Stephens Inc. AR reduced its holdings in MarketAxess Holdings Inc. (NASDAQ:MKTX - Free Report) by 60.3% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 3,187 shares of the financial services provider's stock after selling 4,849 shares during the quarter. Stephens Inc. AR's holdings in MarketAxess were worth $816,000 as of its most recent filing with the Securities and Exchange Commission.

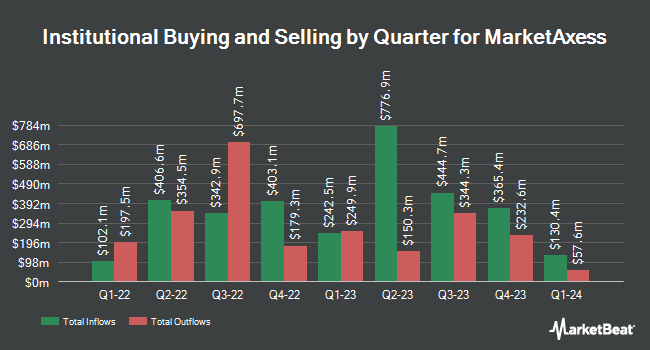

Several other large investors have also recently added to or reduced their stakes in the business. Retirement Planning Co of New England Inc. boosted its holdings in shares of MarketAxess by 2.9% in the 2nd quarter. Retirement Planning Co of New England Inc. now owns 1,566 shares of the financial services provider's stock valued at $314,000 after purchasing an additional 44 shares during the last quarter. Nisa Investment Advisors LLC boosted its holdings in MarketAxess by 0.7% in the second quarter. Nisa Investment Advisors LLC now owns 7,376 shares of the financial services provider's stock valued at $1,479,000 after acquiring an additional 52 shares during the last quarter. DekaBank Deutsche Girozentrale grew its position in MarketAxess by 1.0% during the third quarter. DekaBank Deutsche Girozentrale now owns 5,080 shares of the financial services provider's stock valued at $1,287,000 after acquiring an additional 52 shares during the period. Northwestern Mutual Wealth Management Co. increased its stake in MarketAxess by 4.9% during the second quarter. Northwestern Mutual Wealth Management Co. now owns 1,616 shares of the financial services provider's stock worth $324,000 after acquiring an additional 76 shares during the last quarter. Finally, CVA Family Office LLC raised its holdings in shares of MarketAxess by 47.4% in the 2nd quarter. CVA Family Office LLC now owns 252 shares of the financial services provider's stock worth $51,000 after purchasing an additional 81 shares during the period. 99.01% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on MKTX. Piper Sandler boosted their target price on MarketAxess from $235.00 to $265.00 and gave the stock a "neutral" rating in a report on Tuesday, October 8th. Barclays increased their price objective on shares of MarketAxess from $237.00 to $268.00 and gave the stock an "equal weight" rating in a research report on Monday, October 7th. The Goldman Sachs Group upped their price target on shares of MarketAxess from $204.00 to $233.00 and gave the stock a "neutral" rating in a research report on Monday, September 30th. Bank of America cut their price objective on MarketAxess from $193.00 to $185.00 and set an "underperform" rating on the stock in a research report on Thursday, October 3rd. Finally, Keefe, Bruyette & Woods increased their target price on MarketAxess from $222.00 to $225.00 and gave the company a "market perform" rating in a research note on Wednesday, August 7th. Two investment analysts have rated the stock with a sell rating, seven have given a hold rating and three have assigned a buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $253.30.

Check Out Our Latest Report on MKTX

Insider Buying and Selling

In related news, insider Christophe Pierre Danie Roupie sold 617 shares of the company's stock in a transaction that occurred on Thursday, August 8th. The stock was sold at an average price of $231.63, for a total transaction of $142,915.71. Following the sale, the insider now directly owns 7,409 shares of the company's stock, valued at approximately $1,716,146.67. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Insiders own 2.66% of the company's stock.

MarketAxess Stock Down 1.5 %

Shares of MarketAxess stock traded down $4.28 on Wednesday, hitting $274.87. 867,768 shares of the company's stock traded hands, compared to its average volume of 408,917. The company has a quick ratio of 2.91, a current ratio of 2.91 and a debt-to-equity ratio of 0.01. The firm's 50-day moving average is $268.54 and its 200 day moving average is $232.21. The stock has a market cap of $10.38 billion, a P/E ratio of 40.22, a PEG ratio of 9.03 and a beta of 1.05. MarketAxess Holdings Inc. has a 52-week low of $192.42 and a 52-week high of $297.97.

MarketAxess (NASDAQ:MKTX - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The financial services provider reported $1.72 EPS for the quarter, beating analysts' consensus estimates of $1.68 by $0.04. The firm had revenue of $197.70 million for the quarter, compared to the consensus estimate of $198.07 million. MarketAxess had a net margin of 33.71% and a return on equity of 20.43%. The firm's revenue was up 9.9% compared to the same quarter last year. During the same period in the prior year, the firm posted $1.63 EPS. Equities analysts anticipate that MarketAxess Holdings Inc. will post 7.26 earnings per share for the current year.

MarketAxess Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, December 4th. Investors of record on Wednesday, November 20th will be paid a $0.74 dividend. This represents a $2.96 dividend on an annualized basis and a yield of 1.08%. MarketAxess's dividend payout ratio (DPR) is 42.65%.

MarketAxess declared that its Board of Directors has approved a share buyback plan on Tuesday, August 6th that authorizes the company to repurchase $250.00 million in shares. This repurchase authorization authorizes the financial services provider to purchase up to 2.8% of its stock through open market purchases. Stock repurchase plans are typically an indication that the company's leadership believes its stock is undervalued.

MarketAxess Company Profile

(

Free Report)

MarketAxess Holdings Inc, together with its subsidiaries, operates an electronic trading platform for institutional investor and broker-dealer companies worldwide. The company offers trading technology that provides liquidity access in U.S. high-grade bonds, U.S. high-yield bonds, emerging market debt, eurobonds, municipal bonds, U.S.

Featured Stories

Before you consider MarketAxess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MarketAxess wasn't on the list.

While MarketAxess currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.