Stifel Financial Corp increased its position in Illumina, Inc. (NASDAQ:ILMN - Free Report) by 98.5% in the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 261,154 shares of the life sciences company's stock after buying an additional 129,622 shares during the period. Stifel Financial Corp owned about 0.16% of Illumina worth $34,057,000 at the end of the most recent quarter.

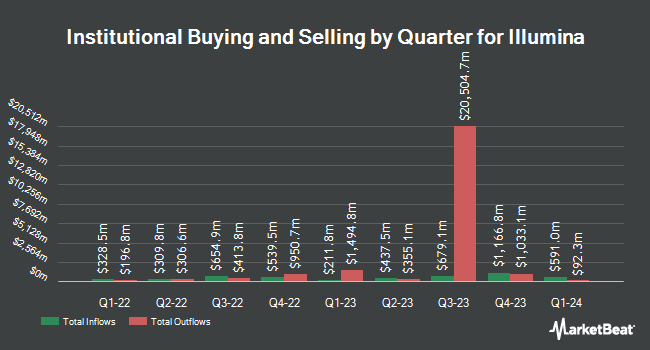

A number of other institutional investors have also bought and sold shares of the business. Bank of New York Mellon Corp grew its position in shares of Illumina by 7.2% during the second quarter. Bank of New York Mellon Corp now owns 3,039,538 shares of the life sciences company's stock worth $317,267,000 after purchasing an additional 204,043 shares in the last quarter. Primecap Management Co. CA boosted its stake in Illumina by 3.6% in the 3rd quarter. Primecap Management Co. CA now owns 2,516,359 shares of the life sciences company's stock worth $328,158,000 after purchasing an additional 87,599 shares during the period. Janus Henderson Group PLC grew its holdings in Illumina by 40.5% during the 3rd quarter. Janus Henderson Group PLC now owns 2,168,057 shares of the life sciences company's stock valued at $282,735,000 after buying an additional 625,245 shares in the last quarter. Millennium Management LLC raised its position in shares of Illumina by 305.0% during the second quarter. Millennium Management LLC now owns 1,485,599 shares of the life sciences company's stock valued at $155,067,000 after buying an additional 1,118,747 shares during the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in shares of Illumina by 4.5% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,260,137 shares of the life sciences company's stock valued at $164,334,000 after buying an additional 54,319 shares during the last quarter. Hedge funds and other institutional investors own 89.42% of the company's stock.

Analyst Upgrades and Downgrades

ILMN has been the subject of several research analyst reports. Stephens raised their target price on shares of Illumina from $170.00 to $184.00 and gave the company an "overweight" rating in a research note on Tuesday, November 12th. Barclays raised their price objective on Illumina from $135.00 to $145.00 and gave the company an "equal weight" rating in a research report on Tuesday, November 5th. Scotiabank reduced their target price on Illumina from $176.00 to $164.00 and set a "sector outperform" rating on the stock in a report on Thursday, August 15th. Robert W. Baird increased their price target on Illumina from $124.00 to $139.00 and gave the company a "neutral" rating in a research note on Wednesday, November 6th. Finally, Piper Sandler reduced their price objective on Illumina from $195.00 to $185.00 and set an "overweight" rating on the stock in a research note on Monday, November 11th. One research analyst has rated the stock with a sell rating, eight have assigned a hold rating, fourteen have assigned a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $164.00.

Check Out Our Latest Analysis on Illumina

Illumina Trading Up 0.8 %

ILMN traded up $1.18 during trading hours on Friday, reaching $141.09. 1,106,683 shares of the company's stock traded hands, compared to its average volume of 2,073,166. The company has a quick ratio of 1.85, a current ratio of 2.43 and a debt-to-equity ratio of 0.94. The firm has a 50-day moving average price of $143.12 and a 200 day moving average price of $127.02. Illumina, Inc. has a 52-week low of $100.08 and a 52-week high of $156.66. The firm has a market capitalization of $22.38 billion, a PE ratio of -14.17 and a beta of 1.11.

Illumina (NASDAQ:ILMN - Get Free Report) last issued its earnings results on Monday, November 4th. The life sciences company reported $1.14 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.88 by $0.26. The firm had revenue of $1.08 billion during the quarter, compared to analyst estimates of $1.08 billion. Illumina had a negative net margin of 36.10% and a positive return on equity of 7.29%. The business's revenue was down 3.5% on a year-over-year basis. During the same period in the previous year, the firm earned $0.33 earnings per share. As a group, sell-side analysts predict that Illumina, Inc. will post 4.11 EPS for the current fiscal year.

About Illumina

(

Free Report)

Illumina, Inc offers sequencing- and array-based solutions for genetic and genomic analysis in the United States, Singapore, the United Kingdom, and internationally. It operates through Core Illumina and GRAIL segments. The company offers sequencing and array-based instruments and consumables, which include reagents, flow cells, and library preparation; whole-genome sequencing kits, which sequence entire genomes of various size and complexity; and targeted resequencing kits, which sequence exomes, specific genes, and RNA or other genomic regions of interest.

Recommended Stories

Before you consider Illumina, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Illumina wasn't on the list.

While Illumina currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.