Bank OZK (NASDAQ:OZK - Get Free Report) had its price target decreased by equities research analysts at Stephens from $59.00 to $54.00 in a research report issued to clients and investors on Monday,Benzinga reports. The brokerage presently has an "equal weight" rating on the stock. Stephens' target price suggests a potential upside of 26.40% from the stock's current price.

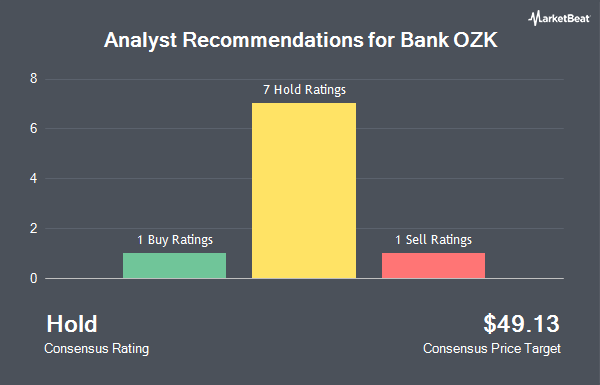

OZK has been the subject of a number of other reports. Wells Fargo & Company decreased their price target on Bank OZK from $48.00 to $40.00 and set an "equal weight" rating for the company in a research note on Wednesday, April 9th. Morgan Stanley decreased their target price on Bank OZK from $58.00 to $54.00 and set an "equal weight" rating for the company in a research report on Thursday, March 13th. One investment analyst has rated the stock with a sell rating, eight have assigned a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat.com, Bank OZK has an average rating of "Hold" and an average target price of $49.13.

Get Our Latest Research Report on Bank OZK

Bank OZK Stock Up 0.2 %

Shares of Bank OZK stock traded up $0.09 on Monday, hitting $42.72. 811,977 shares of the company's stock traded hands, compared to its average volume of 1,332,247. Bank OZK has a 52-week low of $35.71 and a 52-week high of $53.64. The company has a quick ratio of 1.02, a current ratio of 1.03 and a debt-to-equity ratio of 0.16. The stock has a market cap of $4.85 billion, a P/E ratio of 6.96 and a beta of 1.05. The firm's 50-day moving average is $43.33 and its 200 day moving average is $45.80.

Bank OZK (NASDAQ:OZK - Get Free Report) last posted its quarterly earnings results on Wednesday, April 16th. The company reported $1.47 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.42 by $0.05. The firm had revenue of $409.23 million for the quarter, compared to analysts' expectations of $403.05 million. Bank OZK had a net margin of 25.83% and a return on equity of 13.90%. During the same period in the prior year, the company posted $1.51 earnings per share. Equities analysts anticipate that Bank OZK will post 6.02 earnings per share for the current year.

Institutional Investors Weigh In On Bank OZK

Hedge funds have recently added to or reduced their stakes in the stock. Norges Bank acquired a new stake in shares of Bank OZK in the 4th quarter worth about $53,114,000. Wasatch Advisors LP increased its stake in shares of Bank OZK by 19.3% in the fourth quarter. Wasatch Advisors LP now owns 7,102,657 shares of the company's stock valued at $316,281,000 after purchasing an additional 1,149,880 shares during the period. First Trust Advisors LP increased its stake in shares of Bank OZK by 30.4% in the fourth quarter. First Trust Advisors LP now owns 2,945,480 shares of the company's stock valued at $131,162,000 after purchasing an additional 686,775 shares during the period. Raymond James Financial Inc. bought a new stake in shares of Bank OZK during the fourth quarter valued at approximately $14,077,000. Finally, AQR Capital Management LLC boosted its position in shares of Bank OZK by 12.6% during the fourth quarter. AQR Capital Management LLC now owns 2,811,354 shares of the company's stock worth $125,190,000 after buying an additional 314,488 shares during the period. 86.18% of the stock is currently owned by institutional investors.

Bank OZK Company Profile

(

Get Free Report)

Bank OZK provides various retail and commercial banking services for individuals and businesses in the United States. The company offers deposit services, including non-interest bearing checking, interest bearing transaction, business sweep, savings, money market, individual retirement, and other accounts, as well as time and reciprocal deposits.

See Also

Before you consider Bank OZK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank OZK wasn't on the list.

While Bank OZK currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.