State Street (NYSE:STT - Get Free Report) was downgraded by research analysts at StockNews.com from a "buy" rating to a "hold" rating in a research note issued to investors on Wednesday.

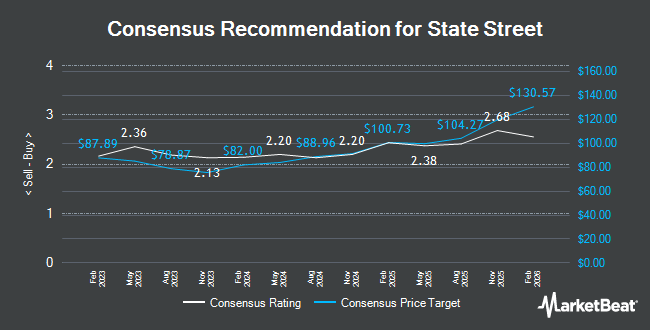

Other research analysts also recently issued research reports about the company. Wells Fargo & Company increased their price target on State Street from $108.00 to $118.00 and gave the stock an "overweight" rating in a research note on Thursday, January 2nd. Keefe, Bruyette & Woods upgraded shares of State Street from a "market perform" rating to an "outperform" rating and increased their target price for the stock from $105.00 to $120.00 in a research report on Tuesday, December 3rd. Deutsche Bank Aktiengesellschaft boosted their price target on shares of State Street from $90.00 to $95.00 and gave the company a "hold" rating in a research report on Monday, November 11th. Barclays raised their price objective on shares of State Street from $108.00 to $127.00 and gave the stock an "overweight" rating in a report on Monday. Finally, The Goldman Sachs Group boosted their target price on shares of State Street from $98.00 to $100.00 and gave the company a "buy" rating in a report on Thursday, September 26th. Two research analysts have rated the stock with a sell rating, seven have assigned a hold rating and seven have issued a buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $100.33.

Read Our Latest Analysis on STT

State Street Stock Performance

NYSE STT traded down $0.04 during trading hours on Wednesday, reaching $97.68. 1,575,657 shares of the company were exchanged, compared to its average volume of 1,504,431. The stock has a market capitalization of $28.63 billion, a P/E ratio of 15.43, a P/E/G ratio of 1.24 and a beta of 1.43. The company has a quick ratio of 0.56, a current ratio of 0.56 and a debt-to-equity ratio of 0.91. State Street has a 1 year low of $70.20 and a 1 year high of $101.91. The business's 50 day simple moving average is $97.29 and its 200-day simple moving average is $88.47.

State Street (NYSE:STT - Get Free Report) last issued its quarterly earnings results on Tuesday, October 15th. The asset manager reported $2.26 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.12 by $0.14. State Street had a net margin of 9.87% and a return on equity of 12.02%. The company had revenue of $3.26 billion during the quarter, compared to analyst estimates of $3.19 billion. During the same quarter last year, the business posted $1.93 EPS. State Street's quarterly revenue was up 21.1% compared to the same quarter last year. On average, equities research analysts expect that State Street will post 8.42 earnings per share for the current year.

Insider Activity at State Street

In other State Street news, EVP John Plansky sold 13,859 shares of the company's stock in a transaction that occurred on Friday, October 18th. The stock was sold at an average price of $91.32, for a total value of $1,265,603.88. Following the completion of the sale, the executive vice president now owns 55,108 shares of the company's stock, valued at $5,032,462.56. This represents a 20.10 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, EVP Kathryn M. Horgan sold 12,500 shares of State Street stock in a transaction that occurred on Monday, November 25th. The stock was sold at an average price of $97.97, for a total transaction of $1,224,625.00. Following the transaction, the executive vice president now directly owns 111,042 shares in the company, valued at $10,878,784.74. This trade represents a 10.12 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 26,460 shares of company stock valued at $2,499,860 over the last three months. 0.31% of the stock is owned by corporate insiders.

Institutional Trading of State Street

Institutional investors have recently added to or reduced their stakes in the business. Geode Capital Management LLC grew its position in State Street by 0.6% during the 3rd quarter. Geode Capital Management LLC now owns 7,169,070 shares of the asset manager's stock worth $632,111,000 after acquiring an additional 41,442 shares during the last quarter. FMR LLC grew its holdings in shares of State Street by 15.8% in the third quarter. FMR LLC now owns 6,112,758 shares of the asset manager's stock worth $540,796,000 after purchasing an additional 833,679 shares during the last quarter. Hotchkis & Wiley Capital Management LLC increased its stake in shares of State Street by 30.4% in the third quarter. Hotchkis & Wiley Capital Management LLC now owns 5,811,415 shares of the asset manager's stock worth $514,136,000 after buying an additional 1,354,560 shares during the period. Metropolis Capital Ltd raised its holdings in State Street by 3.9% during the 3rd quarter. Metropolis Capital Ltd now owns 4,286,306 shares of the asset manager's stock valued at $379,209,000 after buying an additional 161,466 shares during the last quarter. Finally, Franklin Resources Inc. raised its holdings in State Street by 13.8% during the 3rd quarter. Franklin Resources Inc. now owns 3,366,549 shares of the asset manager's stock valued at $306,116,000 after buying an additional 408,792 shares during the last quarter. 87.44% of the stock is currently owned by hedge funds and other institutional investors.

About State Street

(

Get Free Report)

State Street Corporation, through its subsidiaries, provides a range of financial products and services to institutional investors worldwide. The company offers investment servicing products and services, including custody, accounting, regulatory reporting, investor, and performance and analytics; middle office products, such as IBOR, transaction management, loans, cash, derivatives and collateral, record keeping, and client reporting and investment analytics; finance leasing; foreign exchange, and brokerage and other trading services; securities finance and enhanced custody products; deposit and short-term investment facilities; investment manager and alternative investment manager operations outsourcing; performance, risk, and compliance analytics; and financial data management to support institutional investors.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider State Street, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and State Street wasn't on the list.

While State Street currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report