Occidental Petroleum (NYSE:OXY - Free Report) had its price target raised by Stephens from $70.00 to $71.00 in a report published on Wednesday morning,Benzinga reports. Stephens currently has an overweight rating on the oil and gas producer's stock.

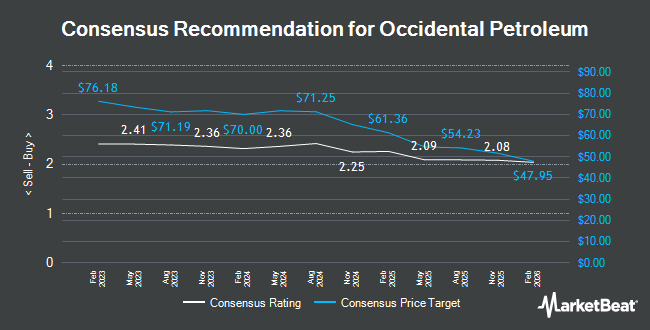

Several other equities research analysts also recently issued reports on the stock. Susquehanna lowered their price objective on shares of Occidental Petroleum from $78.00 to $77.00 and set a "positive" rating on the stock in a research note on Friday, October 18th. Wells Fargo & Company lowered their price objective on shares of Occidental Petroleum from $65.00 to $56.00 and set an "equal weight" rating on the stock in a research note on Friday, September 27th. UBS Group lowered their price objective on shares of Occidental Petroleum from $70.00 to $59.00 and set a "neutral" rating on the stock in a research note on Wednesday, September 18th. JPMorgan Chase & Co. reaffirmed a "neutral" rating and issued a $56.00 target price on shares of Occidental Petroleum in a research report on Friday, November 8th. Finally, Jefferies Financial Group raised their target price on Occidental Petroleum from $53.00 to $54.00 and gave the stock a "hold" rating in a research report on Tuesday. One investment analyst has rated the stock with a sell rating, thirteen have assigned a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat, the company has an average rating of "Hold" and an average target price of $64.30.

Get Our Latest Stock Report on OXY

Occidental Petroleum Stock Performance

OXY stock traded up $0.83 during midday trading on Wednesday, hitting $51.12. 24,142,190 shares of the company traded hands, compared to its average volume of 9,334,393. Occidental Petroleum has a twelve month low of $48.42 and a twelve month high of $71.18. The company has a quick ratio of 0.75, a current ratio of 1.04 and a debt-to-equity ratio of 0.77. The business has a 50 day simple moving average of $51.97 and a 200-day simple moving average of $57.72. The stock has a market capitalization of $46.30 billion, a price-to-earnings ratio of 12.88 and a beta of 1.58.

Occidental Petroleum Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 10th will be issued a $0.22 dividend. The ex-dividend date is Tuesday, December 10th. This represents a $0.88 dividend on an annualized basis and a dividend yield of 1.72%. Occidental Petroleum's dividend payout ratio is 22.92%.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in OXY. Fortitude Family Office LLC raised its holdings in shares of Occidental Petroleum by 160.0% in the third quarter. Fortitude Family Office LLC now owns 494 shares of the oil and gas producer's stock valued at $25,000 after buying an additional 304 shares during the last quarter. Mizuho Securities Co. Ltd. bought a new position in shares of Occidental Petroleum in the third quarter valued at about $32,000. New Covenant Trust Company N.A. bought a new position in shares of Occidental Petroleum in the first quarter valued at about $44,000. LRI Investments LLC acquired a new stake in Occidental Petroleum in the first quarter worth about $44,000. Finally, Transamerica Financial Advisors Inc. acquired a new stake in Occidental Petroleum in the third quarter worth about $50,000. 88.70% of the stock is owned by institutional investors.

About Occidental Petroleum

(

Get Free Report)

Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, and North Africa. It operates through three segments: Oil and Gas, Chemical, and Midstream and Marketing. The company's Oil and Gas segment explores for, develops, and produces oil and condensate, natural gas liquids (NGLs), and natural gas.

Featured Stories

Before you consider Occidental Petroleum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Occidental Petroleum wasn't on the list.

While Occidental Petroleum currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.