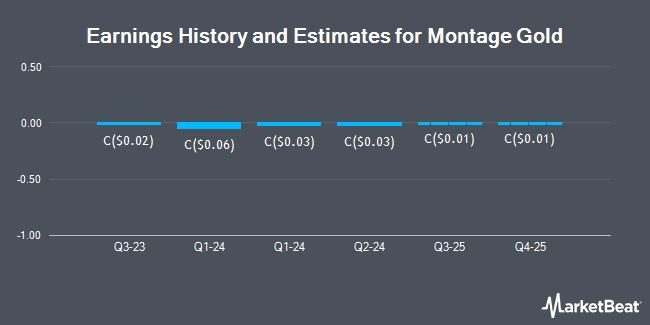

Montage Gold Corp. (CVE:MAU - Free Report) - Analysts at Stifel Canada issued their FY2029 EPS estimates for Montage Gold in a research note issued on Wednesday, March 19th. Stifel Canada analyst C. Mcgill anticipates that the company will post earnings per share of $0.63 for the year. Stifel Canada has a "Strong-Buy" rating on the stock. The consensus estimate for Montage Gold's current full-year earnings is ($0.04) per share.

A number of other equities research analysts have also recently issued reports on MAU. Stifel Nicolaus set a C$4.60 target price on Montage Gold and gave the company a "buy" rating in a research note on Wednesday, March 19th. National Bank Financial upgraded shares of Montage Gold to a "strong-buy" rating in a research report on Friday. Finally, Cormark upped their target price on shares of Montage Gold from C$3.00 to C$4.50 and gave the stock a "buy" rating in a research report on Tuesday. Four investment analysts have rated the stock with a buy rating and three have issued a strong buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Buy" and an average price target of C$3.62.

View Our Latest Stock Report on Montage Gold

Montage Gold Stock Performance

CVE:MAU traded up C$0.18 during midday trading on Friday, reaching C$3.16. 541,426 shares of the company traded hands, compared to its average volume of 218,557. The firm has a market capitalization of C$1.12 billion, a price-to-earnings ratio of -22.49 and a beta of 1.55. The company has a fifty day moving average price of C$2.39 and a 200 day moving average price of C$2.22. The company has a debt-to-equity ratio of 0.30, a current ratio of 26.33 and a quick ratio of 0.36. Montage Gold has a twelve month low of C$1.18 and a twelve month high of C$3.19.

About Montage Gold

(

Get Free Report)

Montage Gold Corp., a precious metals exploration and development company, engages in the exploration and development of mineral properties. Its flagship property is the Koné Gold Project covering an area of 2,259 square kilometers located in the Côte d'Ivoire, West Africa. The company was incorporated in 2019 and is headquartered in Vancouver, Canada.

See Also

Before you consider Montage Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Montage Gold wasn't on the list.

While Montage Gold currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.