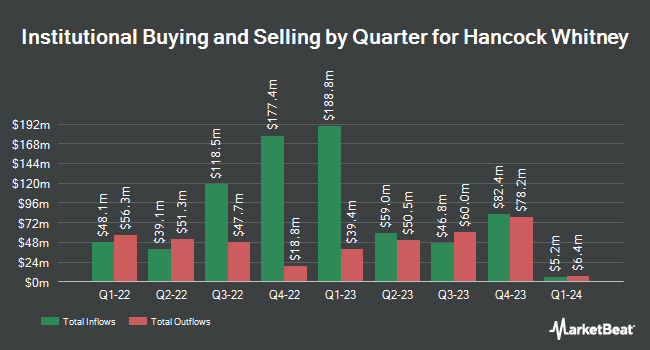

State Street Corp increased its holdings in Hancock Whitney Co. (NASDAQ:HWC - Free Report) by 1.7% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 4,297,776 shares of the company's stock after purchasing an additional 73,316 shares during the quarter. State Street Corp owned approximately 4.99% of Hancock Whitney worth $219,917,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds also recently bought and sold shares of HWC. Harvest Fund Management Co. Ltd bought a new stake in shares of Hancock Whitney during the 3rd quarter valued at $28,000. Triad Wealth Partners LLC purchased a new stake in Hancock Whitney in the second quarter worth about $31,000. Headlands Technologies LLC bought a new position in shares of Hancock Whitney during the second quarter valued at approximately $43,000. CWM LLC lifted its holdings in shares of Hancock Whitney by 268.9% during the second quarter. CWM LLC now owns 985 shares of the company's stock valued at $47,000 after purchasing an additional 718 shares during the last quarter. Finally, Meeder Asset Management Inc. bought a new stake in shares of Hancock Whitney in the 2nd quarter worth approximately $63,000. Hedge funds and other institutional investors own 81.22% of the company's stock.

Hancock Whitney Price Performance

Shares of HWC traded down $0.43 during midday trading on Thursday, hitting $57.89. 164,343 shares of the company traded hands, compared to its average volume of 501,968. Hancock Whitney Co. has a 52 week low of $41.19 and a 52 week high of $62.40. The company has a debt-to-equity ratio of 0.06, a quick ratio of 0.81 and a current ratio of 0.82. The firm has a 50 day moving average of $55.64 and a 200-day moving average of $51.57. The stock has a market cap of $4.98 billion, a price-to-earnings ratio of 13.08 and a beta of 1.27.

Hancock Whitney (NASDAQ:HWC - Get Free Report) last posted its earnings results on Tuesday, October 15th. The company reported $1.33 EPS for the quarter, beating analysts' consensus estimates of $1.31 by $0.02. The firm had revenue of $525.37 million during the quarter, compared to the consensus estimate of $363.54 million. Hancock Whitney had a return on equity of 11.47% and a net margin of 19.30%. During the same period in the prior year, the company earned $1.12 EPS. On average, analysts forecast that Hancock Whitney Co. will post 5.19 EPS for the current fiscal year.

Hancock Whitney Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Thursday, December 5th will be issued a dividend of $0.40 per share. The ex-dividend date is Thursday, December 5th. This represents a $1.60 annualized dividend and a yield of 2.76%. Hancock Whitney's payout ratio is currently 35.87%.

Analyst Ratings Changes

Several equities analysts have recently weighed in on the company. Keefe, Bruyette & Woods raised their price target on Hancock Whitney from $60.00 to $70.00 and gave the company an "outperform" rating in a report on Wednesday, December 4th. DA Davidson lifted their target price on Hancock Whitney from $62.00 to $65.00 and gave the company a "buy" rating in a research report on Wednesday, October 16th. Truist Financial lowered their price objective on Hancock Whitney from $57.00 to $56.00 and set a "hold" rating on the stock in a research report on Friday, September 20th. Finally, Stephens upgraded shares of Hancock Whitney from an "equal weight" rating to an "overweight" rating in a research note on Monday. Three investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat.com, Hancock Whitney presently has a consensus rating of "Moderate Buy" and an average price target of $58.00.

Get Our Latest Research Report on HWC

Insider Buying and Selling at Hancock Whitney

In other Hancock Whitney news, Director Carleton Richard Wilkins sold 800 shares of the firm's stock in a transaction dated Monday, October 21st. The shares were sold at an average price of $50.95, for a total transaction of $40,760.00. Following the transaction, the director now owns 15,900 shares of the company's stock, valued at approximately $810,105. This trade represents a 4.79 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Christine L. Pickering sold 763 shares of the company's stock in a transaction that occurred on Tuesday, October 29th. The stock was sold at an average price of $52.40, for a total transaction of $39,981.20. Following the completion of the sale, the director now directly owns 23,518 shares of the company's stock, valued at $1,232,343.20. The trade was a 3.14 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 27,994 shares of company stock valued at $1,593,710 in the last ninety days. Corporate insiders own 1.10% of the company's stock.

About Hancock Whitney

(

Free Report)

Hancock Whitney Corporation operates as the financial holding company for Hancock Whitney Bank that provides traditional and online banking services to commercial, small business, and retail customers. It offers various transaction and savings deposit products consisting of brokered deposits, time deposits, and money market accounts; treasury management services, secured and unsecured loan products including revolving credit facilities, and letters of credit and similar financial guarantees; and trust and investment management services to retirement plans, corporations, and individuals, and investment advisory and brokerage products.

Read More

Before you consider Hancock Whitney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hancock Whitney wasn't on the list.

While Hancock Whitney currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.