock had a trading volume of 661,075 shares, compared to its average volume of 722,335. The business has a fifty day moving average of $36.28 and a 200 day moving average of $35.62. The firm has a market cap of $2.61 billion, a price-to-earnings ratio of 23.76, a PEG ratio of 0.71 and a beta of 1.35. Yelp Inc. has a 12 month low of $32.56 and a 12 month high of $48.99.

Insider Buying and Selling

In other Yelp news, CFO David A. Schwarzbach sold 10,000 shares of the business's stock in a transaction on Friday, November 29th. The shares were sold at an average price of $38.29, for a total value of $382,900.00. Following the sale, the chief financial officer now owns 211,988 shares in the company, valued at $8,117,020.52. The trade was a 4.50 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, COO Joseph R. Nachman sold 7,000 shares of the firm's stock in a transaction that occurred on Friday, October 4th. The shares were sold at an average price of $34.02, for a total value of $238,140.00. Following the transaction, the chief operating officer now owns 255,558 shares of the company's stock, valued at $8,694,083.16. This represents a 2.67 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 41,865 shares of company stock valued at $1,537,218. Company insiders own 7.40% of the company's stock.

About Yelp

(

Free Report)

Yelp Inc operates a platform that connects consumers with local businesses in the United States and internationally. The company's platform covers various categories, including restaurants, shopping, beauty and fitness, health, and other categories, as well as home, local, auto, professional, pets, events, real estate, and financial services.

Read More

Before you consider Yelp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yelp wasn't on the list.

While Yelp currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.