State Street Corp lowered its position in Denali Therapeutics Inc. (NASDAQ:DNLI - Free Report) by 4.1% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 4,252,011 shares of the company's stock after selling 182,779 shares during the quarter. State Street Corp owned 2.95% of Denali Therapeutics worth $123,861,000 as of its most recent filing with the Securities and Exchange Commission.

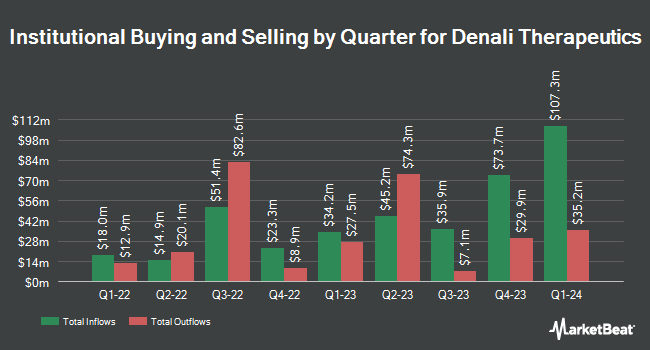

A number of other institutional investors and hedge funds have also recently bought and sold shares of DNLI. MONECO Advisors LLC grew its position in shares of Denali Therapeutics by 4.6% in the 3rd quarter. MONECO Advisors LLC now owns 9,100 shares of the company's stock worth $265,000 after acquiring an additional 400 shares in the last quarter. Assetmark Inc. grew its holdings in Denali Therapeutics by 18.0% during the third quarter. Assetmark Inc. now owns 3,808 shares of the company's stock worth $111,000 after acquiring an additional 580 shares during the period. CWM LLC raised its holdings in shares of Denali Therapeutics by 43.6% in the 3rd quarter. CWM LLC now owns 2,153 shares of the company's stock worth $63,000 after purchasing an additional 654 shares in the last quarter. Mirae Asset Global Investments Co. Ltd. boosted its stake in shares of Denali Therapeutics by 21.6% during the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 5,178 shares of the company's stock worth $152,000 after acquiring an additional 920 shares in the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank increased its stake in Denali Therapeutics by 5.5% in the 2nd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 26,403 shares of the company's stock worth $613,000 after purchasing an additional 1,372 shares in the last quarter. Institutional investors and hedge funds own 92.92% of the company's stock.

Insider Buying and Selling at Denali Therapeutics

In other Denali Therapeutics news, CEO Ryan J. Watts sold 40,000 shares of the firm's stock in a transaction that occurred on Friday, October 18th. The stock was sold at an average price of $27.69, for a total value of $1,107,600.00. Following the completion of the transaction, the chief executive officer now directly owns 235,807 shares in the company, valued at $6,529,495.83. This trade represents a 14.50 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Steve E. Krognes sold 30,000 shares of the business's stock in a transaction on Monday, September 30th. The stock was sold at an average price of $29.03, for a total transaction of $870,900.00. Following the transaction, the director now owns 29,096 shares in the company, valued at approximately $844,656.88. The trade was a 50.76 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 86,578 shares of company stock valued at $2,474,440. Corporate insiders own 7.90% of the company's stock.

Denali Therapeutics Price Performance

Shares of NASDAQ DNLI traded down $0.50 during midday trading on Friday, hitting $22.97. The stock had a trading volume of 719,126 shares, compared to its average volume of 1,050,527. The company's 50-day simple moving average is $26.28 and its 200 day simple moving average is $24.85. The firm has a market cap of $3.31 billion, a P/E ratio of -8.32 and a beta of 1.35. Denali Therapeutics Inc. has a fifty-two week low of $14.56 and a fifty-two week high of $33.33.

Denali Therapeutics (NASDAQ:DNLI - Get Free Report) last issued its earnings results on Wednesday, November 6th. The company reported ($0.63) EPS for the quarter, missing the consensus estimate of ($0.60) by ($0.03). During the same quarter in the prior year, the company posted ($0.72) EPS. Equities analysts expect that Denali Therapeutics Inc. will post -2.71 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of brokerages have recently weighed in on DNLI. Raymond James reiterated a "market perform" rating on shares of Denali Therapeutics in a report on Thursday, October 10th. Bank of America boosted their price objective on Denali Therapeutics from $25.00 to $29.00 and gave the stock a "buy" rating in a research report on Wednesday, September 4th. Cantor Fitzgerald lowered shares of Denali Therapeutics from an "overweight" rating to a "neutral" rating in a research report on Monday, October 7th. Jefferies Financial Group boosted their price target on shares of Denali Therapeutics from $40.00 to $45.00 and gave the company a "buy" rating in a report on Friday, November 1st. Finally, HC Wainwright restated a "buy" rating and set a $90.00 target price on shares of Denali Therapeutics in a research report on Thursday, November 7th. Three research analysts have rated the stock with a hold rating and eight have given a buy rating to the company. According to MarketBeat.com, Denali Therapeutics currently has an average rating of "Moderate Buy" and an average target price of $38.90.

View Our Latest Research Report on DNLI

Denali Therapeutics Company Profile

(

Free Report)

Denali Therapeutics Inc, a biopharmaceutical company, develops a portfolio of product candidates engineered to cross the blood-brain barrier for neurodegenerative diseases and lysosomal storage diseases in the United States. The company's transport vehicle (TV)-enabled programs include DNL310 ETV, an IDS enzyme replacement therapy program for MPS II; TAK-594/DNL593 which is in Phase 1/II for frontotemporal dementia-granulin; DNL126 program for MPS IIIA; and DNL622 for MPS I, as well as other preclinical programs that target amyloid beta and HER2.

Further Reading

Before you consider Denali Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Denali Therapeutics wasn't on the list.

While Denali Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.