Stieven Capital Advisors L.P. purchased a new position in HomeStreet, Inc. (NASDAQ:HMST - Free Report) in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 339,969 shares of the financial services provider's stock, valued at approximately $5,358,000. Stieven Capital Advisors L.P. owned about 1.80% of HomeStreet at the end of the most recent quarter.

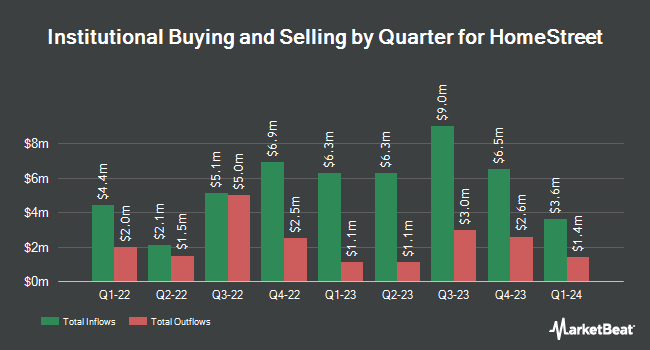

A number of other hedge funds and other institutional investors have also made changes to their positions in HMST. Squarepoint Ops LLC purchased a new position in shares of HomeStreet in the second quarter worth $122,000. EMC Capital Management raised its holdings in shares of HomeStreet by 16.2% in the first quarter. EMC Capital Management now owns 8,613 shares of the financial services provider's stock worth $130,000 after buying an additional 1,201 shares during the last quarter. Vanguard Personalized Indexing Management LLC raised its holdings in shares of HomeStreet by 23.2% in the second quarter. Vanguard Personalized Indexing Management LLC now owns 14,350 shares of the financial services provider's stock worth $164,000 after buying an additional 2,703 shares during the last quarter. Price T Rowe Associates Inc. MD raised its holdings in shares of HomeStreet by 10.3% in the first quarter. Price T Rowe Associates Inc. MD now owns 14,446 shares of the financial services provider's stock worth $218,000 after buying an additional 1,354 shares during the last quarter. Finally, Point72 Asia Singapore Pte. Ltd. purchased a new position in shares of HomeStreet in the second quarter worth $410,000. Hedge funds and other institutional investors own 74.71% of the company's stock.

Analysts Set New Price Targets

HMST has been the subject of a number of research analyst reports. Wedbush raised shares of HomeStreet from a "neutral" rating to an "outperform" rating and set a $12.00 price target for the company in a report on Tuesday, November 5th. StockNews.com started coverage on shares of HomeStreet in a report on Sunday, September 22nd. They set a "sell" rating for the company. Janney Montgomery Scott cut shares of HomeStreet from a "strong-buy" rating to a "hold" rating in a report on Wednesday, October 30th. Finally, Keefe, Bruyette & Woods raised their target price on shares of HomeStreet from $13.50 to $14.50 and gave the stock a "market perform" rating in a report on Tuesday, July 30th.

Read Our Latest Stock Report on HMST

Insider Activity

In other HomeStreet news, Director Paulette Lemon sold 2,401 shares of HomeStreet stock in a transaction dated Friday, August 30th. The shares were sold at an average price of $15.59, for a total transaction of $37,431.59. Following the transaction, the director now directly owns 16,923 shares of the company's stock, valued at $263,829.57. The trade was a 12.42 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Company insiders own 4.60% of the company's stock.

HomeStreet Stock Performance

Shares of NASDAQ HMST opened at $11.43 on Friday. The company's 50-day simple moving average is $13.82 and its 200-day simple moving average is $12.68. HomeStreet, Inc. has a 52-week low of $5.98 and a 52-week high of $16.10. The company has a current ratio of 1.15, a quick ratio of 1.14 and a debt-to-equity ratio of 3.94.

HomeStreet Company Profile

(

Free Report)

HomeStreet, Inc operates as the bank holding company for HomeStreet Bank that provides commercial, mortgage, and consumer/retail banking services in the Western United States. The company offers personal and business checking, savings, interest-bearing negotiable order of withdrawal, and money market accounts, as well as certificates of deposit; credit cards; insurance; and treasury management services.

Read More

Want to see what other hedge funds are holding HMST? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for HomeStreet, Inc. (NASDAQ:HMST - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider HomeStreet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HomeStreet wasn't on the list.

While HomeStreet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.