Sterling Capital Management LLC lifted its holdings in Globant S.A. (NYSE:GLOB - Free Report) by 54.2% in the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 20,104 shares of the information technology services provider's stock after buying an additional 7,069 shares during the quarter. Sterling Capital Management LLC's holdings in Globant were worth $4,311,000 at the end of the most recent quarter.

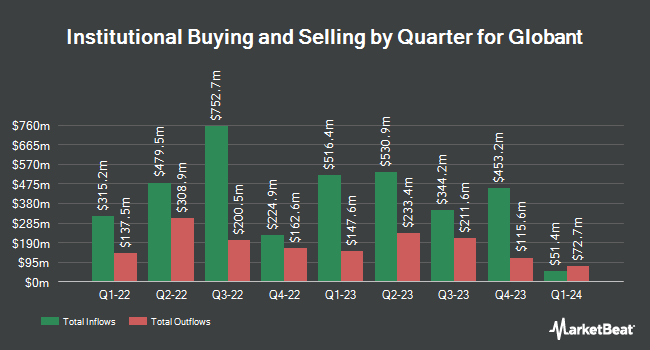

A number of other institutional investors also recently modified their holdings of the stock. Quantinno Capital Management LP lifted its holdings in Globant by 14.0% in the third quarter. Quantinno Capital Management LP now owns 1,502 shares of the information technology services provider's stock valued at $298,000 after buying an additional 185 shares during the period. National Bank of Canada FI grew its stake in shares of Globant by 3.3% during the third quarter. National Bank of Canada FI now owns 3,816 shares of the information technology services provider's stock worth $756,000 after purchasing an additional 122 shares during the period. Barclays PLC increased its holdings in Globant by 132.9% in the third quarter. Barclays PLC now owns 22,537 shares of the information technology services provider's stock valued at $4,467,000 after purchasing an additional 12,862 shares during the last quarter. M&T Bank Corp grew its position in shares of Globant by 3.8% during the 3rd quarter. M&T Bank Corp now owns 1,641 shares of the information technology services provider's stock worth $326,000 after buying an additional 60 shares during the period. Finally, Sanctuary Advisors LLC raised its position in shares of Globant by 26.2% in the 3rd quarter. Sanctuary Advisors LLC now owns 3,312 shares of the information technology services provider's stock valued at $656,000 after acquiring an additional 688 shares during the period. 91.60% of the stock is owned by institutional investors.

Globant Stock Performance

Shares of NYSE:GLOB traded down $0.90 during midday trading on Thursday, reaching $105.69. 401,366 shares of the company's stock traded hands, compared to its average volume of 870,487. Globant S.A. has a one year low of $96.23 and a one year high of $238.32. The company has a market cap of $4.65 billion, a price-to-earnings ratio of 28.41, a P/E/G ratio of 2.38 and a beta of 1.50. The stock has a 50 day moving average of $143.65 and a 200 day moving average of $191.26.

Globant (NYSE:GLOB - Get Free Report) last posted its earnings results on Thursday, February 20th. The information technology services provider reported $1.36 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.75 by ($0.39). Globant had a net margin of 6.86% and a return on equity of 11.83%. The company had revenue of $642.48 million for the quarter, compared to the consensus estimate of $644.42 million. Sell-side analysts predict that Globant S.A. will post 5.73 EPS for the current fiscal year.

Analysts Set New Price Targets

Several research firms have issued reports on GLOB. UBS Group dropped their price target on Globant from $217.00 to $190.00 and set a "neutral" rating on the stock in a research note on Wednesday, February 26th. Redburn Atlantic raised shares of Globant from a "sell" rating to a "neutral" rating and boosted their price objective for the stock from $140.00 to $150.00 in a research report on Tuesday, February 25th. Needham & Company LLC reiterated a "buy" rating and issued a $220.00 price target on shares of Globant in a research note on Wednesday, March 12th. Canaccord Genuity Group lowered their price target on Globant from $205.00 to $165.00 and set a "hold" rating on the stock in a research report on Monday, February 24th. Finally, Scotiabank cut their price objective on Globant from $220.00 to $170.00 and set a "sector perform" rating for the company in a report on Monday, February 24th. One equities research analyst has rated the stock with a sell rating, five have given a hold rating and eleven have given a buy rating to the stock. Based on data from MarketBeat.com, Globant presently has a consensus rating of "Moderate Buy" and a consensus price target of $209.94.

Get Our Latest Research Report on GLOB

About Globant

(

Free Report)

Globant SA, together with its subsidiaries, provides technology services worldwide. It provides digital solutions comprising blockchain, cloud technologies, cybersecurity, data and artificial intelligence, digital experience and performance, code, Internet of Things, metaverse, and engineering and testing; and enterprise technology solutions and services, such as Agile organization, Cultural Hacking, process optimization services, as well as AWS, Google Cloud, Microsoft, Oracle, SalesForce, SAP, and ServiceNow technology solutions.

Featured Articles

Before you consider Globant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globant wasn't on the list.

While Globant currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.