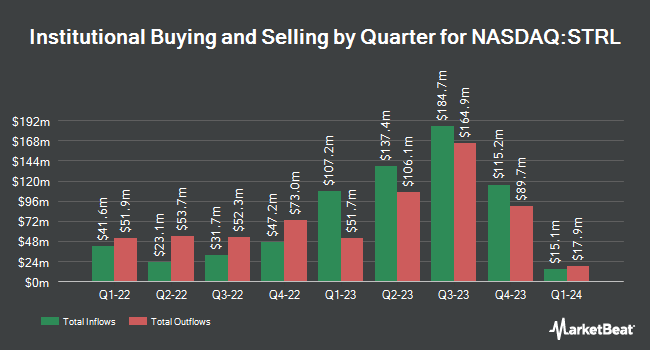

Bridge City Capital LLC grew its holdings in Sterling Infrastructure, Inc. (NASDAQ:STRL - Free Report) by 8.1% in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 66,303 shares of the construction company's stock after purchasing an additional 4,964 shares during the period. Sterling Infrastructure makes up 3.0% of Bridge City Capital LLC's portfolio, making the stock its biggest position. Bridge City Capital LLC owned about 0.22% of Sterling Infrastructure worth $11,169,000 at the end of the most recent quarter.

Other hedge funds also recently modified their holdings of the company. LPL Financial LLC lifted its position in shares of Sterling Infrastructure by 11.9% in the fourth quarter. LPL Financial LLC now owns 64,850 shares of the construction company's stock worth $10,924,000 after purchasing an additional 6,903 shares in the last quarter. KLP Kapitalforvaltning AS acquired a new position in Sterling Infrastructure in the 4th quarter valued at approximately $1,061,000. American Century Companies Inc. lifted its position in Sterling Infrastructure by 1.3% in the 4th quarter. American Century Companies Inc. now owns 291,458 shares of the construction company's stock worth $49,096,000 after buying an additional 3,831 shares in the last quarter. MRP Capital Investments LLC boosted its stake in shares of Sterling Infrastructure by 17.2% during the 4th quarter. MRP Capital Investments LLC now owns 4,600 shares of the construction company's stock valued at $775,000 after buying an additional 675 shares during the period. Finally, Harvest Fund Management Co. Ltd grew its holdings in shares of Sterling Infrastructure by 28.9% during the 4th quarter. Harvest Fund Management Co. Ltd now owns 1,445 shares of the construction company's stock valued at $240,000 after acquiring an additional 324 shares in the last quarter. Hedge funds and other institutional investors own 80.95% of the company's stock.

Analysts Set New Price Targets

STRL has been the subject of several recent research reports. StockNews.com lowered Sterling Infrastructure from a "buy" rating to a "hold" rating in a report on Monday. William Blair started coverage on Sterling Infrastructure in a research note on Friday, January 17th. They set an "outperform" rating for the company. Finally, DA Davidson raised Sterling Infrastructure from a "neutral" rating to a "buy" rating and set a $185.00 price target for the company in a research note on Thursday, February 27th.

View Our Latest Report on STRL

Sterling Infrastructure Stock Down 6.8 %

Shares of STRL stock traded down $8.56 on Thursday, hitting $117.00. The company's stock had a trading volume of 641,847 shares, compared to its average volume of 396,685. The stock has a market capitalization of $3.58 billion, a price-to-earnings ratio of 19.76, a P/E/G ratio of 1.28 and a beta of 1.32. Sterling Infrastructure, Inc. has a fifty-two week low of $93.50 and a fifty-two week high of $206.07. The firm's fifty day moving average price is $136.42 and its 200-day moving average price is $155.87. The company has a debt-to-equity ratio of 0.41, a current ratio of 1.29 and a quick ratio of 1.29.

Sterling Infrastructure Company Profile

(

Free Report)

Sterling Infrastructure, Inc engages in the provision of e-infrastructure, transportation, and building solutions primarily in the United States. It operates through three segments: E-Infrastructure Solutions, Transportation Solutions, and Building Solutions. The E-Infrastructure Solutions segment provides site development services for the blue-chip end users in the e-commerce distribution center, data center, manufacturing, warehousing, and power generation sectors.

See Also

Before you consider Sterling Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sterling Infrastructure wasn't on the list.

While Sterling Infrastructure currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn how options trading can help you navigate market volatility, manage risk, and maximize returns with MarketBeat's "Unlock the Potential in Options Trading." Click the link below to have this special report delivered to your inbox.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.