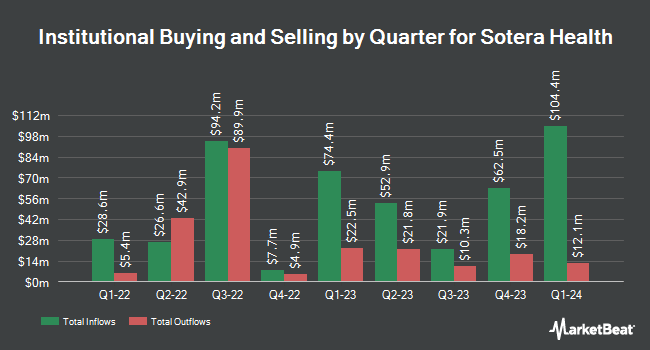

State Street Corp raised its stake in Sotera Health (NASDAQ:SHC - Free Report) by 18.5% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 4,126,806 shares of the company's stock after acquiring an additional 644,236 shares during the quarter. State Street Corp owned about 1.46% of Sotera Health worth $68,918,000 at the end of the most recent reporting period.

Other hedge funds have also recently bought and sold shares of the company. Darsana Capital Partners LP boosted its position in shares of Sotera Health by 716.9% in the third quarter. Darsana Capital Partners LP now owns 20,010,000 shares of the company's stock valued at $334,167,000 after acquiring an additional 17,560,636 shares during the period. Sessa Capital IM L.P. raised its stake in Sotera Health by 46.5% in the 3rd quarter. Sessa Capital IM L.P. now owns 6,300,597 shares of the company's stock worth $105,220,000 after purchasing an additional 2,000,000 shares in the last quarter. AQR Capital Management LLC boosted its holdings in Sotera Health by 3,198.2% in the 2nd quarter. AQR Capital Management LLC now owns 511,580 shares of the company's stock valued at $6,072,000 after purchasing an additional 496,069 shares during the period. Captrust Financial Advisors acquired a new position in shares of Sotera Health during the 3rd quarter worth approximately $4,771,000. Finally, Charles Schwab Investment Management Inc. increased its holdings in shares of Sotera Health by 18.3% during the third quarter. Charles Schwab Investment Management Inc. now owns 1,348,917 shares of the company's stock worth $22,527,000 after purchasing an additional 208,914 shares during the period. 91.03% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts recently issued reports on SHC shares. Royal Bank of Canada reiterated an "outperform" rating and issued a $17.00 price target on shares of Sotera Health in a research note on Thursday, November 21st. The Goldman Sachs Group started coverage on Sotera Health in a research report on Friday, December 6th. They set a "neutral" rating and a $14.00 target price for the company. Finally, Citigroup raised their price target on Sotera Health from $18.00 to $20.00 and gave the stock a "buy" rating in a research report on Wednesday, November 6th. Three research analysts have rated the stock with a hold rating and four have given a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $16.08.

Check Out Our Latest Research Report on SHC

Sotera Health Price Performance

Shares of SHC traded up $0.12 during midday trading on Wednesday, hitting $13.20. The company's stock had a trading volume of 1,674,765 shares, compared to its average volume of 1,336,528. The company has a quick ratio of 2.61, a current ratio of 2.88 and a debt-to-equity ratio of 4.91. Sotera Health has a one year low of $10.71 and a one year high of $17.44. The stock has a market capitalization of $3.74 billion, a price-to-earnings ratio of 52.80 and a beta of 1.96. The company's fifty day simple moving average is $14.47 and its two-hundred day simple moving average is $14.21.

Sotera Health (NASDAQ:SHC - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The company reported $0.17 earnings per share for the quarter, missing the consensus estimate of $0.18 by ($0.01). The business had revenue of $285.47 million during the quarter, compared to analyst estimates of $278.64 million. Sotera Health had a net margin of 6.31% and a return on equity of 42.27%. The business's quarterly revenue was up 8.5% compared to the same quarter last year. During the same period last year, the business earned $0.18 earnings per share. As a group, equities analysts expect that Sotera Health will post 0.61 earnings per share for the current fiscal year.

Sotera Health Company Profile

(

Free Report)

Sotera Health Company engages in the provision of sterilization, lab testing, and advisory services in the United States and internationally. The company operates through three segments: Sterigenics, Nordion, and Nelson Labs. It provides mission-critical end-to-end sterilization services, including gamma and electron beam irradiation, and ethylene oxide processing, as well as designs, installs, and maintains gamma irradiation systems.

Recommended Stories

Before you consider Sotera Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sotera Health wasn't on the list.

While Sotera Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.