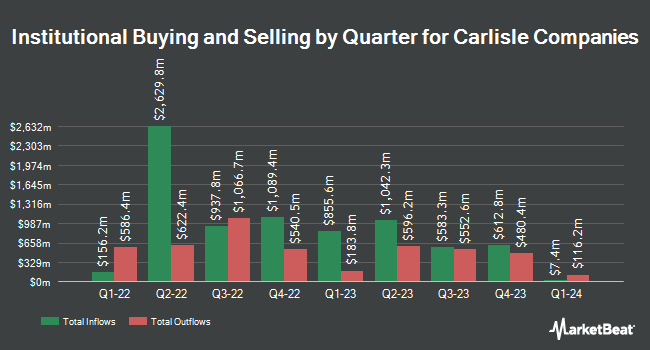

State Street Corp reduced its stake in Carlisle Companies Incorporated (NYSE:CSL - Free Report) by 0.4% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 2,197,836 shares of the conglomerate's stock after selling 8,282 shares during the period. State Street Corp owned approximately 4.85% of Carlisle Companies worth $988,476,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. FMR LLC raised its stake in shares of Carlisle Companies by 29.6% in the third quarter. FMR LLC now owns 955,289 shares of the conglomerate's stock valued at $429,641,000 after acquiring an additional 218,002 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in Carlisle Companies by 14.1% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 338,343 shares of the conglomerate's stock valued at $152,170,000 after acquiring an additional 41,766 shares in the last quarter. Truist Financial Corp lifted its position in shares of Carlisle Companies by 0.8% during the second quarter. Truist Financial Corp now owns 334,241 shares of the conglomerate's stock worth $135,438,000 after purchasing an additional 2,545 shares in the last quarter. TD Asset Management Inc grew its stake in shares of Carlisle Companies by 2,073.5% during the second quarter. TD Asset Management Inc now owns 281,643 shares of the conglomerate's stock valued at $114,125,000 after purchasing an additional 268,685 shares during the last quarter. Finally, Public Employees Retirement Association of Colorado increased its holdings in shares of Carlisle Companies by 2.9% in the second quarter. Public Employees Retirement Association of Colorado now owns 234,166 shares of the conglomerate's stock valued at $94,886,000 after purchasing an additional 6,613 shares in the last quarter. 89.52% of the stock is owned by institutional investors.

Carlisle Companies Trading Up 0.9 %

NYSE CSL traded up $3.74 during trading on Friday, reaching $440.01. 232,197 shares of the stock traded hands, compared to its average volume of 302,453. Carlisle Companies Incorporated has a fifty-two week low of $290.32 and a fifty-two week high of $481.26. The company has a quick ratio of 2.29, a current ratio of 2.72 and a debt-to-equity ratio of 0.68. The firm has a market cap of $19.95 billion, a price-to-earnings ratio of 15.57, a price-to-earnings-growth ratio of 1.44 and a beta of 0.92. The stock's 50-day moving average price is $449.64 and its 200 day moving average price is $426.31.

Carlisle Companies (NYSE:CSL - Get Free Report) last issued its quarterly earnings data on Thursday, October 24th. The conglomerate reported $5.78 EPS for the quarter, missing the consensus estimate of $5.82 by ($0.04). The business had revenue of $1.33 billion for the quarter, compared to analyst estimates of $1.38 billion. Carlisle Companies had a return on equity of 33.29% and a net margin of 27.05%. The business's quarterly revenue was up 5.9% compared to the same quarter last year. During the same period in the previous year, the business posted $4.68 EPS. Analysts predict that Carlisle Companies Incorporated will post 20.25 EPS for the current year.

Carlisle Companies Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Friday, November 15th will be paid a $1.00 dividend. The ex-dividend date is Friday, November 15th. This represents a $4.00 dividend on an annualized basis and a yield of 0.91%. Carlisle Companies's dividend payout ratio is 14.15%.

Insiders Place Their Bets

In other Carlisle Companies news, VP David W. Smith sold 275 shares of the company's stock in a transaction that occurred on Thursday, November 21st. The stock was sold at an average price of $443.41, for a total value of $121,937.75. Following the sale, the vice president now owns 2,834 shares in the company, valued at $1,256,623.94. This represents a 8.85 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Insiders own 1.50% of the company's stock.

Analyst Ratings Changes

Several equities research analysts have recently commented on CSL shares. Truist Financial initiated coverage on Carlisle Companies in a research note on Thursday, November 14th. They issued a "hold" rating and a $460.00 target price for the company. StockNews.com lowered shares of Carlisle Companies from a "buy" rating to a "hold" rating in a research note on Tuesday, August 27th. Oppenheimer boosted their price target on shares of Carlisle Companies from $480.00 to $505.00 and gave the stock an "outperform" rating in a research note on Tuesday, October 22nd. Finally, Robert W. Baird lowered their target price on shares of Carlisle Companies from $506.00 to $500.00 and set an "outperform" rating for the company in a report on Friday, October 25th. Two analysts have rated the stock with a hold rating and four have given a buy rating to the company. Based on data from MarketBeat, Carlisle Companies presently has a consensus rating of "Moderate Buy" and an average price target of $472.00.

Get Our Latest Stock Report on Carlisle Companies

Carlisle Companies Profile

(

Free Report)

Carlisle Companies Incorporated operates as a manufacturer and supplier of building envelope products and solutions in the United States, Europe, North America, Asia and the Middle East, Africa, and internationally. It operates through two segments: Carlisle Construction Materials and Carlisle Weatherproofing Technologies.

See Also

Before you consider Carlisle Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carlisle Companies wasn't on the list.

While Carlisle Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.