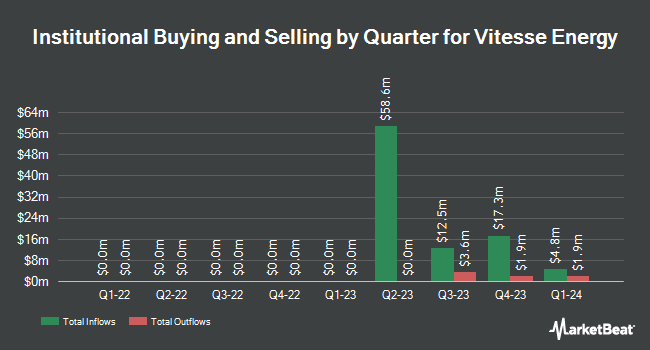

State Street Corp decreased its holdings in Vitesse Energy, Inc. (NYSE:VTS - Free Report) by 2.8% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 738,601 shares of the company's stock after selling 21,383 shares during the quarter. State Street Corp owned 2.50% of Vitesse Energy worth $17,741,000 as of its most recent SEC filing.

Several other institutional investors also recently modified their holdings of the stock. Wealth Enhancement Advisory Services LLC purchased a new stake in Vitesse Energy during the second quarter valued at about $281,000. Bank of New York Mellon Corp boosted its holdings in Vitesse Energy by 2.8% during the second quarter. Bank of New York Mellon Corp now owns 277,465 shares of the company's stock valued at $6,576,000 after purchasing an additional 7,513 shares in the last quarter. Principal Financial Group Inc. grew its position in Vitesse Energy by 6.0% in the second quarter. Principal Financial Group Inc. now owns 11,113 shares of the company's stock valued at $263,000 after acquiring an additional 627 shares during the period. Lee Danner & Bass Inc. acquired a new stake in shares of Vitesse Energy during the 2nd quarter worth about $3,430,000. Finally, nVerses Capital LLC acquired a new position in Vitesse Energy in the second quarter valued at about $26,000. Institutional investors own 51.63% of the company's stock.

Wall Street Analyst Weigh In

Separately, Alliance Global Partners upgraded shares of Vitesse Energy from a "neutral" rating to a "buy" rating and lifted their target price for the company from $26.00 to $29.00 in a research note on Tuesday, December 17th.

Check Out Our Latest Report on Vitesse Energy

Vitesse Energy Price Performance

Vitesse Energy stock traded up $0.17 on Tuesday, reaching $24.53. The company's stock had a trading volume of 118,208 shares, compared to its average volume of 192,472. The business's fifty day moving average price is $26.43 and its 200 day moving average price is $25.26. The company has a debt-to-equity ratio of 0.20, a quick ratio of 0.75 and a current ratio of 0.75. The company has a market cap of $724.71 million, a price-to-earnings ratio of 16.80 and a beta of 0.35. Vitesse Energy, Inc. has a twelve month low of $19.63 and a twelve month high of $28.41.

Vitesse Energy Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Monday, December 16th will be issued a dividend of $0.525 per share. This represents a $2.10 dividend on an annualized basis and a yield of 8.56%. The ex-dividend date of this dividend is Monday, December 16th. Vitesse Energy's dividend payout ratio is currently 143.84%.

Vitesse Energy Company Profile

(

Free Report)

Vitesse Energy, Inc, together with its subsidiaries, engages in the acquisition, development, and production of non-operated oil and natural gas properties in the United States. It owns and acquires non-operated working interest and royalty interest ownership in the Williston Basin properties located in North Dakota and Montana.

Recommended Stories

Before you consider Vitesse Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vitesse Energy wasn't on the list.

While Vitesse Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.