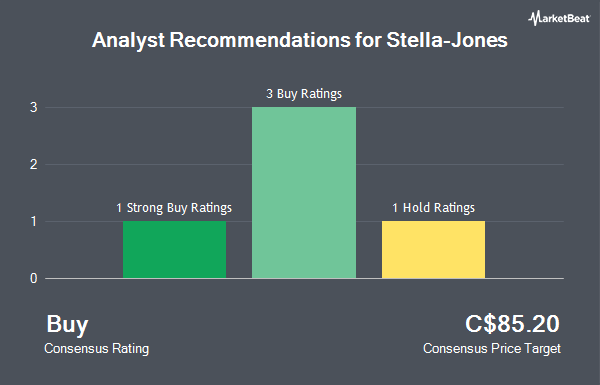

Stella-Jones Inc. (TSE:SJ - Get Free Report) has been assigned a consensus rating of "Moderate Buy" from the six ratings firms that are covering the company, Marketbeat Ratings reports. Three research analysts have rated the stock with a hold rating and three have given a buy rating to the company. The average 1 year target price among analysts that have issued ratings on the stock in the last year is C$88.00.

A number of brokerages recently issued reports on SJ. TD Securities decreased their price target on Stella-Jones from C$103.00 to C$88.00 and set a "buy" rating for the company in a research note on Thursday, November 7th. CIBC decreased their price target on Stella-Jones from C$99.00 to C$83.00 in a research note on Thursday, November 7th. Royal Bank of Canada decreased their price target on Stella-Jones from C$97.00 to C$81.00 in a research note on Thursday, November 7th. National Bankshares raised their price target on Stella-Jones from C$91.00 to C$99.00 and gave the stock an "outperform" rating in a research note on Tuesday, July 16th. Finally, Scotiabank decreased their target price on Stella-Jones from C$95.00 to C$85.00 in a research report on Thursday, November 7th.

Check Out Our Latest Stock Report on SJ

Stella-Jones Price Performance

Shares of SJ traded down C$0.68 during mid-day trading on Wednesday, hitting C$70.04. 295,416 shares of the stock were exchanged, compared to its average volume of 142,319. The company has a market cap of C$3.95 billion, a PE ratio of 11.32, a price-to-earnings-growth ratio of 2.40 and a beta of 0.64. Stella-Jones has a 52-week low of C$69.15 and a 52-week high of C$98.00. The firm has a 50-day moving average of C$87.85 and a two-hundred day moving average of C$87.50. The company has a debt-to-equity ratio of 93.08, a quick ratio of 1.20 and a current ratio of 6.57.

Stella-Jones Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 20th. Stockholders of record on Monday, December 2nd will be issued a $0.28 dividend. The ex-dividend date of this dividend is Monday, December 2nd. This represents a $1.12 dividend on an annualized basis and a dividend yield of 1.60%. Stella-Jones's payout ratio is 18.09%.

Insider Activity

In other news, Director Rhodri Harries acquired 5,000 shares of the company's stock in a transaction on Tuesday, November 12th. The shares were bought at an average cost of C$70.50 per share, with a total value of C$352,500.00. Corporate insiders own 0.14% of the company's stock.

About Stella-Jones

(

Get Free ReportStella-Jones Inc produces and sells pressure-treated wood products in Canada and the United States. It operates through two segments, Pressure-Treated Wood; and Logs and Lumber. The company offers railway ties and timbers for short line and commercial railroad operators; and wood utility poles for electrical utilities and telecommunication companies.

Read More

Before you consider Stella-Jones, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stella-Jones wasn't on the list.

While Stella-Jones currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.