Royce & Associates LP trimmed its holdings in Steven Madden, Ltd. (NASDAQ:SHOO - Free Report) by 22.7% during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 210,921 shares of the textile maker's stock after selling 61,857 shares during the period. Royce & Associates LP owned about 0.29% of Steven Madden worth $10,333,000 as of its most recent filing with the Securities & Exchange Commission.

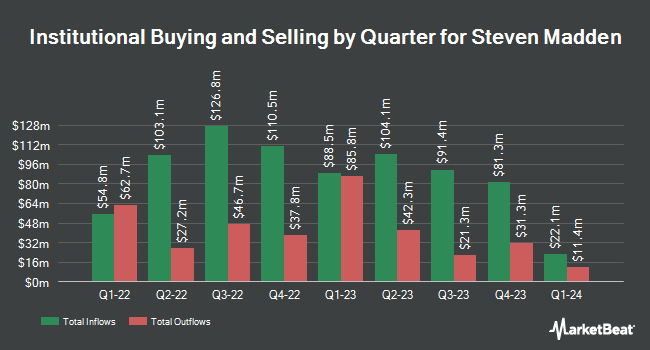

Several other institutional investors have also recently made changes to their positions in the business. SG Americas Securities LLC boosted its stake in Steven Madden by 225.8% in the 1st quarter. SG Americas Securities LLC now owns 13,075 shares of the textile maker's stock worth $553,000 after purchasing an additional 9,062 shares during the period. ProShare Advisors LLC lifted its stake in Steven Madden by 5.8% in the 1st quarter. ProShare Advisors LLC now owns 14,817 shares of the textile maker's stock worth $626,000 after purchasing an additional 807 shares in the last quarter. Seven Eight Capital LP lifted its stake in Steven Madden by 902.5% in the 1st quarter. Seven Eight Capital LP now owns 49,265 shares of the textile maker's stock worth $2,083,000 after purchasing an additional 44,351 shares in the last quarter. UniSuper Management Pty Ltd bought a new position in shares of Steven Madden during the 1st quarter valued at about $757,000. Finally, CANADA LIFE ASSURANCE Co grew its position in shares of Steven Madden by 5.1% during the first quarter. CANADA LIFE ASSURANCE Co now owns 73,147 shares of the textile maker's stock valued at $3,089,000 after purchasing an additional 3,569 shares in the last quarter. Hedge funds and other institutional investors own 99.88% of the company's stock.

Steven Madden Price Performance

Shares of SHOO traded down $0.72 during midday trading on Friday, hitting $43.23. The stock had a trading volume of 750,477 shares, compared to its average volume of 812,201. The stock's 50 day moving average is $46.43 and its 200 day moving average is $44.36. The firm has a market cap of $3.12 billion, a PE ratio of 18.40 and a beta of 1.08. Steven Madden, Ltd. has a 1 year low of $35.64 and a 1 year high of $50.01.

Steven Madden (NASDAQ:SHOO - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The textile maker reported $0.91 earnings per share for the quarter, topping analysts' consensus estimates of $0.89 by $0.02. Steven Madden had a net margin of 7.68% and a return on equity of 23.41%. The company had revenue of $624.68 million for the quarter, compared to analyst estimates of $607.89 million. During the same period in the prior year, the company posted $0.88 EPS. The firm's revenue for the quarter was up 13.0% on a year-over-year basis. As a group, equities research analysts expect that Steven Madden, Ltd. will post 2.65 earnings per share for the current fiscal year.

Steven Madden Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Investors of record on Friday, December 13th will be issued a dividend of $0.21 per share. This represents a $0.84 dividend on an annualized basis and a yield of 1.94%. The ex-dividend date of this dividend is Friday, December 13th. Steven Madden's payout ratio is currently 35.74%.

Analyst Ratings Changes

A number of brokerages recently commented on SHOO. Citigroup increased their price target on Steven Madden from $43.00 to $45.00 and gave the company a "neutral" rating in a research note on Friday, November 8th. Piper Sandler reiterated a "neutral" rating and set a $45.00 target price on shares of Steven Madden in a research report on Friday, August 23rd. Telsey Advisory Group restated a "market perform" rating and issued a $50.00 price target on shares of Steven Madden in a research report on Wednesday. StockNews.com raised shares of Steven Madden from a "hold" rating to a "buy" rating in a research note on Saturday. Finally, Wedbush reissued a "neutral" rating and issued a $41.00 price objective on shares of Steven Madden in a research note on Wednesday, August 7th. Six analysts have rated the stock with a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $45.43.

View Our Latest Research Report on SHOO

Steven Madden Profile

(

Free Report)

Steven Madden, Ltd. designs, sources, and markets fashion-forward branded and private label footwear, accessories, and apparel in the United States and internationally. It operates through Wholesale Footwear, Wholesale Accessories/Apparel, Direct-to- Consumer, and Licensing segments. The Wholesale Footwear segment designs, sources, and markets various products, including dress shoes, boots, booties, fashion sneakers, sandals, and casual shoes under the Steve Madden, Dolce Vita, Betsey Johnson, Blondo, GREATS, and Anne Klein brands.

Featured Articles

Before you consider Steven Madden, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Steven Madden wasn't on the list.

While Steven Madden currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.