State Street Corp trimmed its stake in shares of M/I Homes, Inc. (NYSE:MHO - Free Report) by 1.6% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,438,370 shares of the construction company's stock after selling 23,906 shares during the period. State Street Corp owned about 5.18% of M/I Homes worth $246,479,000 as of its most recent SEC filing.

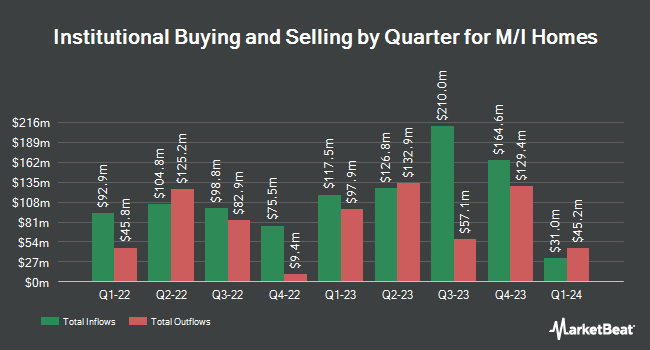

A number of other hedge funds and other institutional investors have also modified their holdings of the stock. Assenagon Asset Management S.A. grew its position in M/I Homes by 42.0% during the 2nd quarter. Assenagon Asset Management S.A. now owns 55,471 shares of the construction company's stock worth $6,775,000 after purchasing an additional 16,413 shares in the last quarter. Canada Pension Plan Investment Board purchased a new position in shares of M/I Homes during the second quarter valued at $1,124,000. Healthcare of Ontario Pension Plan Trust Fund purchased a new position in shares of M/I Homes during the third quarter valued at $1,388,000. Renaissance Technologies LLC raised its position in M/I Homes by 187.0% during the second quarter. Renaissance Technologies LLC now owns 79,200 shares of the construction company's stock valued at $9,673,000 after buying an additional 51,600 shares during the period. Finally, Algert Global LLC lifted its stake in M/I Homes by 23.8% in the 2nd quarter. Algert Global LLC now owns 63,105 shares of the construction company's stock worth $7,708,000 after acquiring an additional 12,123 shares in the last quarter. Institutional investors and hedge funds own 95.14% of the company's stock.

Insider Buying and Selling at M/I Homes

In related news, CFO Phillip G. Creek sold 20,000 shares of the stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $160.00, for a total transaction of $3,200,000.00. Following the sale, the chief financial officer now directly owns 18,545 shares in the company, valued at $2,967,200. This represents a 51.89 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Company insiders own 3.70% of the company's stock.

M/I Homes Stock Performance

Shares of MHO traded down $0.74 on Thursday, reaching $155.74. 401,864 shares of the stock traded hands, compared to its average volume of 273,719. M/I Homes, Inc. has a 12 month low of $109.92 and a 12 month high of $176.18. The company has a debt-to-equity ratio of 0.33, a current ratio of 6.81 and a quick ratio of 1.60. The stock's 50-day moving average price is $161.11 and its 200-day moving average price is $150.17. The firm has a market cap of $4.32 billion, a price-to-earnings ratio of 8.35 and a beta of 2.23.

Wall Street Analysts Forecast Growth

A number of research analysts have commented on MHO shares. Wedbush upgraded M/I Homes from a "neutral" rating to an "outperform" rating and boosted their target price for the company from $155.00 to $185.00 in a research note on Monday, November 4th. StockNews.com cut M/I Homes from a "strong-buy" rating to a "buy" rating in a research note on Thursday, October 31st.

Read Our Latest Report on MHO

M/I Homes Profile

(

Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

Read More

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.