State Street Corp boosted its holdings in Regal Rexnord Co. (NYSE:RRX - Free Report) by 1.3% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,972,866 shares of the company's stock after acquiring an additional 24,860 shares during the quarter. State Street Corp owned 2.98% of Regal Rexnord worth $327,944,000 at the end of the most recent quarter.

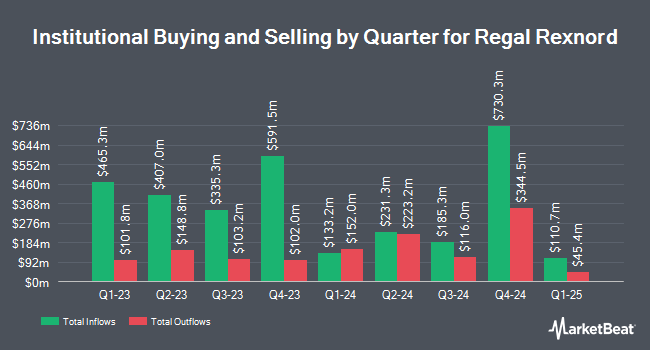

Other hedge funds have also recently added to or reduced their stakes in the company. PNC Financial Services Group Inc. raised its holdings in shares of Regal Rexnord by 29.2% in the 3rd quarter. PNC Financial Services Group Inc. now owns 12,311 shares of the company's stock worth $2,042,000 after buying an additional 2,783 shares in the last quarter. Natixis Advisors LLC increased its holdings in Regal Rexnord by 15.3% during the 3rd quarter. Natixis Advisors LLC now owns 86,933 shares of the company's stock valued at $14,420,000 after purchasing an additional 11,568 shares in the last quarter. Charles Schwab Investment Management Inc. increased its holdings in Regal Rexnord by 1.1% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 431,774 shares of the company's stock valued at $71,623,000 after purchasing an additional 4,752 shares in the last quarter. Harbor Capital Advisors Inc. increased its holdings in Regal Rexnord by 164.6% during the 3rd quarter. Harbor Capital Advisors Inc. now owns 22,958 shares of the company's stock valued at $3,808,000 after purchasing an additional 14,280 shares in the last quarter. Finally, BNP PARIBAS ASSET MANAGEMENT Holding S.A. boosted its position in Regal Rexnord by 31.4% in the 2nd quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 19,686 shares of the company's stock valued at $2,662,000 after buying an additional 4,701 shares during the last quarter. Institutional investors and hedge funds own 99.72% of the company's stock.

Insider Activity at Regal Rexnord

In related news, CEO Louis V. Pinkham sold 8,774 shares of Regal Rexnord stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $180.03, for a total transaction of $1,579,583.22. Following the completion of the transaction, the chief executive officer now owns 149,618 shares in the company, valued at approximately $26,935,728.54. This trade represents a 5.54 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 0.82% of the stock is owned by company insiders.

Regal Rexnord Trading Down 1.3 %

RRX stock traded down $2.27 during midday trading on Tuesday, hitting $168.18. 346,281 shares of the company's stock were exchanged, compared to its average volume of 453,465. The stock's fifty day moving average price is $171.42 and its 200-day moving average price is $158.18. Regal Rexnord Co. has a one year low of $124.50 and a one year high of $185.28. The company has a market cap of $11.14 billion, a PE ratio of 53.77, a price-to-earnings-growth ratio of 1.84 and a beta of 1.03. The company has a debt-to-equity ratio of 0.87, a quick ratio of 1.35 and a current ratio of 2.45.

Regal Rexnord (NYSE:RRX - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The company reported $2.49 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.48 by $0.01. Regal Rexnord had a return on equity of 9.48% and a net margin of 3.41%. The firm had revenue of $1.48 billion for the quarter, compared to the consensus estimate of $1.53 billion. During the same quarter last year, the business posted $2.10 EPS. The company's revenue for the quarter was down 10.4% on a year-over-year basis. Research analysts predict that Regal Rexnord Co. will post 9.25 earnings per share for the current fiscal year.

Regal Rexnord Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, January 14th. Investors of record on Tuesday, December 31st will be given a $0.35 dividend. This represents a $1.40 dividend on an annualized basis and a dividend yield of 0.83%. The ex-dividend date of this dividend is Tuesday, December 31st. Regal Rexnord's dividend payout ratio is currently 44.16%.

Wall Street Analysts Forecast Growth

A number of research analysts have commented on RRX shares. Loop Capital reiterated a "buy" rating and issued a $200.00 price objective on shares of Regal Rexnord in a research report on Thursday, September 19th. Citigroup started coverage on Regal Rexnord in a research report on Monday, October 14th. They issued a "buy" rating and a $200.00 price objective on the stock. Robert W. Baird decreased their price objective on Regal Rexnord from $223.00 to $208.00 and set an "outperform" rating on the stock in a research report on Wednesday, November 6th. StockNews.com upgraded Regal Rexnord from a "hold" rating to a "buy" rating in a research report on Wednesday, October 16th. Finally, Barclays raised their price target on Regal Rexnord from $190.00 to $205.00 and gave the stock an "overweight" rating in a research report on Thursday, December 5th. One research analyst has rated the stock with a hold rating and nine have assigned a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $194.88.

Get Our Latest Research Report on Regal Rexnord

Regal Rexnord Profile

(

Free Report)

Regal Rexnord Corporation manufactures and sells industrial powertrain solutions, power transmission components, electric motors and electronic controls, air moving products, and specialty electrical components and systems worldwide. The Industrial Powertrain Solutions segment provides mounted and unmounted bearings, couplings, mechanical power transmission drives and components, gearboxes, gear motors, clutches, brakes, special, and industrial powertrain components and solutions for food and beverage, bulk material handling, eCommerce/warehouse distribution, energy, mining, marine, agricultural machinery, turf and garden, and general industrial markets.

Further Reading

Before you consider Regal Rexnord, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regal Rexnord wasn't on the list.

While Regal Rexnord currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.