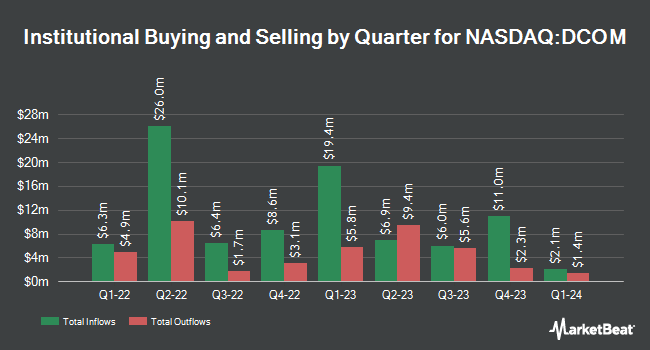

Stieven Capital Advisors L.P. grew its position in shares of Dime Community Bancshares, Inc. (NASDAQ:DCOM - Free Report) by 11.6% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 332,960 shares of the savings and loans company's stock after buying an additional 34,615 shares during the quarter. Dime Community Bancshares accounts for approximately 1.8% of Stieven Capital Advisors L.P.'s holdings, making the stock its 23rd largest position. Stieven Capital Advisors L.P. owned approximately 0.85% of Dime Community Bancshares worth $9,589,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Boston Partners increased its stake in shares of Dime Community Bancshares by 4.8% in the 1st quarter. Boston Partners now owns 693,457 shares of the savings and loans company's stock worth $13,334,000 after purchasing an additional 31,853 shares in the last quarter. Renaissance Technologies LLC increased its stake in shares of Dime Community Bancshares by 12.8% in the 2nd quarter. Renaissance Technologies LLC now owns 211,604 shares of the savings and loans company's stock worth $4,317,000 after purchasing an additional 24,000 shares in the last quarter. American Century Companies Inc. increased its stake in shares of Dime Community Bancshares by 13.9% in the 2nd quarter. American Century Companies Inc. now owns 635,265 shares of the savings and loans company's stock worth $12,959,000 after purchasing an additional 77,284 shares in the last quarter. First Eagle Investment Management LLC increased its stake in shares of Dime Community Bancshares by 33.9% in the 2nd quarter. First Eagle Investment Management LLC now owns 488,554 shares of the savings and loans company's stock worth $9,967,000 after purchasing an additional 123,800 shares in the last quarter. Finally, Royce & Associates LP increased its stake in shares of Dime Community Bancshares by 47.4% in the 3rd quarter. Royce & Associates LP now owns 503,653 shares of the savings and loans company's stock worth $14,505,000 after purchasing an additional 162,004 shares in the last quarter. 75.27% of the stock is owned by institutional investors.

Dime Community Bancshares Trading Down 0.4 %

Shares of Dime Community Bancshares stock opened at $33.70 on Friday. The firm has a market cap of $1.32 billion, a price-to-earnings ratio of 22.47 and a beta of 0.99. The business has a 50-day moving average price of $29.47 and a 200-day moving average price of $24.16. The company has a quick ratio of 1.01, a current ratio of 1.01 and a debt-to-equity ratio of 0.68. Dime Community Bancshares, Inc. has a twelve month low of $17.29 and a twelve month high of $35.21.

Dime Community Bancshares (NASDAQ:DCOM - Get Free Report) last issued its quarterly earnings data on Tuesday, October 22nd. The savings and loans company reported $0.29 earnings per share for the quarter, missing analysts' consensus estimates of $0.41 by ($0.12). The firm had revenue of $171.87 million for the quarter, compared to analysts' expectations of $86.65 million. Dime Community Bancshares had a net margin of 9.65% and a return on equity of 5.58%. During the same quarter in the previous year, the business earned $0.56 EPS. Equities research analysts anticipate that Dime Community Bancshares, Inc. will post 1.48 EPS for the current fiscal year.

Dime Community Bancshares Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, October 24th. Stockholders of record on Thursday, October 17th were given a dividend of $0.25 per share. The ex-dividend date was Thursday, October 17th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 2.97%. Dime Community Bancshares's payout ratio is 66.67%.

Insider Activity

In other Dime Community Bancshares news, Director Basswood Capital Management, L purchased 29,000 shares of the stock in a transaction that occurred on Tuesday, November 12th. The stock was purchased at an average price of $32.00 per share, with a total value of $928,000.00. Following the acquisition, the director now owns 1,044,221 shares in the company, valued at approximately $33,415,072. The trade was a 2.86 % increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Company insiders own 9.10% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts have issued reports on the company. StockNews.com lowered Dime Community Bancshares from a "hold" rating to a "sell" rating in a research note on Saturday, September 21st. Piper Sandler lowered Dime Community Bancshares from an "overweight" rating to a "neutral" rating and increased their price target for the stock from $23.00 to $26.00 in a research note on Tuesday, July 23rd. Raymond James increased their price target on Dime Community Bancshares from $35.00 to $36.00 and gave the stock a "strong-buy" rating in a research note on Wednesday, October 2nd. Finally, Keefe, Bruyette & Woods increased their price target on Dime Community Bancshares from $25.50 to $28.00 and gave the stock an "outperform" rating in a research note on Thursday, July 25th. One research analyst has rated the stock with a sell rating, one has assigned a hold rating, two have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $29.50.

Get Our Latest Stock Report on DCOM

Dime Community Bancshares Profile

(

Free Report)

Dime Community Bancshares, Inc operates as the holding company for Dime Community Bank that engages in the provision of various commercial banking and financial services. The company accepts time, savings, and demand deposits from the businesses, consumers, and local municipalities. It also offers commercial real estate loans; multi-family mortgage loans; residential mortgage loans; letters of credit; secured and unsecured commercial and consumer loans; lines of credit; home equity loans; and construction and land loans.

Further Reading

Want to see what other hedge funds are holding DCOM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Dime Community Bancshares, Inc. (NASDAQ:DCOM - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Dime Community Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dime Community Bancshares wasn't on the list.

While Dime Community Bancshares currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.