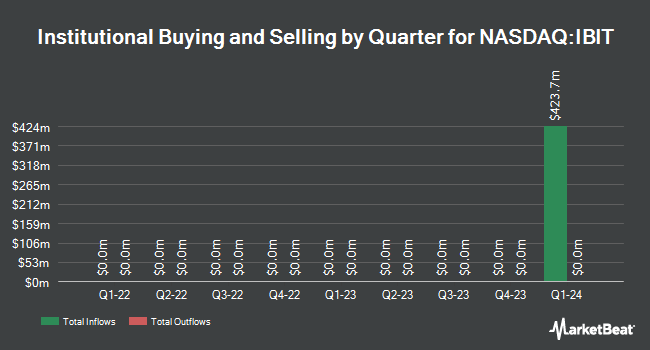

Stevens Capital Management LP acquired a new position in shares of iShares Bitcoin Trust (NASDAQ:IBIT - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 252,097 shares of the company's stock, valued at approximately $9,108,000. iShares Bitcoin Trust makes up approximately 1.3% of Stevens Capital Management LP's investment portfolio, making the stock its 20th largest position.

Other institutional investors have also bought and sold shares of the company. Comerica Bank bought a new stake in iShares Bitcoin Trust during the first quarter worth $225,000. Mather Group LLC. bought a new position in iShares Bitcoin Trust during the second quarter valued at about $85,000. CWM LLC purchased a new stake in iShares Bitcoin Trust during the second quarter worth about $1,203,000. Csenge Advisory Group raised its position in iShares Bitcoin Trust by 3.0% in the second quarter. Csenge Advisory Group now owns 14,477 shares of the company's stock worth $494,000 after acquiring an additional 423 shares during the period. Finally, U.S. Capital Wealth Advisors LLC boosted its stake in iShares Bitcoin Trust by 64.4% in the second quarter. U.S. Capital Wealth Advisors LLC now owns 8,756 shares of the company's stock valued at $299,000 after acquiring an additional 3,431 shares during the last quarter.

iShares Bitcoin Trust Stock Performance

Shares of IBIT traded down $0.02 during mid-day trading on Thursday, hitting $56.40. The stock had a trading volume of 85,545,617 shares, compared to its average volume of 34,288,625. iShares Bitcoin Trust has a 52 week low of $22.02 and a 52 week high of $59.16. The business has a fifty day moving average price of $43.59 and a 200-day moving average price of $38.46.

About iShares Bitcoin Trust

(

Free Report)

The IShares Bitcoin Trust Registered (IBIT) is an exchange-traded fund that mostly invests in long btc, short usd currency. The fund is a passively managed fund that seeks to track the spot price of Bitcoin. IBIT was launched on Jan 5, 2024 and is issued by BlackRock.

Featured Stories

Before you consider iShares Bitcoin Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and iShares Bitcoin Trust wasn't on the list.

While iShares Bitcoin Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.