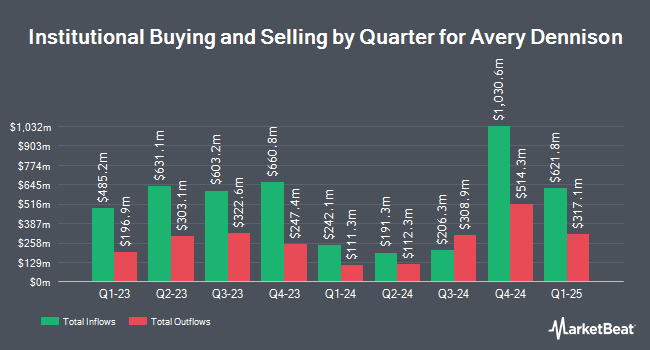

Sterling Capital Management LLC decreased its position in Avery Dennison Co. (NYSE:AVY - Free Report) by 10.4% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 536,527 shares of the industrial products company's stock after selling 62,183 shares during the quarter. Avery Dennison accounts for approximately 1.4% of Sterling Capital Management LLC's holdings, making the stock its 16th largest holding. Sterling Capital Management LLC owned 0.67% of Avery Dennison worth $100,400,000 at the end of the most recent reporting period.

A number of other large investors have also recently bought and sold shares of the company. Vanguard Group Inc. grew its stake in Avery Dennison by 0.3% in the 4th quarter. Vanguard Group Inc. now owns 9,681,709 shares of the industrial products company's stock valued at $1,811,738,000 after buying an additional 33,149 shares during the last quarter. Geode Capital Management LLC boosted its stake in shares of Avery Dennison by 0.7% in the 4th quarter. Geode Capital Management LLC now owns 2,102,331 shares of the industrial products company's stock valued at $392,445,000 after purchasing an additional 13,815 shares in the last quarter. Norges Bank acquired a new stake in shares of Avery Dennison during the 4th quarter valued at $188,643,000. Boston Partners raised its holdings in Avery Dennison by 7.7% in the 4th quarter. Boston Partners now owns 926,506 shares of the industrial products company's stock valued at $173,385,000 after buying an additional 66,216 shares during the last quarter. Finally, Massachusetts Financial Services Co. MA lifted its holdings in shares of Avery Dennison by 16.1% during the fourth quarter. Massachusetts Financial Services Co. MA now owns 812,191 shares of the industrial products company's stock worth $151,985,000 after purchasing an additional 112,650 shares during the period. Institutional investors and hedge funds own 94.17% of the company's stock.

Avery Dennison Stock Up 1.6 %

NYSE:AVY traded up $2.67 during mid-day trading on Monday, hitting $172.35. 821,321 shares of the company's stock traded hands, compared to its average volume of 579,277. Avery Dennison Co. has a twelve month low of $157.00 and a twelve month high of $233.48. The company has a debt-to-equity ratio of 1.10, a quick ratio of 0.73 and a current ratio of 1.08. The company has a market capitalization of $13.61 billion, a P/E ratio of 19.76, a P/E/G ratio of 2.07 and a beta of 0.85. The company has a fifty day moving average of $178.64 and a 200 day moving average of $192.62.

Avery Dennison (NYSE:AVY - Get Free Report) last released its quarterly earnings results on Thursday, January 30th. The industrial products company reported $2.38 earnings per share for the quarter, missing analysts' consensus estimates of $2.39 by ($0.01). Avery Dennison had a return on equity of 33.06% and a net margin of 8.05%. On average, analysts forecast that Avery Dennison Co. will post 9.96 EPS for the current year.

Avery Dennison Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, March 19th. Shareholders of record on Wednesday, March 5th were paid a $0.88 dividend. The ex-dividend date of this dividend was Wednesday, March 5th. This represents a $3.52 annualized dividend and a yield of 2.04%. Avery Dennison's dividend payout ratio is currently 40.37%.

Wall Street Analyst Weigh In

Several equities research analysts recently commented on the company. Robert W. Baird set a $220.00 target price on Avery Dennison in a report on Friday, January 31st. BMO Capital Markets set a $226.00 price target on Avery Dennison in a research report on Monday, February 3rd. Raymond James restated an "outperform" rating and set a $208.00 price target (down previously from $218.00) on shares of Avery Dennison in a research note on Friday, January 31st. Barclays lowered their price target on shares of Avery Dennison from $245.00 to $225.00 and set an "overweight" rating on the stock in a research report on Monday, February 3rd. Finally, UBS Group reduced their target price on Avery Dennison from $207.00 to $189.00 and set a "neutral" rating for the company in a report on Monday, April 7th. Three analysts have rated the stock with a hold rating and nine have issued a buy rating to the company. According to data from MarketBeat.com, Avery Dennison has an average rating of "Moderate Buy" and an average price target of $220.87.

Get Our Latest Report on Avery Dennison

Insider Activity at Avery Dennison

In other news, Chairman Mitchell R. Butier sold 12,969 shares of the firm's stock in a transaction on Thursday, March 6th. The shares were sold at an average price of $181.85, for a total value of $2,358,412.65. Following the completion of the sale, the chairman now owns 303,331 shares in the company, valued at approximately $55,160,742.35. This trade represents a 4.10 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 0.84% of the stock is owned by corporate insiders.

Avery Dennison Profile

(

Free Report)

Avery Dennison Corporation operates as a materials science and digital identification solutions company in the United States, Europe, the Middle East, North Africa, Asia, Latin, America, and internationally. It provides pressure-sensitive materials comprising papers, plastic films, metal foils, and fabrics; performance tapes products, including tapes for wire harnessing, as well as cable wrapping for automotive, electrical, and general industrial applications; mechanical fasteners, which are precision-extruded and injection-molded plastic devices used in various automotive, general industrial, and retail applications; and other pressure-sensitive adhesive-based materials and converted products under the Fasson, JAC, Yongle, and Avery Dennison brands.

Featured Articles

Before you consider Avery Dennison, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avery Dennison wasn't on the list.

While Avery Dennison currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report