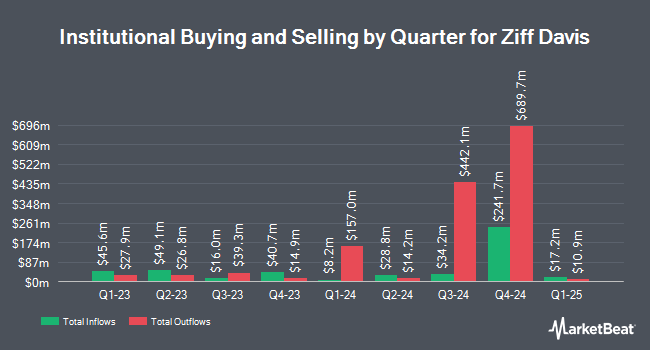

State Street Corp decreased its position in shares of Ziff Davis, Inc. (NASDAQ:ZD - Free Report) by 85.0% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,871,318 shares of the technology company's stock after selling 10,641,205 shares during the period. State Street Corp owned about 4.38% of Ziff Davis worth $91,058,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other large investors also recently made changes to their positions in the stock. SG Americas Securities LLC increased its holdings in shares of Ziff Davis by 142.3% during the second quarter. SG Americas Securities LLC now owns 11,745 shares of the technology company's stock worth $647,000 after buying an additional 6,897 shares in the last quarter. Envestnet Portfolio Solutions Inc. bought a new position in shares of Ziff Davis in the second quarter valued at $221,000. Assenagon Asset Management S.A. grew its holdings in shares of Ziff Davis by 8.2% during the second quarter. Assenagon Asset Management S.A. now owns 113,196 shares of the technology company's stock valued at $6,231,000 after buying an additional 8,625 shares during the last quarter. Blue Trust Inc. lifted its position in Ziff Davis by 72.4% in the 2nd quarter. Blue Trust Inc. now owns 1,686 shares of the technology company's stock valued at $93,000 after acquiring an additional 708 shares in the last quarter. Finally, Retirement Systems of Alabama boosted its stake in Ziff Davis by 21.4% during the 2nd quarter. Retirement Systems of Alabama now owns 360,030 shares of the technology company's stock valued at $19,820,000 after purchasing an additional 63,458 shares during the last quarter. Institutional investors and hedge funds own 99.76% of the company's stock.

Wall Street Analyst Weigh In

ZD has been the topic of a number of research analyst reports. UBS Group cut their price target on shares of Ziff Davis from $76.00 to $65.00 and set a "neutral" rating on the stock in a report on Tuesday, December 3rd. Barclays boosted their target price on shares of Ziff Davis from $44.00 to $61.00 and gave the company an "equal weight" rating in a research note on Monday, November 11th. Finally, Royal Bank of Canada restated an "outperform" rating and set a $95.00 price target on shares of Ziff Davis in a research note on Friday, September 6th. Three analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $69.71.

Get Our Latest Stock Report on ZD

Ziff Davis Stock Up 0.5 %

Shares of NASDAQ:ZD traded up $0.28 during trading on Tuesday, hitting $58.18. The stock had a trading volume of 1,054,872 shares, compared to its average volume of 435,055. The company has a quick ratio of 1.42, a current ratio of 1.42 and a debt-to-equity ratio of 0.49. Ziff Davis, Inc. has a 12 month low of $37.76 and a 12 month high of $70.90. The company has a market capitalization of $2.49 billion, a PE ratio of 49.31 and a beta of 1.35. The firm's fifty day moving average is $52.60 and its 200 day moving average is $50.53.

Ziff Davis Profile

(

Free Report)

Ziff Davis, Inc, together with its subsidiaries, operates as a digital media and internet company in the United States and internationally. The company offers PCMag, an online resource for laboratory-based product reviews, technology news, buying guides, and research papers; Mashable for publishing technology and culture content; Spiceworks Ziff Davis provides digital content of IT products and services; retailMeNot, a savings destination platform; Offers.com, a coupon and deals website; and event-based properties, including BlackFriday.com, TheBlackFriday.com, BestBlackFriday.com, and DealsofAmerica.com.

Featured Articles

Before you consider Ziff Davis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ziff Davis wasn't on the list.

While Ziff Davis currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.