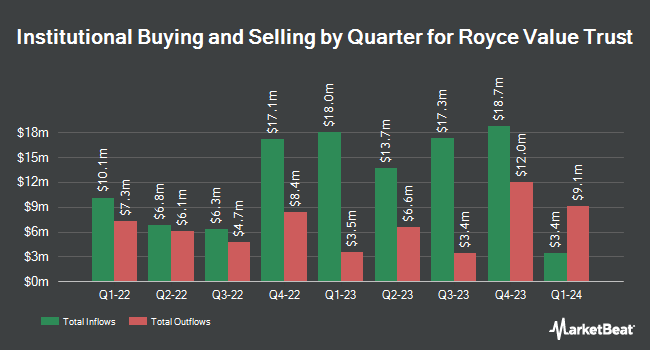

Steward Partners Investment Advisory LLC boosted its position in shares of Royce Value Trust Inc. (NYSE:RVT - Free Report) by 123.0% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 166,040 shares of the financial services provider's stock after purchasing an additional 91,586 shares during the period. Steward Partners Investment Advisory LLC owned approximately 0.14% of Royce Value Trust worth $2,623,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds also recently bought and sold shares of the company. Stifel Financial Corp increased its holdings in shares of Royce Value Trust by 10.0% during the 3rd quarter. Stifel Financial Corp now owns 775,846 shares of the financial services provider's stock worth $12,181,000 after buying an additional 70,449 shares during the last quarter. Janney Montgomery Scott LLC raised its position in Royce Value Trust by 2.8% in the fourth quarter. Janney Montgomery Scott LLC now owns 439,830 shares of the financial services provider's stock valued at $6,949,000 after purchasing an additional 11,777 shares during the period. Waterfront Wealth Inc. lifted its stake in shares of Royce Value Trust by 5.8% in the 4th quarter. Waterfront Wealth Inc. now owns 426,902 shares of the financial services provider's stock valued at $6,745,000 after purchasing an additional 23,238 shares during the last quarter. D.A. Davidson & CO. grew its holdings in shares of Royce Value Trust by 2.4% during the 4th quarter. D.A. Davidson & CO. now owns 223,093 shares of the financial services provider's stock worth $3,525,000 after purchasing an additional 5,149 shares during the period. Finally, Sanctuary Advisors LLC increased its position in shares of Royce Value Trust by 1.9% during the 4th quarter. Sanctuary Advisors LLC now owns 215,889 shares of the financial services provider's stock worth $3,547,000 after purchasing an additional 3,964 shares during the last quarter. 25.57% of the stock is currently owned by institutional investors and hedge funds.

Royce Value Trust Trading Down 0.1 %

RVT stock traded down $0.02 during mid-day trading on Tuesday, hitting $14.48. 372,235 shares of the company were exchanged, compared to its average volume of 272,442. Royce Value Trust Inc. has a 12-month low of $13.78 and a 12-month high of $16.93. The business has a fifty day simple moving average of $15.86 and a 200-day simple moving average of $15.79.

Royce Value Trust Cuts Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, March 26th. Investors of record on Thursday, March 13th will be given a dividend of $0.30 per share. The ex-dividend date of this dividend is Thursday, March 13th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 8.29%.

Royce Value Trust Profile

(

Free Report)

Royce Value Trust Inc is a close ended equity mutual fund launched and managed by Royce & Associates, LLC. It invests in the public equity markets of the United States. The fund spreads its investments across diversified sectors. It invests in value oriented stocks of small cap and micro cap companies.

Further Reading

Before you consider Royce Value Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royce Value Trust wasn't on the list.

While Royce Value Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.