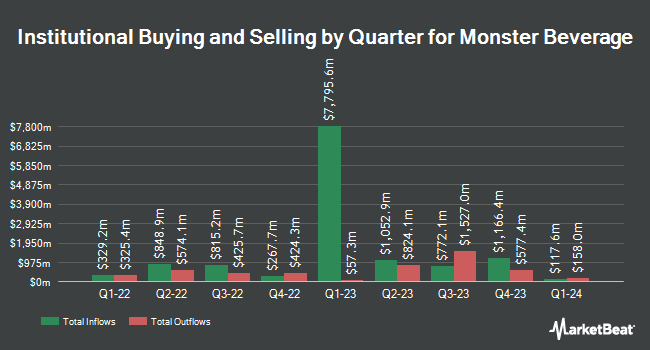

State Street Corp raised its stake in Monster Beverage Co. (NASDAQ:MNST - Free Report) by 6.9% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 33,742,390 shares of the company's stock after purchasing an additional 2,168,379 shares during the period. State Street Corp owned 3.47% of Monster Beverage worth $1,760,341,000 at the end of the most recent quarter.

Several other large investors also recently modified their holdings of the stock. Stephens Consulting LLC acquired a new position in Monster Beverage in the 2nd quarter valued at about $26,000. Kings Path Partners LLC acquired a new position in shares of Monster Beverage in the second quarter valued at approximately $30,000. University of Texas Texas AM Investment Management Co. bought a new position in shares of Monster Beverage during the second quarter worth approximately $30,000. Quarry LP lifted its holdings in Monster Beverage by 152.0% during the 2nd quarter. Quarry LP now owns 824 shares of the company's stock worth $41,000 after purchasing an additional 497 shares during the last quarter. Finally, Crewe Advisors LLC boosted its stake in Monster Beverage by 37.5% in the 2nd quarter. Crewe Advisors LLC now owns 850 shares of the company's stock valued at $42,000 after purchasing an additional 232 shares during the period. 72.36% of the stock is owned by institutional investors.

Monster Beverage Price Performance

Monster Beverage stock traded down $0.83 during mid-day trading on Friday, reaching $52.27. The company had a trading volume of 3,936,984 shares, compared to its average volume of 5,801,366. The business has a fifty day simple moving average of $53.25 and a 200 day simple moving average of $51.05. The company has a market cap of $50.83 billion, a P/E ratio of 33.51, a P/E/G ratio of 2.57 and a beta of 0.74. Monster Beverage Co. has a fifty-two week low of $43.32 and a fifty-two week high of $61.22. The company has a current ratio of 3.13, a quick ratio of 2.51 and a debt-to-equity ratio of 0.13.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on MNST. Wells Fargo & Company increased their price objective on Monster Beverage from $57.00 to $60.00 and gave the stock an "overweight" rating in a research report on Tuesday, November 5th. Deutsche Bank Aktiengesellschaft lowered their price target on shares of Monster Beverage from $61.00 to $59.00 and set a "buy" rating on the stock in a research report on Friday, November 8th. Argus increased their target price on shares of Monster Beverage from $55.00 to $65.00 and gave the stock a "buy" rating in a research report on Tuesday, November 12th. Stifel Nicolaus raised their target price on shares of Monster Beverage from $57.00 to $59.00 and gave the stock a "buy" rating in a report on Friday, November 8th. Finally, Needham & Company LLC initiated coverage on Monster Beverage in a research note on Friday. They issued a "hold" rating for the company. Two investment analysts have rated the stock with a sell rating, seven have given a hold rating and thirteen have given a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $56.45.

Read Our Latest Stock Analysis on Monster Beverage

Monster Beverage Profile

(

Free Report)

Monster Beverage Corporation, through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally. The company operates through three segments: Monster Energy Drinks, Strategic Brands, Alcohol Brands, and Other.

Further Reading

Before you consider Monster Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monster Beverage wasn't on the list.

While Monster Beverage currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.